The market is disconnected from everything. Throughout history, there are correlations you would expect to hold constant between the market, consumer confidence, and the economy. Currently, after a decade of zero interest rate policy, massive amounts of liquidity, and financial supports, the market has become detached from reality.

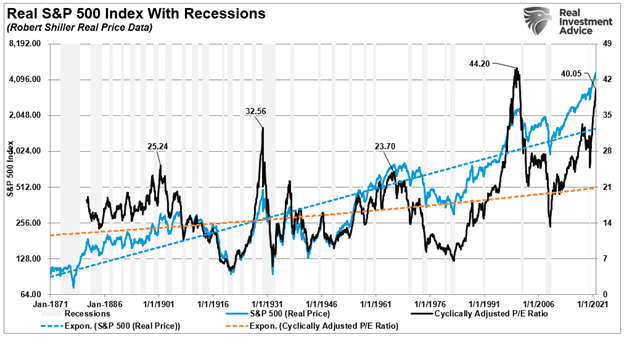

Of course, such should not be surprising as we witnessed previously throughout history. Whether it was 1929, 2000, or today, the basic measure of the market disconnect, and investor exuberance, was valuations.

The most obvious is the Shiller CAPE ratio which takes current prices dividend by 10-years of earnings. This method smoothes out the volatility of earnings that can occur on an annual basis. At 40x trailing earnings, current valuations are higher at the peak of the market in 1999.

Importantly, valuations are only the mathematical representation of investor psychology. At the peak of every major market cycle, investor exuberance ran amok. Notably, at the peak of each cycle, investors believed “this time was different,” whether due to some new wave of technology or monetary interventions.

However, while valuations reflect investor “greed,” other measures better represent the disconnect between the market and fundamental realities.

Market Vs. Economic Growth

One of the most fundamental disconnects currently is between stocks and the economy. Historically when stocks have deviated from the underlying economy, the eventual resolution is lower stock prices.

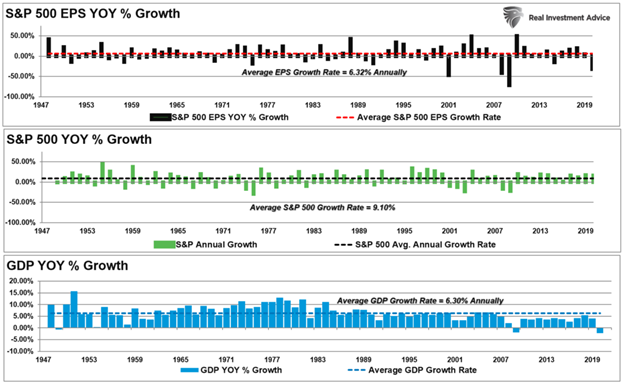

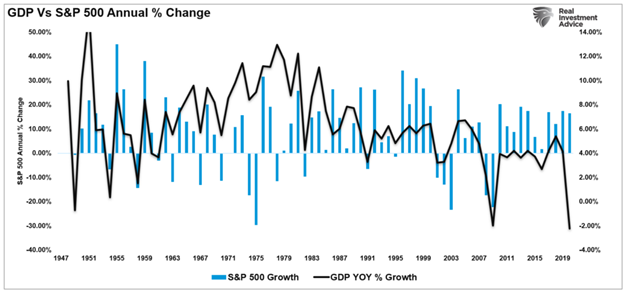

Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2020.

Since 1947, earnings per share have grown at 6.32%, while the economy has expanded by 6.30% annually. That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

While stock prices can deviate from immediate activity, reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

Stocks Vs. The Economy, Which Is Right?

The market disconnect from underlying economic activity is due to psychology. Such is particularly the case over the last decade, as successive rounds of monetary interventions led investors to believe “this time is different.”

Unfortunately, it never is.

