Key Points

- Core strategies are designed to track core mega trends around the world.

- Industry leading brands serving important consumption industries win over time.

- Cost averaging into a basket of brand leaders can add significant additional value.

For More Insights: Listen to a Quick Market Update Podcast from Eric Clark: Why Top Brands & Why Cost Averaging Adds Significant Value – https://www.globalbrandsmatter.com/podcasts

Brands: The Ideal Core Equity Decision

In last week’s blog, I highlighted the positive long-term track records of a handful of the most admired brands to show how important the consumption thematic is for investors. I also showed the corrections that happen along the way as a reminder that stocks do not always go straight up, nor does a basket of stocks always outperform. Over the long-term, however, the data is very clear. The Consumer Discretionary & Tech sectors have a very strong track record versus the overall market as measured by the S&P 500. Today, it’s important to widen the lens as the Consumer Discretionary & Tech sectors struggle with rising rates and a difficult macro environment. The important point, however, is to not get shaken out of owning great companies when they are underperforming. If you loved these companies and sectors when they were outperforming, you should love them even more now that they are experiencing a rare period of underperformance.

The definition of “core” is the “central” or most important part of something. As a U.S. investor, one of the core parts of our economy is the consumer and household/business consumption. This important component accounts for ~70% of U.S. GDP. To track the beneficiaries of a consumption led economy, the ideal proxies are the leading brands serving this $14 trillion a year thematic. There is no other thematic bigger or more important than consumption. Do you have a consumption-focused core allocation? If so, good news: the leading brands, these key leaders of industry, are on sale. So now is an opportune time to start building positions in these well-positioned businesses. Many of these highly admired brands are trading at levels not seen for many years and their operating metrics are much better than the stock action might indicate.

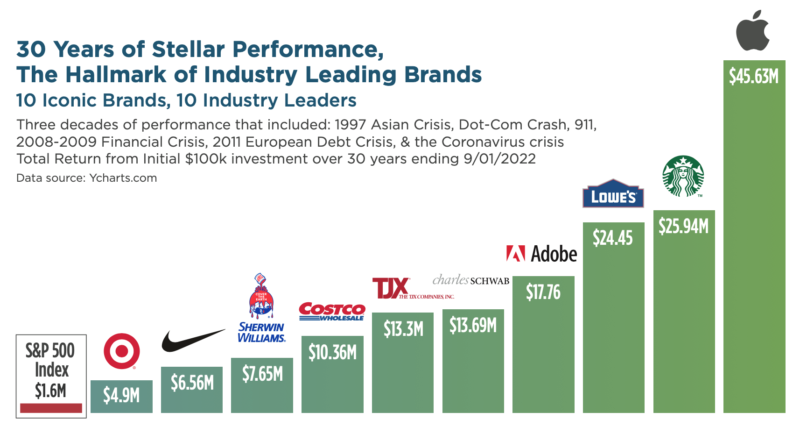

Track Records Matter. Brands Matter.

For perspective, I have posted a 30-year look-back of the performance of some of the most important consumption brand leaders across key spending industries. When a brand stays highly relevant and continues to dominate its industry, big weakness in its stock has historically been a gift for investors. As you can see from the chart below, there’s some wonderful excess returns to be had if you understand how to identify brand relevancy and hold a core basket of brand leaders. Most importantly, investors only received these stellar long-term returns if they were committed to holding them through good times and bad. I’m sure you’ve seen the Morningstar studies of long-term returns versus the actual returns received by investors. The actual returns tended to be considerably lower because investors tended to panic sell in volatile market conditions like what we are seeing today versus adding to positions when they go on sale.

Data source: Ycharts.com

What I find most interesting about the chart above is the strong excess returns that were generated even through very difficult market environments. Over the last 30 years, we’ve had to endure multiple recessions, bear markets, flash crashes, 9/11, multiple Fed-induced taper tantrums, the European debt crisis, the 2020 Coronavirus, and today’s current high inflationary environment. I can guarantee there will be more turmoil in the future, it’s simply the nature of markets. When you’re sitting in the middle of the hurricane, it always feels like the world and markets will never recover and yet they always have.

Cost Averaging into Additional Shares of Core Holdings Adds Even More Value Over Time.

