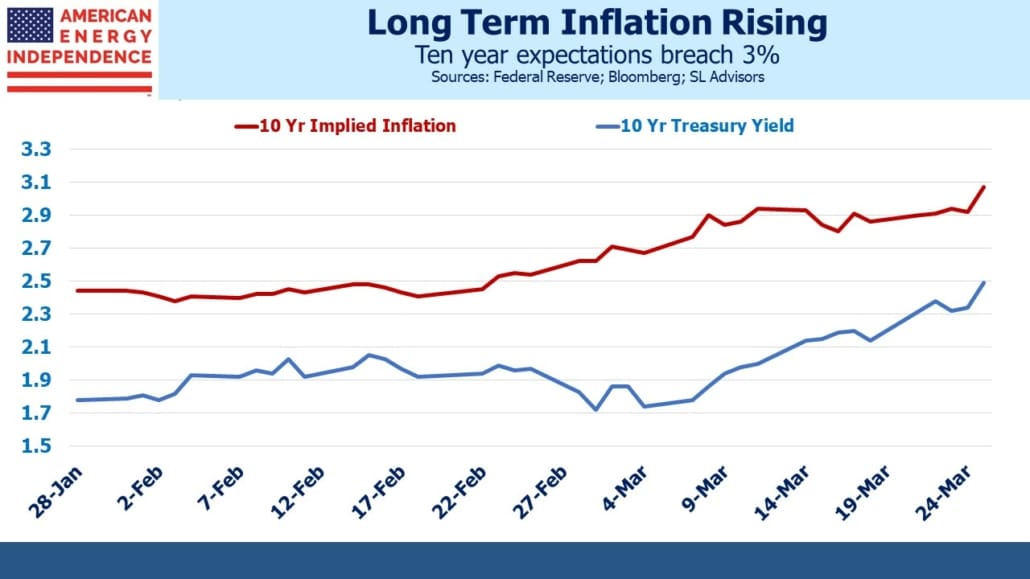

In mid-January in Why You Shouldn’t Expect A Return To 2% Inflation we explained some of the persistent upward pressures on inflation. Since then ten year inflation expectations derived from the treasury bond market have increased by 0.5%. Russia’s invasion of Ukraine is a big factor, but nonetheless a half point increase over the next decade is a substantial move. Preserving purchasing power is the point of saving, and inflation entrenched at a higher level investors presents new challenges to investors.

Five year inflation expectations have moved up to 3.5%

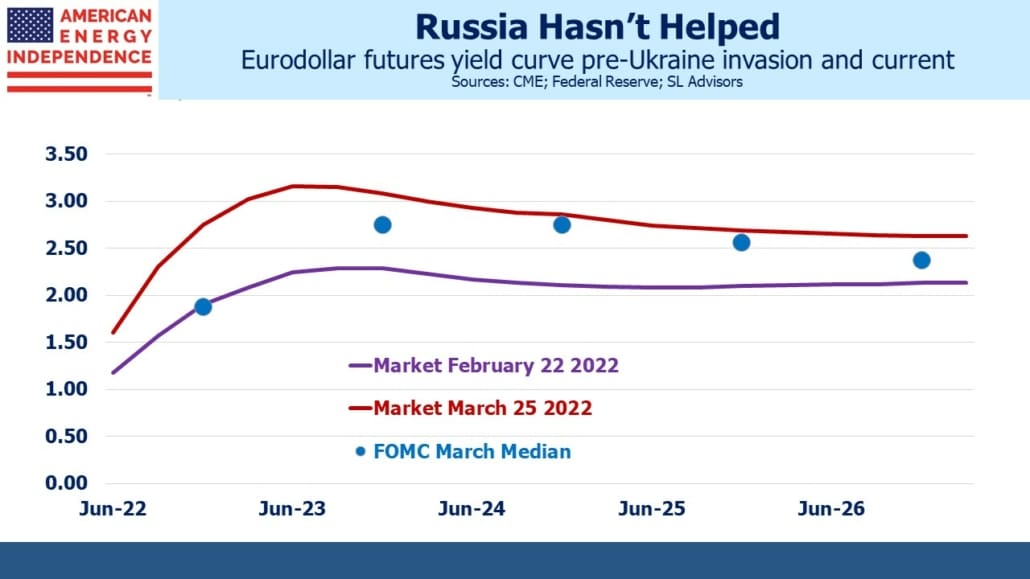

Interest rates have moved sharply higher, with the market pricing in at least one 0.50% hike over the next few months and a neutral rate around 2.5%, up from 2% a month ago. Inflation permanently above the Fed’s 2% objective is being priced in.

The list of reasons to expect inflation closer to 4% than 2% over the next several years includes:

- Excess fiscal stimulus from Covid. The $1.9TN American Rescue Plan that the Democrats passed shortly after Biden’s inauguration last year is now widely accepted to be the root cause of sharply rising prices. The Federal government boosted consumption even while the Covid vaccine was allowing the economy to re-open.

