Key Points

- The U.S. economy and the global economy is driven by consumer spending and technology adoption.

- Tech and consumer discretionary stocks have a long history of outperformance.

- When underperformance periods arrive, that’s the time to begin building up exposures.

“Households are wealthy, flush with cash, and ready to spend—setting the stage for a lasting, self-reinforcing surge in demand.” Bridgewater Associates 10/19/21

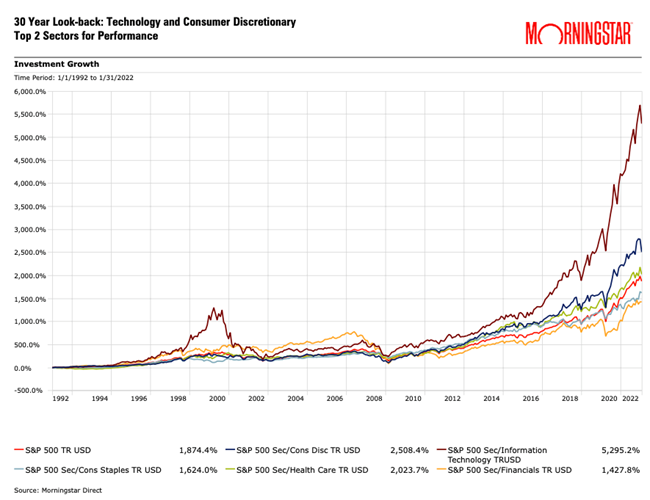

Here’s the long-term, 30 year look on sector performance:

The leading technology & Consumer Discretionary stocks have a significant track record of success relative to other sectors and the S&P 500 overall.

Interestingly, both the technology and consumer discretionary indices have the highest beat rates versus the S&P 500 on a calendar year basis as well. Technology indices have outperformed the S&P 500 index 19 of the 32 years since the data began or roughly 59% of the time. Consumer Discretionary stocks via the index has outperformed the S&P 500 20 of the 32 years with a roughly 63% beat rate. From 1/1/1992 to 1/31/2022, the Information Technology sector’s total return per Morningstar is +5295%. The Consumer Discretionary sector’s total return for the same period is +2508% versus the S&P 500 return of +1874%. As with any index, the returns tend to come from a handful of stocks versus broad-based returns so what you own in these sectors is just as important as whether you own the actual sector exposures. Technology & Consumer Discretionary stocks in particular, as I type this post, are in the process of having their normal pullback in a very uncertain market. Here’s the opportunity: you have the answers to the test, you know how this story ends: now is the time to assess whether you have sufficient exposure to the top two performing sectors in markets. There’s a massive sale happening right now, these are wonderful times to take advantage of short-term volatility for your potential long-term gains.

Why have Tech & Consumer Discretionary stocks been persistent performers?

As I have stated over and over, roughly 60% of global GDP comes from the consumer. Roughly 70% of overall U.S. economic activity also comes from the consumer and all the spending that happens year after year. The consumer spending component of global GDP alone is about $40+ trillion each year. Add to that the investments in technology at the corporate and consumer level and you have trillions more of spending. That’s a powerful and predictable theme to anchor your portfolio too. The best part – the leading brands are on sale now. Nothing has changed, there’s simply a sale happening.

