Key Points

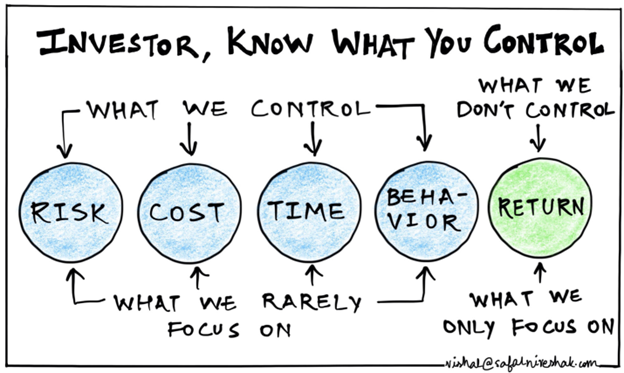

- There’s a mismatch between what we preach & what investors focus on.

- There are things we can control: we should spend most of our time here.

- There are things we cannot completely control: we should spend less time here.

Getting Back to Basics.

In my 30-year career working in financial services, I have been a Financial Advisor, a professional trader, and a long-term investor of iconic brands (along with a host of other roles in the industry). As someone who has worked directly with advisors for most of my career, I have a lot of empathy for you and your team during these tumultuous times. Managing hundreds or thousands of client portfolios is hard enough, but managing their emotions through a cycle is a monumental task, particularly now. With social media and the immediate releases of news and fake news, there is a massive amount of data coming at us very quickly. With algorithms and daily expiration options driving the trading day, minute to minute volatility can be something that undermines our ability to meet long-term goals. Most human beings are emotionally charged and apt to make knee-jerk, impulsive decisions when under stress. Whether it’s wanting more exposure when the narrative is positive or much less exposure when it’s uber-bearish, our emotions often get the best of us.

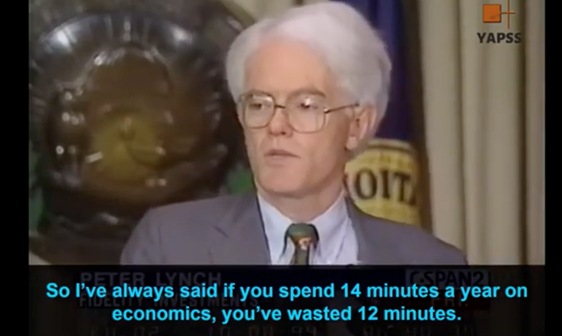

In my experience, the most educated clients, regarding financial markets, are the best clients. When they are well prepared for what to expect over a full market cycle and understand how their portfolios are allocated, they know what to root for and they tend to stay engaged through storms. If they do not understand how their money is being invested, or what needs to happen to help their portfolios thrive, how can we expect them to ride through the storms? That’s a key reason I created the Brands strategy in 2015. I am a long-time Peter Lynch fan and his “know what you own” approach to investing became part of my DNA early in my career. I recently found the image below and thought it was a brilliant illustration of the disconnect we generally have between what we preach and what investors focus on. As advisors, we constantly preach balance between risk and return, diversification, time horizons, being patient investors and being opportunistic when prices get dislocated from “true long-term value.” As investors, we tend to be simpler. Overall, we want and need:

- To generate attractive returns over time.

- A smoother ride along the way.

- To understand what we own & why we own it.

Simple concept, complex in its execution.

The graphic below highlights the things we have some control over and what we never have control over, namely the outcome or return. The more time we spend on control items versus desire items, the better off we tend to be. Let’s talk about each one of the circles one at a time.

What We Can Control: Risk

This is tricky. We can’t control things that happen in the future, but we can control how it affects our portfolio and psyche. We can contain risk levels by our asset allocation choices and through the allocation weights across private, alternative, and public investments. In my experience, investors have a theoretical risk tolerance and an actual risk tolerance. Understanding them both is the key to building the prudent portfolio. Intuitively, we understand that to generate an attractive return will also require some ability to tolerate volatility but when this reality arrives, it often drives behavioral angst. When this happens, we know most investors question whether to stay the course. When I was an advisor, I viewed myself as the friend, teacher, trusted allocator, and psychiatrist to clients. Managing their emotions was often the most difficult part of the job, particularly in a period like today. One way to do this is to show them some visuals.

