Household spending drives the economy. Monitoring the consumer is vital for investors.

Key Summary:

- Consumer sentiment is enormously important for markets and it’s still quite low.

- Consumer spending is still strong while being lumpy across spending categories.

- Incomes and job security are high while some cohorts are showing signs of fatigue.

Important thesis: if the S&P 500 Index has generated an annualized return of roughly 8-10% over the long-term, leading companies serving important industries should, in theory, generate 300bps+ more over long periods of time. That’s what history has shown. Understanding this and investing for it offers investors a long-term edge. Importantly, underperforming years tend to be great buying opportunities so being a contrarian also offers an edge. Brands matter because consumer behavior is largely driven by brand loyalty. The higher the loyalty, the better the business. The better the business, generally the better the stock.

Consumer Sentiment Update:

The longer the prices of everything we consumer regularly stay elevated; the more discerning consumers will be regarding spending. Not every spending category is thriving currently because consumers are making choices about where to spend. Trade-down behavior is widespread and saving money is a key goal. Selective indulgences are also widespread because there are certain activities and products, we simply love too much to ignore. Here, consumers are willing to spend a bit more because the activity/product is important, and the brand has high brand appeal. The brands and spending categories that fall into these categories are performing much better than the aggregate retail-focused company. Market share and loyalty matter more than ever today. Now is a time for the leaders to widen the delta between them and the peer group.

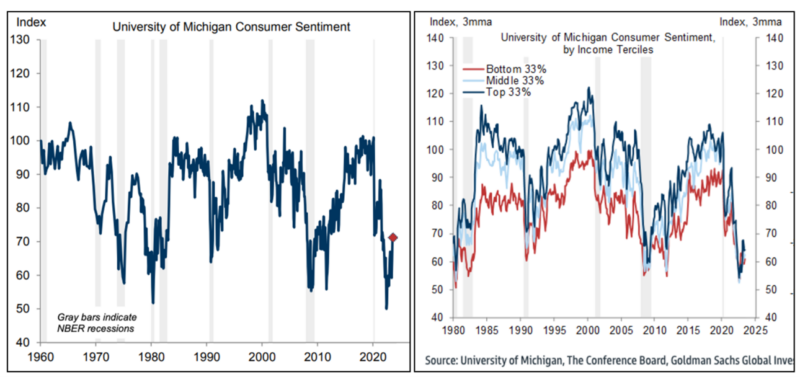

The following charts from Goldman Sachs Research shows a variety of consumer health metrics. Let’s start with consumer sentiment. It’s still quite low by historical standards. The right pane below, shows sentiment by income bracket. The top 33% feels a bit better than the rest, but generally, consumers are still concerned about high prices. They may be concerned, but looking at the recent retail sales numbers shows their concern, generally, hasn’t affected their actual spending yet. The upside from low sentiment: there’s a significant amount of recovery that will eventually happen, and it has positive ramifications for earnings and deferred spending over time.

Consumer spending is still strong, despite the doom & gloom narrative.

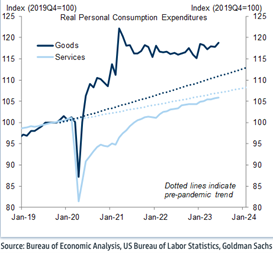

The latest Retail Sales report highlighted the continued resilience of consumers and their spending. Again, spending is not broad-based and smooth, we are deferring non-essential spending to focus on “needs” and “high importance” items like staples and experiences. As the summer and vacation season ends, we expect consumers to focus on the deferred goods spending as prices have come down with incentives getting interesting. Overall, we expect consumer spending to continue to be more resilient than people expect. Additionally, with the prices of many items still elevated, the earnings of the best brands should stay elevated and on solid footing. It’s the second and third tier brands that should continue to experience earnings and revenue headwinds. Over the next quarter or two, estimates should come down enough for a positive beat cycle to begin. This remains a “step-up” opportunity across consumer stocks. As we see this occur, we intend to sift through the rubble to add exposure to a handful of the long-term winners in key spending categories. The Goldman chart below highlights goods spending is still elevated from long-term trendlines and services are slightly below. We expect services and “experiences” to remain of interest to consumers. With higher prices, labor costs and pressure on margins, selectivity in stocks continues to be vital.

Incomes & employment are still strong.

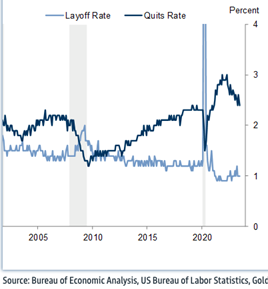

Corporate layoffs have risen slightly but off of a very low base. Generally, consumers do not quit jobs when they do not feel they can get a better, higher paying job. Corporate right-sizing should continue to be a key theme, however. Controlling costs and margins remains very important to company executives. If layoffs do accelerate, we could see more white-collar employees seeking work but for now, we do not see a real problem brewing.

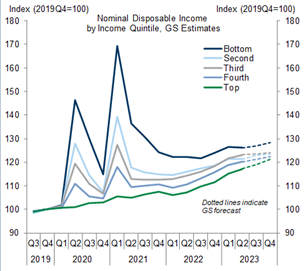

Disposable incomes have risen, albeit not as fast as the early days of inflation ramping. With inflation trending down, higher incomes should help with consumer sentiment and spending. Importantly, the bottom income quintile has seen the best income growth. This is something we have not seen in a very long time. It’s this cohort of the population that’s most vulnerable to persistent high prices so their high job security and higher incomes should help the cohort weather this inflationary storm better than former periods.

Delinquencies across major lending categories are still generally low. These categories are important to monitor but generally, they are still flashing positive. Yes, credit card delinquencies have risen as high debt consumers have experienced a more difficult time servicing high interest debt, but the current levels are still better than the prior decades average. Because most housing debt is fixed and locked at low rates, mortgage delinquencies remain at all-time lows. The wealth effect of a recovering stock market and home price appreciation offers these consumers a bigger spending cushion via consumption capacity than ever before. Auto loan delinquencies have ticked up slightly, particularly for sub-prime borrowers, but generally they remain within historical levels. Student loans have been in the news lately and we should expect delinquencies to rise slightly after the moratorium ends but this will be a very slow-moving train and we do not expect a large jump in delinquencies. We do expect, however, some non-essential spending could be deferred and more trade-downs to occur as this payment begins to take away from discretionary spending.

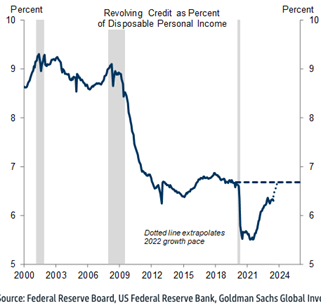

Consumer revolving credit lines have risen lately as some cohorts struggle with paying bills but off a historically low base. The historic deleveraging that occurred after the financial crisis has changed the way consumers manage their balance sheet. That’s a very good development. Goldman expects this number to mean revert slightly higher and back to the recent trends, which is still well below the good-ole days of rampant spending by consumers.

Bottom Line:

High prices always change consumer behavior. Consumers are very good at being cost-conscious when the need arises. While incomes and job security are generally high, consumer sentiment is well below normal levels, and this offers a significant tailwind for spending once normalized. Inflation coming down will be a key catalyst. For now, we expect consumers to stay focused on saving money where they can and spending well on what they really love.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.