Key Points

- Sell in May and go away is the market narrative but it’s track record is spotty.

- Getting more defensive with leading healthcare & staples brands seems to work better.

- As the economy cools further, this strategy seems to have strong merit today.

Sell in May, Go Away?

As April ends and May begins, the drumbeat of “Sell in May and Go Away” grows louder and louder. It’s important to remember two things about this concept: 1) it does not work every year and 2) a better approach has typically been to “rotate to defensives” like healthcare and staples in May versus going away entirely. Every year is unique and there’s always earnings, macro, Fed policy, and geopolitics driving the narrative so making a 1-size fits all decision is likely to end with mixed results. This year, and much to the chagrin of bears, tech and consumer discretionary sectors have performed much better than expected. That tends to happen when bearish sentiment and positioning gets as extreme as it was in Q4 last year. Much of that bearish positioning has been rectified today and healthcare and staples have lagged thus far in 2023. We think that’s about to change as money begins to rotate to get more balance as it seeks more stable, predictable earnings. Time will tell, we certainly do not know the future better than anyone else but in today’s note, I thought it would be interesting to look back at other difficult market years to see how a blend of 3 leading healthcare and staples brands performed versus the S&P 500 and Nasdaq 100 in the May – October period. Very interesting results for people that think the economy gets softer from here as the Fed’s actions begin to filter through the system.

Rotating to healthcare & staples, “defensives”, has a terrific track record in tough periods.