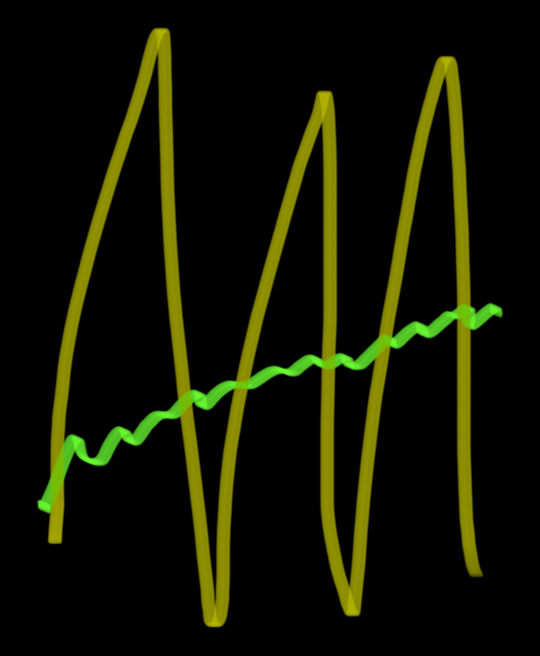

Suggestion: show clients the image below and ask: “which line (green or yellow) is most preferred when deciding what should drive the core of your portfolio?” Every single person will tell you they want the smoother experience represented by the green line. This is your opportunity to remind them, it’s only through long-term investing, staying the course, and adding on major dislocations that allow you to achieve the desired outcome. FYI, the yellow line is the representation of watching daily movements (have you seen regional bank stocks lately?) and the smoother green line is how the trajectory of the portfolio value goes over time.

What We Can Control: Cost

The cost of advice and the internal costs of the investments we make matters to the outcome of returns. Like merchandise in the real world though, sometimes the lower cost product is suitable and sometimes it is cheap for a reason. It’s our job to know the difference. As someone who studies consumer behavior & brands for a living, I can tell you with confidence, investors are willing to pay more for something differentiated. A bag is just a bag, but a Hermes bag is a bag worth paying for fans will say.

Where portfolios are concerned, I think a blend of cheap beta via smart ETF’s and active strategies and a balance between public, privates, and alternatives is the ideal portfolio mix that serves the greatest number of investors.

What We Can Control: Time

This is an easy one. There is significant evidence to support the adage, “it’s time IN the market, not TIMING the market that determines the outcome. The data is very clear, the longer the time frame, the better the outcome. The shorter the time frame, the more potential angst there will be and the more you could feel “off-course” relative to the long-term plan. When people feel off-course, the behavioral response is often to over-steer. Generally, though, most investors are committed to investing with a wide lens viewpoint, and adding to their investments over time, they just need to keep their eye on the prize during periods of volatility. That’s where experience becomes very valuable.

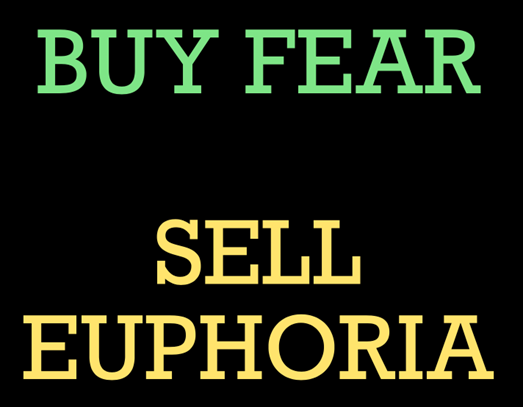

What We Can Control: Behavior

This is where all the magic happens. It’s where being an unemotional investor is ideal. Our behavior at specific moments in time tends to be a key decider of whether we achieve our goals and/or have a smooth ride along the way. Early in my career, I befriended a large advisor team and the senior advisor used to give every new client a framed picture that looked like this. He stated this in their initial meeting: “over the course of our relationship, mostly during pivotal periods, I’m going to ask you to refer to this picture to help us decide what we should do with the portfolio.” It was a brilliant way to help investors find their north star and build a deeper relationship.

What We Can’t Control: Returns

Peter Lynch had the #1 performing fund while he managed Magellan.

Every investor wants certainty. Investment returns, as in life, are not always certain. A lot of things happen over a lifetime of investing. If we know with certainty that the price you pay helps to determine the value you get, then by definition lower prices, particularly for great assets, is a better way to help bring some form of certainty to investment returns. Using a tranching system, for periods like today, being a contrarian could certainly add real value over the long-term.

Overall, returns are loosely determined by staying true to this equation:

The time you commit to invest + the total cost of investing + the base level of risk you are comfortable taking + the type of investment mix you choose + the behavioral temperament you have + your ability to think as a contrarian during perceived extreme periods = a high likelihood of receiving a positive outcome. If you can manage this equation at scale as an advisor, you are doing something very special indeed.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

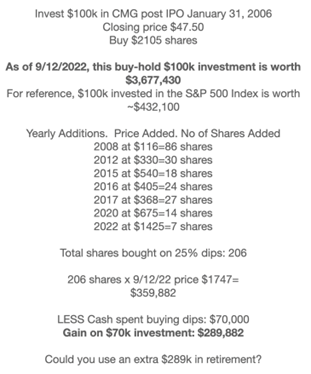

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.