How Should Advisors Utilize Alternatives?

Key Points

- Institutions tend to perform better than individual investors.

- The “new normal” environment requires our portfolio to look more institutional.

- Adding a basket of alternatives via public & private market asset classes is timely, tends to add return and enhance the experience via smoother returns.

Invest Like the Smart Money: Institutions, Endowments, Sovereign Wealth Funds

In the “return generation business”, institutional investors have a big edge over retail investors. The WHY is what’s most important: institutional investors have access to the smartest asset managers in the world, have the time, experience, and resources to assess all potential investment ideas, have a long-term time horizon (wide lens investing), and act opportunistically when asset prices get weak. At the HNW investor level, some of these vital attributes are absent. For individual investors, emotions drive much of our decision making and our emotions tend not to add value to our long-term returns. Reality: most people could use a chunky allocation to strategies that “save them from themselves.” That’s where public and private market alternative strategies comes in. On the private side, most investors could easily place 20-30% of their assets in strategies that are partially or fully illiquid if they are investing with a decade+ timeframe. The trick for Advisors: what percent of the client base has the true patience for 10+ year investing? For clients that have shown evidence of not being long-term committed, there are some great active, alternative funds that allow them the liquidity they think they need to sleep at night. At Catalyst & Rational Funds, there are some great alternative strategies that have added a significant amount of value, particularly in times of uncertainty. In my experience, there is a theoretical pain tolerance for risk and an actual pain tolerance for risk and volatility. Shielding clients from as much day-to-day volatility is the primary key to getting them to goal achievement safely and investors now have a significant number of non-traditional options at their disposal. Given the volatility across stocks and bonds, I can’t think of a more timely conversation to have.

The New Normal

Why consider illiquid assets & non-traditional strategies for an increasing part of the portfolio today? 1) they have a history of generating better, more consistent returns and lower average volatility when compared to their public market & traditional peers. 2) the economic and investment climate warrants it. Rates have been abnormally low and falling for the better part of 40 years. That’s changed in a major way. The good news: investors can now get an attractive yield in fixed income. Unfortunately, rates have become much more choppy, forcing the “safe” traditional fixed income allocation into a more volatile position. This makes a key selling point for bonds less intriguing in our eyes. If bonds are the safe asset inside the portfolio and the yield and price movements are no longer as predictable and stable, is the allocation as valuable as it once was? Perhaps carving off a bit of our bond allocation and adding to things like opportunistic, alternative funds and Private Credit, Private Real Estate or Private Infrastructure can add some real diversification and return benefits.

Equities have generated attractive excess return over the long-term average primarily because we had a benign interest rate environment, with low and stable inflation. With inflation and rates set to stabilize at much higher levels, equities could continue to be more volatile, and multiples may not expand like they used to for a while. It’s never been more important to concentrate your exposure and to be mindful of which style factors your portfolio is tethered to.

If the majority of HNW investors own a portfolio that’s mostly public stocks and traditional fixed income and both assets could continue to deliver higher average volatility and lower than average total returns because of the new normal, shouldn’t every investor be willing to introduce a third option in a portfolio? Particularly if this option has a history of performing well and doing so with less angst along the way?

Let’s quickly focus on “Private Alternatives” for this blog note. I completely agree with the CEO and founder of Apollo Global, a $550 billion asset manager: “How much liquidity does the average HNW investor need every day? Most investors have too much exposure to liquidity…The more due diligence they do, the more investors will see the value in implementing “alternative options” across the most popular asset classes of: equities (private equity), investment grade & high yield (private credit), real estate (private real estate), real assets & commodities (infrastructure, renewable energy), and other tactical and opportunistic strategies.”

These are the assets that have been favored for decades by the smartest, top performing institutional investors. Why would you not want to clone the actions of the smartest investors around the world? Why would you not want to improve your ability to sleep at night via lower day to day volatility in your portfolio? Why would you hold yourself back from investing in strategies and firms with tremendous track records of success over virtually every kind of market environment, particularly when our current environment is uncertain at best?

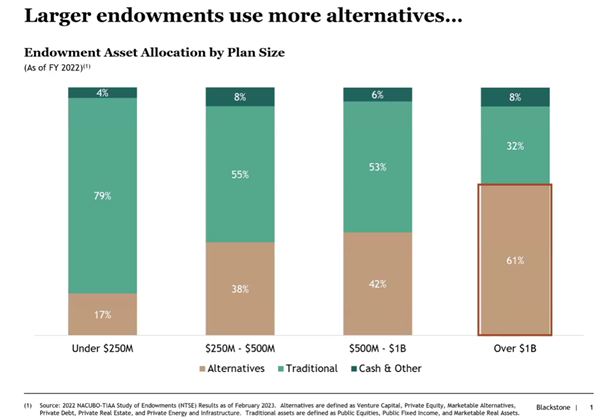

Allocate Like an Institution

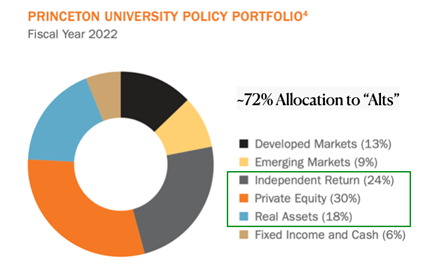

Institutional investors have been allocating to “alternative assets” like non-traditional fixed income, Private Equity, Private Credit, Real Assets, Infrastructure, and other similar strategies for many decades and with very strong results. Using Endowments as our proxy for the “smart money”, as you can see from this chart, the large Endowments ($1B aum+) traditionally hold the highest allocation to alternatives.