Having a strong buy-and-hold mentality regarding leading companies has served investors well over the long-term. Remember, the equity markets deliver positive returns roughly 80% of the time. It’s the periods when market leaders are underperforming that offer the best additional long-term opportunities. Catching the absolute bottom is less important than having a systematic approach to adding to great brands, funds, and ETF’s when they are experiencing periods of weakness. Being committed to adding capital during deep corrections has helped to speed up the ultimate recovery time. To illustrate this, I will use two key brands serving the important spending category of restaurants and fast casual dining. The same results would have occurred if I used other leading brands for this analysis. It wouldn’t have mattered if it was Home Depot, Lowes, Lululemon, Nike, Apple, Amazon, Costco, or Estee Lauder. The results were all the same.

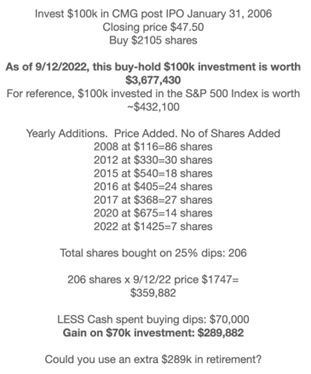

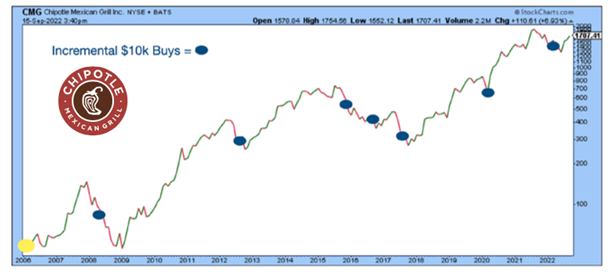

Exhibit 1: Chipotle Mexican Grill, CMG

Investing a hypothetical $100k in your favorite burrito brand after their IPO on 1/31/2006 would have turned into a cool $3.6 million by mid-September 2022. Over the same period of time, an investment in the S&P 500 with the same $100k netted an investor ~$431k. I think you would prefer the $3.6M over the $431k!

Cost Average Benefits:

Using this hypothetical example, let’s see if adding to your core position in CMG would have added value to the end result. Let’s say you systematically invested an additional $10k in CMG stock when it was down 25% from the last 12 month high or from the most recent cost average buy level. In the image above, the additional $10k investments when the stock was on sale are noted as blue dots. It’s important to note that you did not have to time the bottom perfectly to receive a huge additional benefit.

The result from this hypothetical is that you would have invested an additional $10k seven times since 2006. This would be worth an additional roughly $284,000 net of the $70k initial investment. Since 2006, your vote of confidence in Chipotle with the core $100k investment and the additional $70k cost average investment would be worth roughly $3.9 million, much better than an investment in the S&P 500.

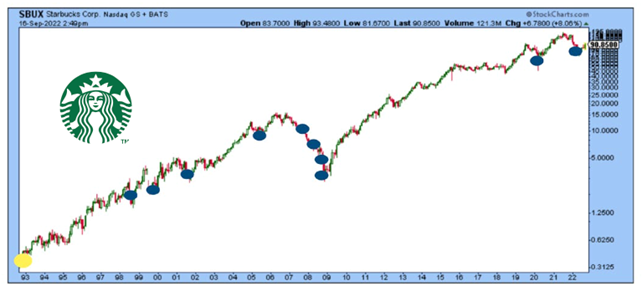

Exhibit 2: Starbucks, SBUX

Investing a hypothetical $100k in your favorite coffee house brand 30 years ago would have turned into roughly $23.7 million by mid-September 2022. Over the same period of time, an investment in the S&P 500 with the same $100k netted an investor ~$1.6 million. I think you would prefer the $23M over the $1.6M!

Cost Average Benefits:

Using the same hypothetical example from above, let’s see if adding to your core position in SBUX added value over time.

Result: You would have invested an additional $10k ten times since 1992. This would be worth an additional roughly $1.58 million net of the $100k initial investment. Since 1992, your vote of confidence in Starbucks with the core $100k investment and the additional $100k cost average investment would be worth roughly $25.2 million, much better than an investment in the S&P 500.

Data source: Ycharts, stockcharts.com, and Accuvest for the calculations.

SUMMARY:

Thematic investing is a commonsense decision. Global consumption and business investment is a roughly $44 trillion a year thematic. That makes this an ideal core allocation given the definition of core. Identifying the dominant brands in consumption categories and holding them so long as they stay relevant is another logical decision. Adding to these great companies when they experience normal corrections can add even more value to the portfolio over the long-term. If you know how the movie ends (brands tend to outperform over time), being savvy and cost averaging into great businesses when they are on sale, has shown to be a very smart decision. Warren Buffett likes to say, “volatility is the friend of the long-term investor”. We agree whole heartedly and are excited to invest in great brands when the market puts them on sale.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.