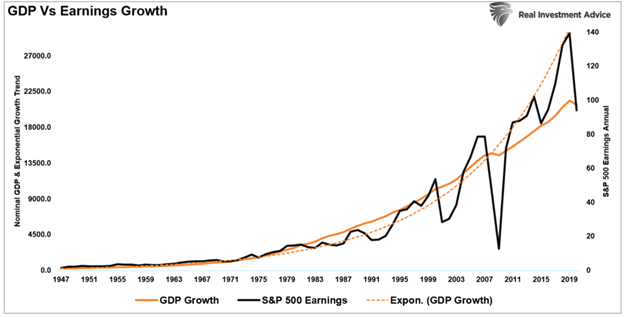

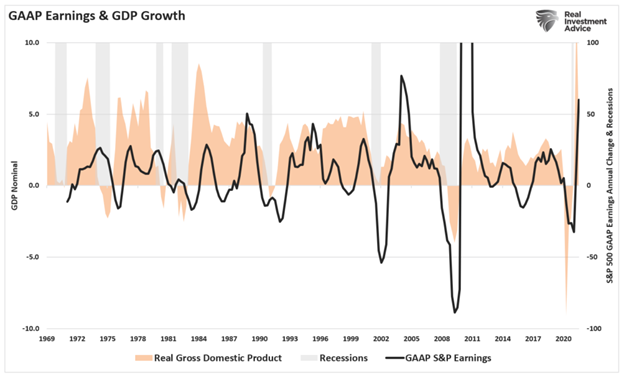

While not as precise, a correlation between economic activity and the rise and fall of equity prices does remain. For example, in 2000 and again in 2008, corporate earnings contracted by 54% and 88%, respectively, as economic growth declined. Such was despite calls of never-ending earnings growth before both previous contractions.

(Chart below are annual data through 2020)

As earnings disappointed, stock prices adjusted by nearly 50% to realign valuations with weaker than expected current earnings and slower future earnings growth. So while the stock market is once again detached from reality, looking at past earnings contractions suggests it won’t be the case for long.

The relationship becomes more evident when looking at the annual change in stock prices relative to the yearly GDP change.

Again, since stock prices get driven by the “psychology” of market participants, there can be periods when markets disconnect from fundamentals.

However, most important to investors is that fundamentals never play “catch up” to stock prices.

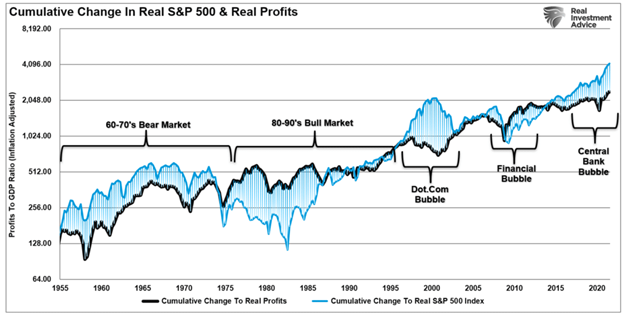

Market Vs. Profits

It isn’t just the economic data that has a historical correlation with markets. Earnings and profits also correlate with markets over the long term due to their dependency on economic growth. Earnings can not live in isolation from the economy.

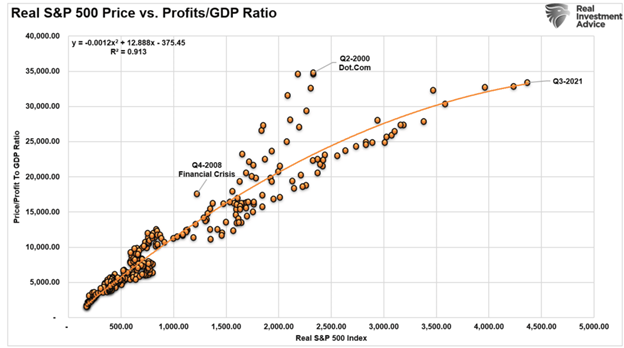

It would be best if you didn’t dismiss the fact markets can and do, deviate from long-term earnings. Historically, such deviations don’t work out well for overly “bullish” investors. The correlation is more evident when looking at the market versus the ratio of corporate profits to GDP.

Why profits? Because “profits” are what gets reported to the IRS for tax purposes and are much less subject to manipulation than “earnings.”