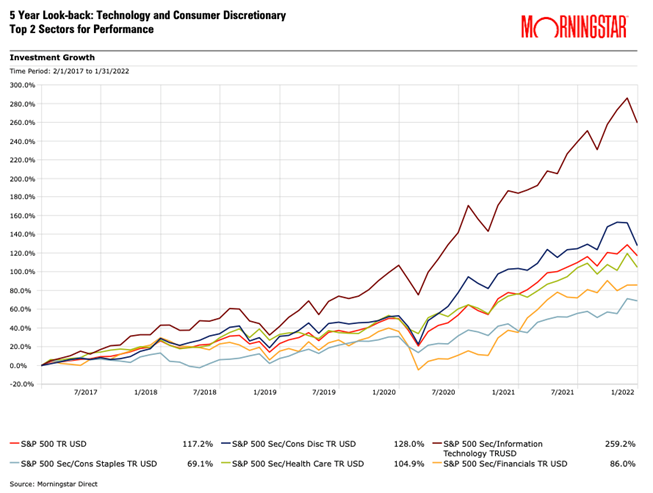

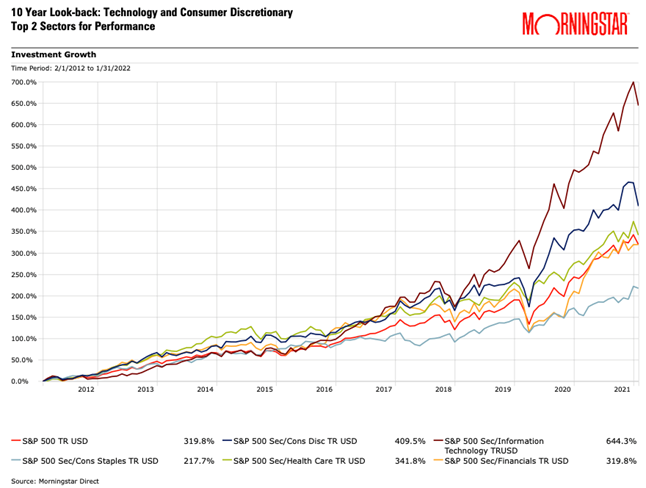

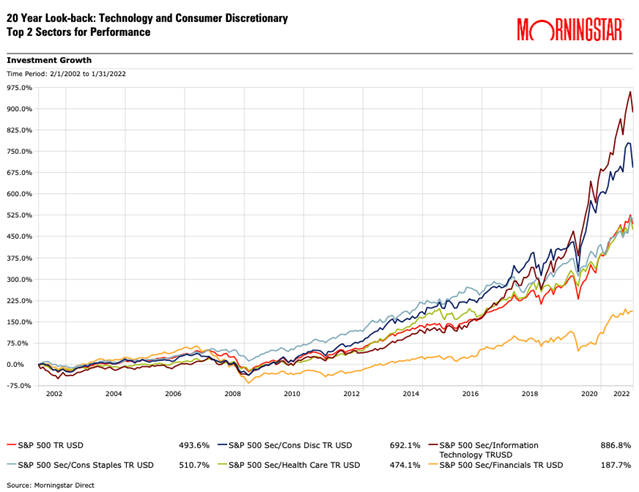

It should shock no one that in a global economy driven by consumer spending and technology adoption, these two sectors, should in theory, be strong relative performers. Here’s the data from Morningstar:

5 years ending 1/31/22: Top two performers – technology & consumer discretionary stocks.

10 years ending 1/31/22: Top two performers – technology & consumer discretionary stocks.

20 years ending 1/31/22: Top two performers – technology & consumer discretionary stocks.

Why are stocks on sale today?

Uncertainty. The markets like certainty and today, we have a lot of uncertainty. With uncertainty comes excess volatility and that creates opportunity as well as paralysis on the part of investors. The wall of worry is quite high today and that’s why the VIX (volatility index) is higher than normal. Opportunists love periods of volatility because they get to take advantage of short-term uncertainty and fear to obtain attractive prices for the next period of calm.

Right now, it’s vital for investors to remember they now know how this story ends. Today and over the next few months, you should have wonderful opportunities presented to you across important technology, Internet and consumer spending industries. It’s equally important to remember: the most relevant brands serving these key consumption industries largely have bomb-proof balance sheets, strong pricing power, continued demand for their products and services, and are beloved by their customers.

Now is the time to remind ourselves about key secular growth trends and high brand relevancy. It’s absolutely the right time to focus on high profitability metrics and strong balance sheets. Buying fear, when sentiment is poor, is one of the best ways to have strong long-term returns. Through those periods, the savvy investors, take advantage of fear for long-term potential gains. The case for active management has never been greater. Why? We currently live in a world where an $800 billion major technology brand can move down 25% in a matter of 15 minutes because of an earnings miss and a $1 trillion consumer brand can move up 18% in the same 15 minutes when the earnings report is not nearly as bad as expected. This is not normal nor is it sustainable, but it is the world we live in for now. Volatile periods are never fun, and they always make us question the things we own but it’s extremely important to remember, hurricanes do not last forever, blue skies and calm follow wicked storms. Please remember this timeless concept: the most attractive forward returns have always come from being willing to be a contrarian when companies, good and bad, where being ignored and under-estimated. The best technology & consumer companies are market share takers in times like today and taking market share ultimately drives big earnings beats down the road. That’s exactly why these two key sectors have the best long-term performance.

The best tech and consumer brands are on sale, seize the opportunity.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.