- Profligate fiscal policy in #1 was exacerbated by the Federal Reserve’s 2019 reinterpretation of its mandate to tolerate inflation risk in pursuit of maximum employment. This led them to maintain highly accommodative monetary policy and expansion of their balance sheet for an additional year compared with what more orthodox policy would have required. Note also that this inflation risk tolerance persists. So while everyone can agree today’s 7.9% inflation is too high, once it falls expect the rising unemployment rate to cause much angst at the FOMC.

- Oil and gas prices were already rising before Russia’s invasion gave them a further boost. Joe Biden ran on a platform of eventually putting traditional energy companies out of business. ESG proponents like Blackrock’s Larry Fink have helped demonize producers of reliable energy. Climate extremists have used the court system to block pipeline projects largely completed. An example is the Mountain Valley Pipeline project owned by EQM Midstream Partners, LP, NextEra Capital Holdings, Inc., Con Edison Transmission, Inc., WGL Midstream; and RGC Midstream, LLC. Biden canceled the Keystone XL pipeline shortly after becoming president, resulting in TC Energy filing a $15BN lawsuit against the US. The Administration is getting the results its energy policies deserve, and the industry’s capex discipline is a result of prior poor returns as well as the long term hostility of Democrats to reliable energy. See I Can’t Go For That (No Can Do) – Why U.S. E&Ps Have Been Slow To Ramp Up Crude Oil Production for further detail.

- Russia’s invasion of Ukraine and the consequent sanctions have disrupted many commodity markets. Corn, wheat, fertilizer and steel are all sharply higher. No matter how the war plays out, Russia’s standing as a reliable supplier has been set back decades. Soviet troops violently suppressed protests in Budapest (1956) and Prague (1968), events that colored the west’s perspective of the Soviet Union until its fall in the early 1990s. Today’s war on Ukraine is much bigger and bloodier. Germany has led western Europe in belatedly correcting a posture of supplicant that relied on Russia for oil and gas and America for security. Many countries will regard Russia’s exports of commodities as permanently at risk to unpredictable military moves by the Kremlin, with prices higher as a result.

- Globalization has been an important source of disinflation for over three decades, allowing OECD economies to benefit from cheap Asian labor. Covid had already exposed supply chains to lockdowns overseas. Sanctions imposed on Russia will cause a further reassessment of suppliers and investments in other countries at risk of invading their neighbors. China and Taiwan is an obvious case. To put it in terms a CFO might consider, even 95% confidence that China won’t invade Taiwan in the next year translates into a 40% probability they will over a decade, resulting in a possible write off of any Chinese assets. This type of risk reassessment runs counter to globalization. Blackrock’s Larry Fink and Oaktree’s Howard Marks have both warned of a fundamental reordering of supply chains. “Cheapest” may lose to “most secure”, which will be closer to home or even domestic. This is inflationary.

- The energy transition is fundamentally inflationary, since it means paying more for the same amount of energy. This receives scant attention in the media which breathlessly reports on falling prices for solar panels and windmills. Obviously renewables cost more – otherwise they would dominate. Germany and California, both farther ahead in renewables use than most, have high electricity prices. Accepting more expensive energy is a legitimate public policy to lower emissions. In spite of the shrill climate extremists, coal-to-natgas switching, carbon capture and increased nuclear power are gaining support as more pragmatic solutions than weather-dependent ones. But reducing emissions is raising prices.

- Federal debt is on track to exceed the levels of World War II as a percentage of GDP. Treasury secretary Yellen has said that current levels of debt are sustainable but not the trajectory. Negative real yields on US treasuries are a persistent gift from return-insensitive buyers such as central banks, sovereign wealth funds and pension funds. They are facilitating our fiscal profligacy. But the US economy’s ability to tolerate rising rates has been decreasing with each cycle. Monetary policy is constrained because it effects the cost of financing our debt.

When wages rise faster than productivity, that provides an easy justification for the Fed to tighten policy. But the other factors listed above are less clearly in need of a hawkish response. Sanctions on Russia, de-globalization and policy choices to pay more for lower-emission power are all inflationary but do they really justify the Fed to counter them by slowing economic growth? This is the debate that will be occupying the FOMC during the current rate cycle.

If the Fed does overshoot, expect more $TNs of inflationary fiscal stimulus and Fed debt monetization via balance sheet expansion, because that’s how we combat recessions nowadays. We dislike recessions more than inflation, so the latter is more likely. Getting inflation back to 4% will calm their critics, such as Larry Summers who’s been as right as the FOMC has been wrong. But the Fed’s reinterpreted dual mandate along with fundamental shifts in world energy markets and trade flows make it likely we’ll adapt to permanently higher inflation than in the past 30 years.

Please see important Legal Disclosures.

The post Markets Lose Faith In 2% Inflation appeared first on SL-Advisors.