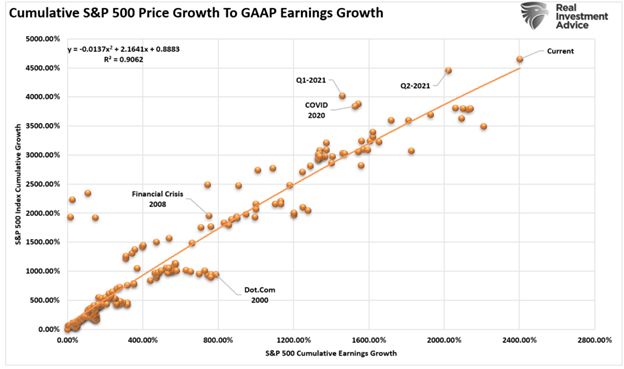

We can see the same excess when comparing cumulative price growth to GAAP earnings growth.

With correlations at 90%, the relationship between economic growth, earnings, and corporate profits should be evident. Hence, neither should the eventual reversion in both series.

Reversions Happen Fast

The detachment of the stock market from underlying profitability guarantees poor future outcomes for investors. But, as has always been the case, the markets can certainly seem to “remain irrational longer than logic would predict.”

However, such detachments never last indefinitely.

“Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.” – Jeremy Grantham

Many things can go wrong in the months ahead. Such is particularly the case of surging stocks against a weakening economy, reduced global liquidity, and rising inflation.

While investors cling to the “hope” that the Fed has everything under control, there is more than a reasonable chance they don’t.

Regardless, there is one truth about stocks and the economy.

“Stocks are NOT the economy. But the economy is a reflection of the very thing that supports higher asset prices – corporate profits.”

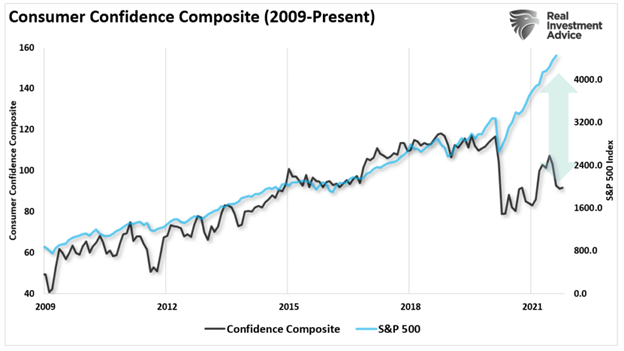

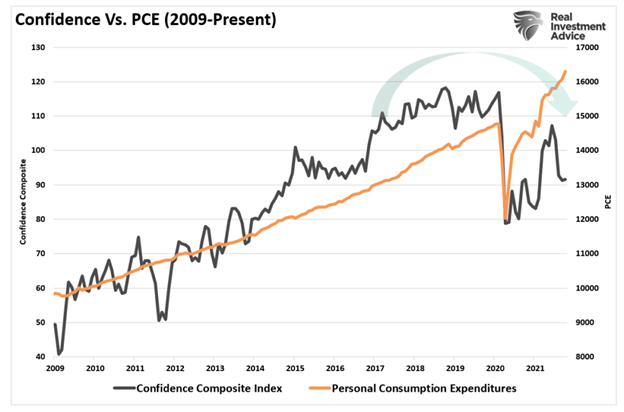

Market Vs. Confidence

The chart below is our Consumer Confidence Composite index, an average of the University of Michigan and Conference Board measures. Again, there is a decent correlation between confidence and the markets, and the current decline suggests weakness the market is heavily discounting currently.

The media is quick to dismiss the decline.

“Earlier this week, we noted that actual spending data from consumers belies the lack of confidence these survey reports suggest, serving as a reminder that an uneven recovery does not mean a forestalled one.

‘In our proprietary data, we see a modest softening, especially in the service sector. But it’s starting to stabilize to a certain extent. It does feel like maybe we’ve come to the bottom of it.’ – Joe Song, Bank of America Global Research

Song added that ‘even though these economic data are starting to slow down, they’re still well above levels we saw at the start of the year.'”