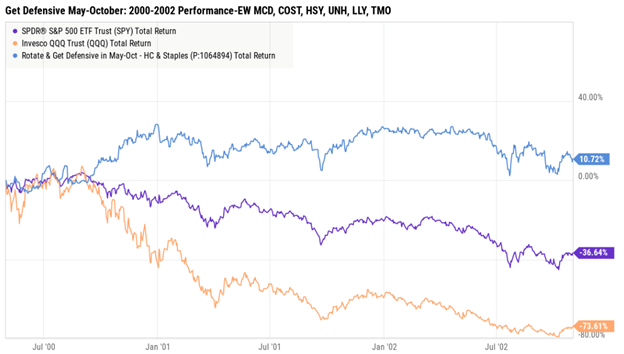

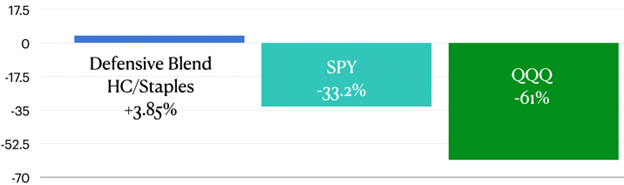

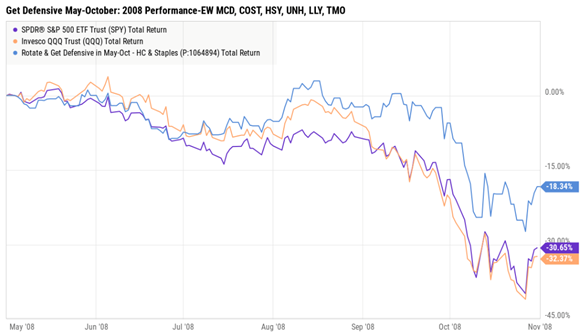

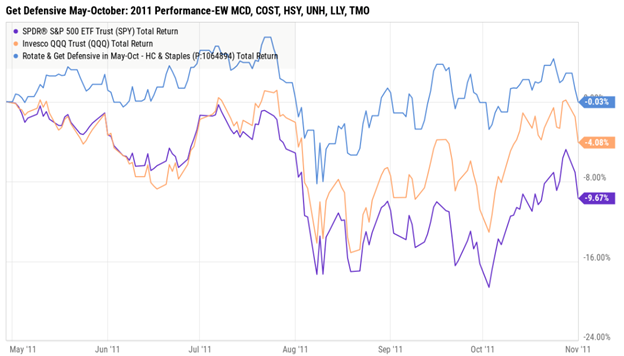

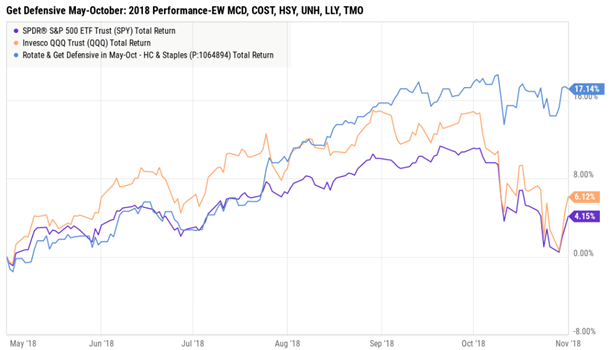

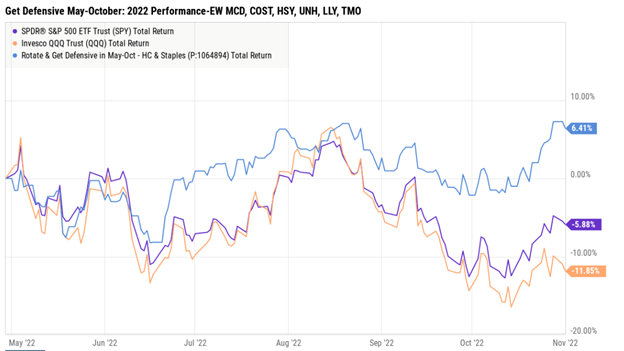

Rather than use broad-based ETF’s as the proxy for this theme, I created an equal-weight 6 stock model portfolio using 3 leading healthcare brands across managed care, pharma, and life sciences & tools (UNH, LLY, TMO) and 3 leading consumer staples brands across general merchandise shopping, fast casual restaurants, and packaged foods (COST, MCD, HSY). I then compared the indices to this defensive, healthcare/staples basket while using SPY and QQQ as the proxy for the broad market. Generally, in positive trending bull markets, the defensive blend lags which we would expect, but in more difficult years, the defense basket generally shielded investors from bigger downside action in the indices. Additional brands that tend to be quite resilient in turbulent times include: Church & Dwight (CHD), Procter & Gamble (PG), Mondelez (MDLZ), Coca-Cola (KO), Pepsi (PEP).

Economic weakness just ahead could favor the defense basket.

Equities have generally performed better than expected thus far in 2023. Earnings beats are slowing, and breadth has been quite poor for the last few weeks. The mega-cap brands have largely done all the heavy lifting where YTD performance is concerned. Either the laggards need to begin performing or the leaders could join the laggards and provide further market weakness.

Only in time will we know what happens but here’s how the indices have performed versus the healthcare and staples blend in years with a recession or some idiosyncratic macro issues that caused some market dislocations The defensive blend is in blue.

2000-2002 Internet Bubble & Recession: Defensives Win Big Through the Entire Period.

2000-2002 May-November, 3 Periods: Internet Bubble & Recession: Defensives Did Their Job.

2008: Great Financial Crisis. Defensives Lose Much Less.

2011: Debt Ceiling Crisis & European Debt Issues. Defensives Win.

2018: Strong Market Until Fed Hikes Rates Into an Economic Slowdown: Defensives Win Big.

2022 Peak Market, Historic Rate Hikes, & 40 Year High Inflation: Defensives Win Big.

Bottom Line:

The market has performed fairly well YTD but we see some softening in prices as earnings & margins become the focus. Generally, defensive business models offer more stable & predictable earnings and dividends, which makes them very interesting in slowdowns. Additionally, capital tends to rotate to defensive sectors and businesses when volatility and uncertainty arises. Healthcare is a big laggard YTD after having a stellar 2022 and seems to be refreshed and ready to begin performing again. Using the ETF’s for healthcare and consumer staples seems fine but my work shows betting on a handful of leaders tends to enhance the experience. In former years where markets were volatile with a downward bias, the defensive basket of leading brands tended to either deliver a positive return or offered much less downside than the indices and other beta sectors.

Rotate in May and Go Play!

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

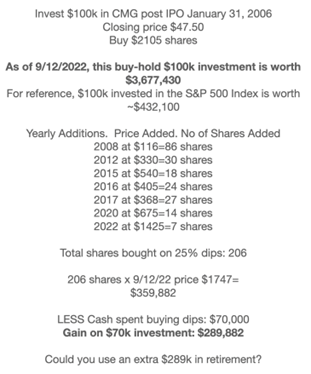

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.