Key Points

- Virtually every asset class around the world has a negative YTD return, that’s rare.

- Do not let wild swings in prices shake you out of solid investments.

- Tax loss volatility allows investors to re-set client cost basis and upgrade portfolios.

“I think there will be a lot of tax loss sales happening into year-end…I would say this is the biggest tax loss selling opportunity in one or two generations”. Jeff Gundlach, DoubleLine Capital

2022 Has Not Been Kind to Investors. The Damage Has Been Broad Based.

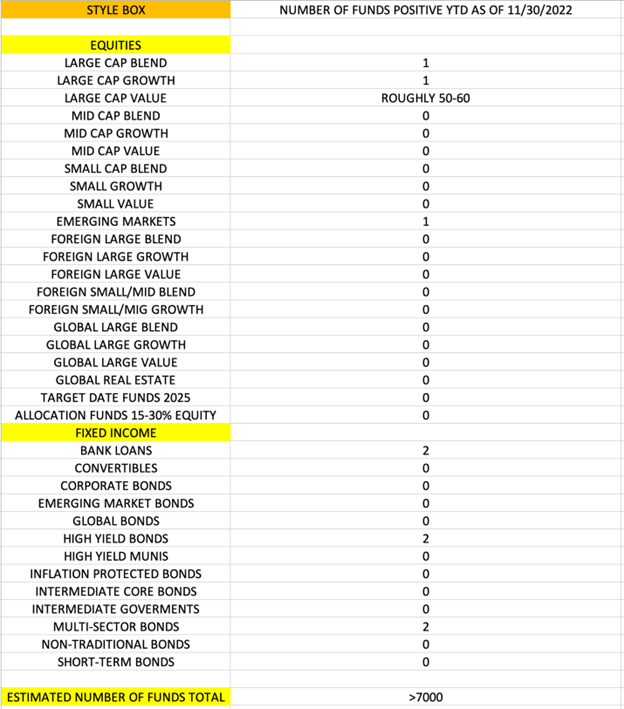

If you are an investor or a manager of other people’s investments, 2022 has been a particularly difficult year. Generally, fixed income assets act as a safe haven when stocks are under siege. But when inflation and rates are rising, very few assets get spared. Today’s 60/40, 70/30 portfolios are very likely negative on the year. It’s times like these that we need to remind ourselves how very rare the 2022 investment experience really is. It’s also a time to remind ourselves what we should be doing in such a rare time: fade the extreme case (negative returns) and position for more normal periods (positive returns). No one knows what the future holds but historically speaking, when virtually every asset class is negative for a calendar year, like 2022 is shaping up to be, the following year is a much better experience. Interest rates in the U.S. already look like they have peaked, making fixed income look much more attractive and still on sale. Equities could remain volatile for a bit longer, but there are some very exciting opportunities developing here and around the world. No one enjoys going through this rare period, but, if history is any guide, the end result is a much more attractive investment experience. To put the current dreadful year of returns into perspective, I looked at Morningstar.com and did an analysis of each style box across active funds in equities and fixed income (>7000 Funds). You can extrapolate the same info across the ETF spectrum (>8000 ETFs), there were very few places to hide this year and the investment wrapper (fund/ETF) was not a factor. Here’s the results:

Remember, equities are positive about 80% of the time. So as an investor, history says you should be thinking about adding to equities, not getting into your bear suit after the carnage has happened. Investors tend to get too cautious AFTER the carnage and they tend to be uber-bullish AFTER strong return years. That’s exactly the wrong way to invest. Collectively, it’s all of our jobs to educate investors and help them be better and generate greater returns over time. Now is one of those periods as we head into 2023.

Because we do not know where markets will ultimately bottom, I would advocate for a systematic tranche approach to get more exposed to equities into any additional weakness, particularly those caused by artificial tax loss harvesting.

Do Not Let Market Volatility Take You Out of Smart Investments & Themes.