That view is very short-sighted. First, while it seems consumers are still spending, such remains a function of the remnants of previous liquidity flows. However, that liquidity is running dry, as witnessed by the sharp increases in consumer credit. Secondly, much of the current economic data gets measured on a year-over-year basis. Those comparisons are about to become extremely tough as the Q2-2020 data gets removed from the equation.

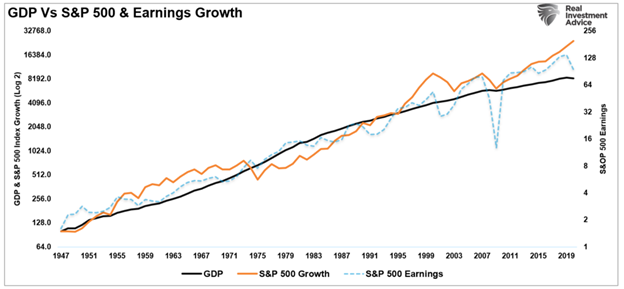

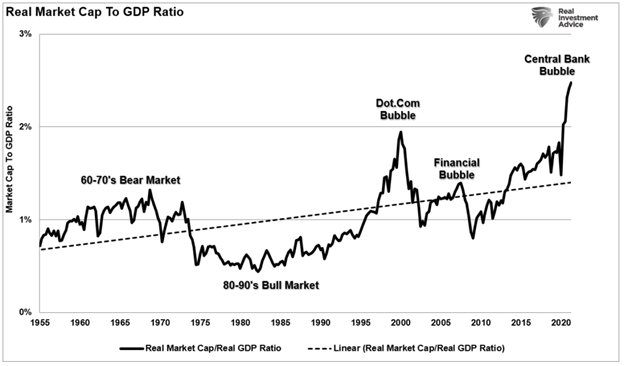

Reversions To The Mean Are Problematic

Notably, the outsized growth of the market reflects repetitive interventions into the financial markets by the Fed. Those interventions detached financial asset growth from their long-term correlation to GDP growth, where, as stated, is where corporate revenue comes from. Such can be explicitly demonstrated by the inflation-adjusted market capitalization to GDP ratio.

Historically, when the S&P 500 separated from economic growth, a reversion eventually occurred.

Currently, analysts continue to expect earnings to outgrow the economy into 2022. However, the flaw in the analysis is the assumption earnings growth will continue its current trend. However, as previously discussed, economic growth is slowing, and the year-over-year comparisons will become exceedingly more difficult next year.

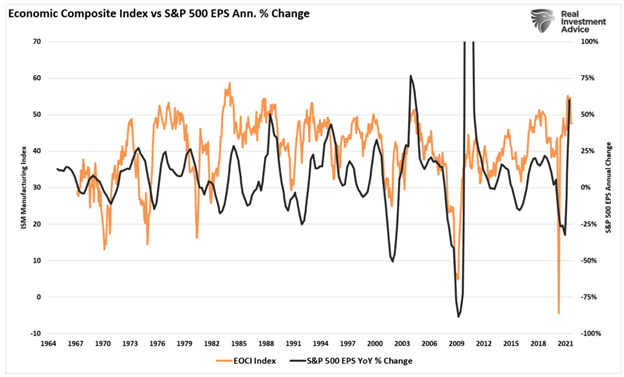

“The chart below is the Economic Output Composite Index. The index comprises the CFNAI, Chicago PMI, ISM Composite, the Fed surveys, Markit Economic Index, Markit PMI, NFIB, TIPP Confidence, and the LEI. In other words, this indicator is the broadest indicator of the U.S. economy there is.

The index just peaked at the second-highest level on record. Given the cyclicality of economic data, such suggests a weaker cycle heading into 2022. Importantly, noted the high correlation between the index and the annual change in earnings.“

Optimism is highly elevated. Such reflects the stock market behavior over the past year combined with more recent economic releases. But some curbing of enthusiasm may be warranted given the history of the stock market sniffing out economic inflection points.

The reality is that the supports that drove the economic recovery will not support an ongoing economic expansion. One is self-sustaining organic growth from productive activity, and the other is not.

The risk of disappointment is high. And so are the costs of being “wilfully blind” to the dangers.