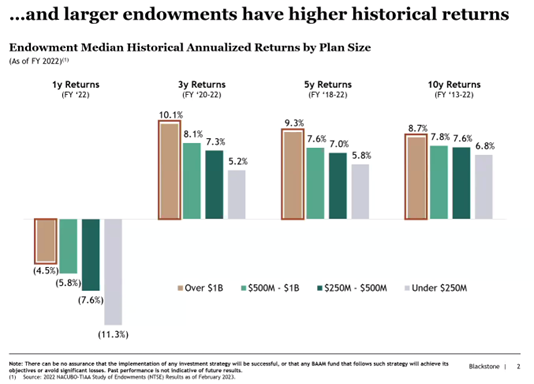

As you can see from the chart below, these Endowments also have a history of stronger performance than their smaller peers. The primary reason: a much larger allocation to illiquid assets and alternative strategies. Smaller endowments are just now beginning to implement more exposure to alternatives, similar to HNW investors. There is a significant amount of assets still pondering an allocation shift towards alternatives which is a key reason we like the stocks of firms like Blackstone, KKR, and Brookfield. We see the path to a significant step-up in distributable earnings and cash flows as this migration of assets continues in their favor.

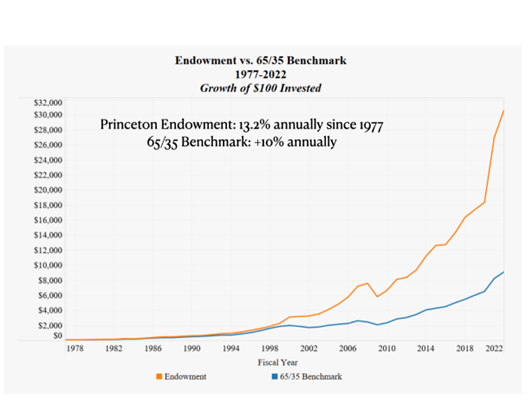

Let’s look at a top performing Endowment, Princeton University for some ideas on what we can do to enhance a portfolio outcome. The images below shows how Princeton has performed versus the traditional 65% equities, 35% fixed income benchmark which tends to be how the typical HNW investor portfolio is constructed. Princeton’s portfolio allocation decisions clearly have added a significant amount of excess return over a very long period. (Data source: Princeton Endowment documents)

I could post the data for other large Endowments like Harvard, Columbia, Michigan, and Yale and they would all scream the same thing: introduce more traditional & private alternatives to the portfolio. Accessing these markets and the leading asset managers serving them, has never been easier. For private market strategies, I urge you to reach out to terrific platforms like iCapital, they can help you access what types of strategies could be right for your clients.

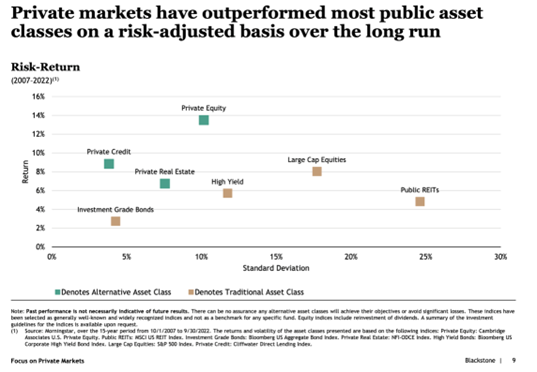

Lastly, let’s go deeper and analyze publics versus privates by primary asset class.

Remember, the goal for our investing is: excess return per unit of risk.

Below, is another chart showing both traditional and private asset classes along the risk & return spectrum. Overall, each private asset class tends to perform better while delivering less angst to investors along the way. If this knowledge doesn’t compel you to do a little extra paperwork to access the private opportunities, I don’t know what else to say. Specifically, Private Equity has performed better and delivered less day-to-day heartburn than its peer, large cap equities, Private Credit has performed better and with less volatility than both investment grade bonds and high yield bonds, and Private Real Estate has performed better and has been less volatile than public REITs. If you have seen some of the charts provided by Catalyst & Rational, the same story would be true in the non-traditional, fully liquid asset classes where Millburn and others traffic.

Perhaps we should all start allocating like the Yale Endowment, the top performing large Endowment over the last 10 and 20 years. This is their secret, taken directly from their Endowment website:

“The heavy allocation to non-traditional asset classes stems from their return potential and diversifying power”…”Alternative assets, by their very nature, tend to be less efficiently priced than traditional marketable securities, providing an opportunity to exploit market inefficiencies through active management. The Endowment’s long time horizon is well suited to exploiting illiquid, less efficient markets such as venture capital, leveraged buyouts, oil and gas, timber, and real estate”

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

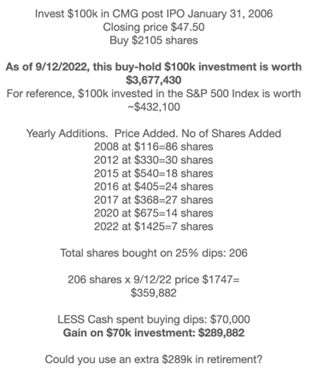

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.