When investors all around the globe do their tax loss harvesting, volatility can emerge, and it can test your resolve and your willingness to stay engaged in your well-constructed portfolio. Investment research firm Dalbar has been studying investor behavior for decades. The conclusion from their research is that the average investor earns below-average returns. For 20 years ending on 12/31/2019, the S&P 500 averaged 6% per year. Yet, the average equity investor earned about 4.2% for the same period. Why? The study showed investors buy high and love to add when markets are strong. They then tend to pull money out when stocks are volatile and struggling. Our industry remains the only place where sales in otherwise great merchandise are ignored or shunned. Investors tend to overreact in times of uncertainty because they extrapolate current fear into the future as if the fear will never end. At the very minute people are selling and thinking a group of stocks or bonds will never recover, things mysteriously turn. This leaves investors back on their heels and under-exposed. I can tell you from all my conversations over the last 6 months, the average investor is very defensively positioned, under-exposed to cyclical stocks, and holding excess cash. That tends to make us feel good on down days, but it rarely helps us meet our long-term goals. Just remember, they do not ring a bell at the bottom, and buying fear is how people get paid well over time. If you see some big bouts of volatility over the next 30 days, please remember tax loss harvesting is an artificial catalyst with a limited shelf-life.

Great Companies & Brands Are on Sale & Tax Loss Harvests Offer Opportunities.

Advisors are performing their annual tax loss harvesting process as we speak. This is an opportunity to reset a client’s cost basis. No one likes to see a portfolio with a host of ticker symbols with parentheses around them. The longer the client statement shows negative returns, the more a client will question the capabilities of the advisor and the viability of investing in general. Today’s tax loss harvest period offers a chance to reset the portfolio to different strategies, all of which are on sale today. Difficult years like 2022 also allow investors to assess whether their portfolio is well positioned for the future. It’s very important to not extrapolate one year’s performance and make long-term allocation decisions based on one year’s returns. How did your funds and ETF’s do for the 3-5 years leading up to the peak in November 2021? That analysis likely helps decide if the focus of the strategy is timeless or not.

We have not seen inflation like we have today for over 40 years, nor have we seen a Federal Reserve this aggressive and hawkish for a long time. These are outlier events and should not be relied upon for long-term portfolio positioning. The most important thing to do in times like today, in our opinion, is to anchor timeless and common-sense strategies that win more often than they lose. One approach is to endeavor to understand the primary driver of every economy in which you invest. Make sure you have sufficient exposure to that driver in a portfolio and most importantly, do not let short term volatility shake you out of letting your logic and common-sense drive decisions.

Do not allow your clients to be the confirming evidence from the Dalbar studies. Be a contrarian, be opportunistic, and take advantage of these more difficult and volatile periods by adding to the strategies and companies that have stood the test of time.

I wrote about the benefits of cost averaging and buying more of great brands in September. I showed readers a few examples of the benefits of holding a core consumer allocation and adding to great brands when they are down 25% or more from highs. Cost averaging into more exposure can add a significant amount of value when you check your emotions at the door. Here’s the link to that blog post:

Cost Averaging into Brands Adds Significant Value

Does it really matter where the ultimate bottom is when you have some of the most profitable companies ever created on mega sale? Here’s a quick list of the percent off the all-time highs for some wonderful Mega Brands. I don’t know about you, but to me, these are some tasty and rare sales across the brands spectrum.

- Spotify -79% off the highs.

- Meta (formerly Facebook) -71%

- Paypal -74%

- Netflix -59%

- Tesla -55%

- Disney -51%

- Amazon -50%

- Estee Lauder -41%

- Intuit -45%

- Nike -41%

- Google -36%

- Domino’s Pizza -31%

- Microsoft -33%

- Lululemon -25%

- Home Depot -22%

- Apple -19%

- Lowes -19%

- Starbucks -21%

- Chipotle -23%

Bottom Line:

- 2022 is a very rare year where both bonds and stocks are broadly negative.

- Valuations across stocks and bonds have been re-set lower, offering better value.

- Not every stock is well positioned for an above average inflationary environment.

- Great businesses with economic moats, strong balance sheets, and predictable profits offer significant value to investors.

- Many of these businesses are well off recent highs and are offering much better entries.

- Do not let the short-term volatility caused by tax loss harvesting dissuade you from being opportunistic.

- Volatility is the friend of the long-term investor because they take advantage of weakness and get great stocks on sale.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.