Key Points

- The July Retail Sales headline was incredibly misleading – the reaction offered an opportunity.

- The U.S. consumer continues to be healthy and very particular about where spending happens.

- Overall Retail Sales will continue to mean revert but spending is expected to stay elevated.

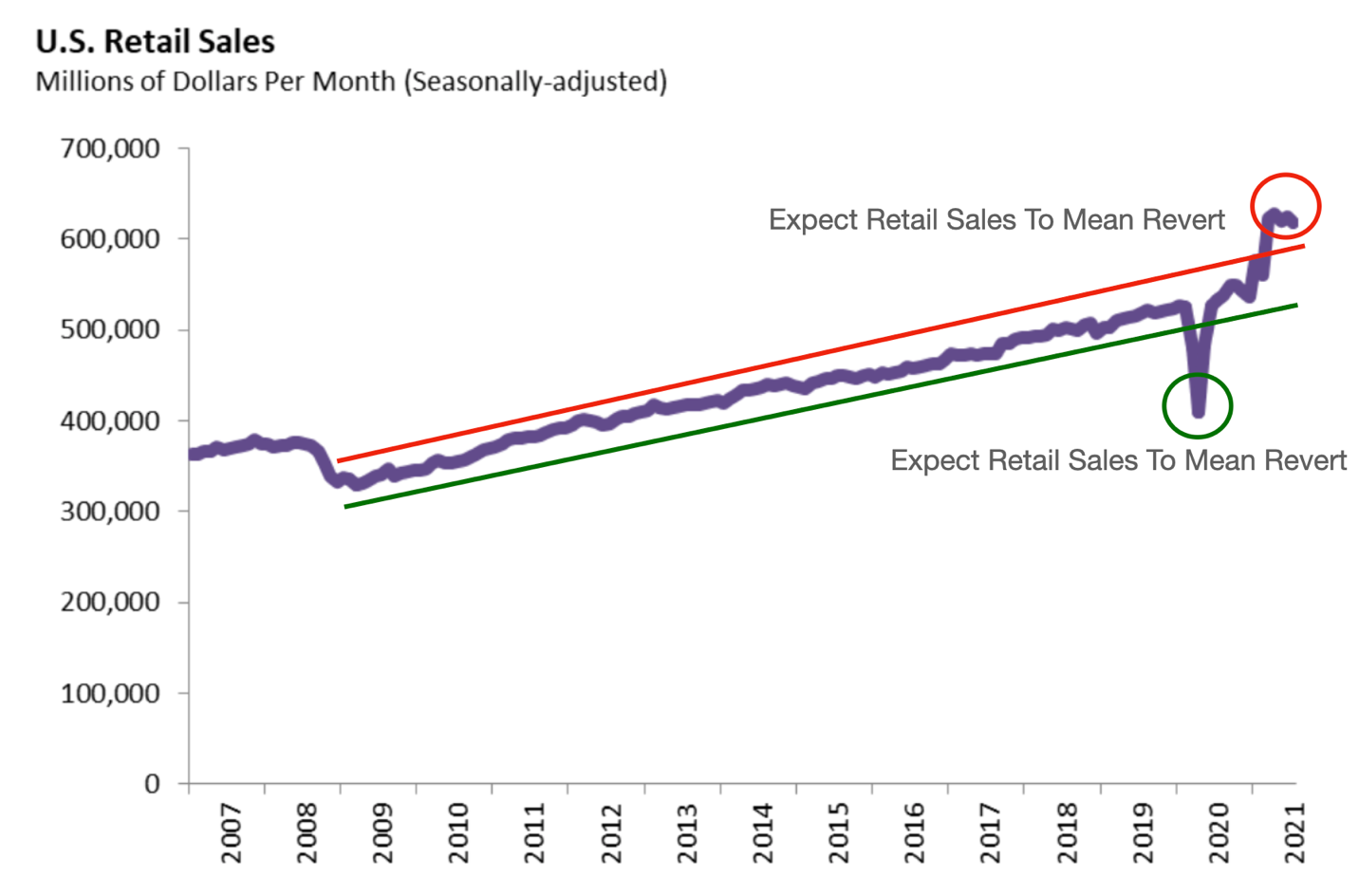

Source: lao.ca.gov for the retail sales chart, Accuvest for the channel lines and notations.

Retail Sales

Drawing conclusions about the state of mind of consumers from one month to the next can be dangerous to your wealth. Our spending can be episodic at times but when you look back over one year, it’s highly predictable. Yesterday’s report of July Retail Sales falling 1.1% from June to July is noise and was to be expected yet the market used this and other geopolitical factors to push down everything, including retail stocks across the board. Why? Because algo’s trade off of headlines and don’t read data and trends very well. As the chart above shows, consumers have been revenge-spending after months of forced savings and lockdowns. This has pushed the overall Retail Sales numbers to unsustainably high levels where we should expect mean reversion to occur. That’s what we are seeing now as the data begins to revert back into the long-term up channel. The most important factor is the trend of consumption, and it’s up and to the right which is exactly what we want to see.

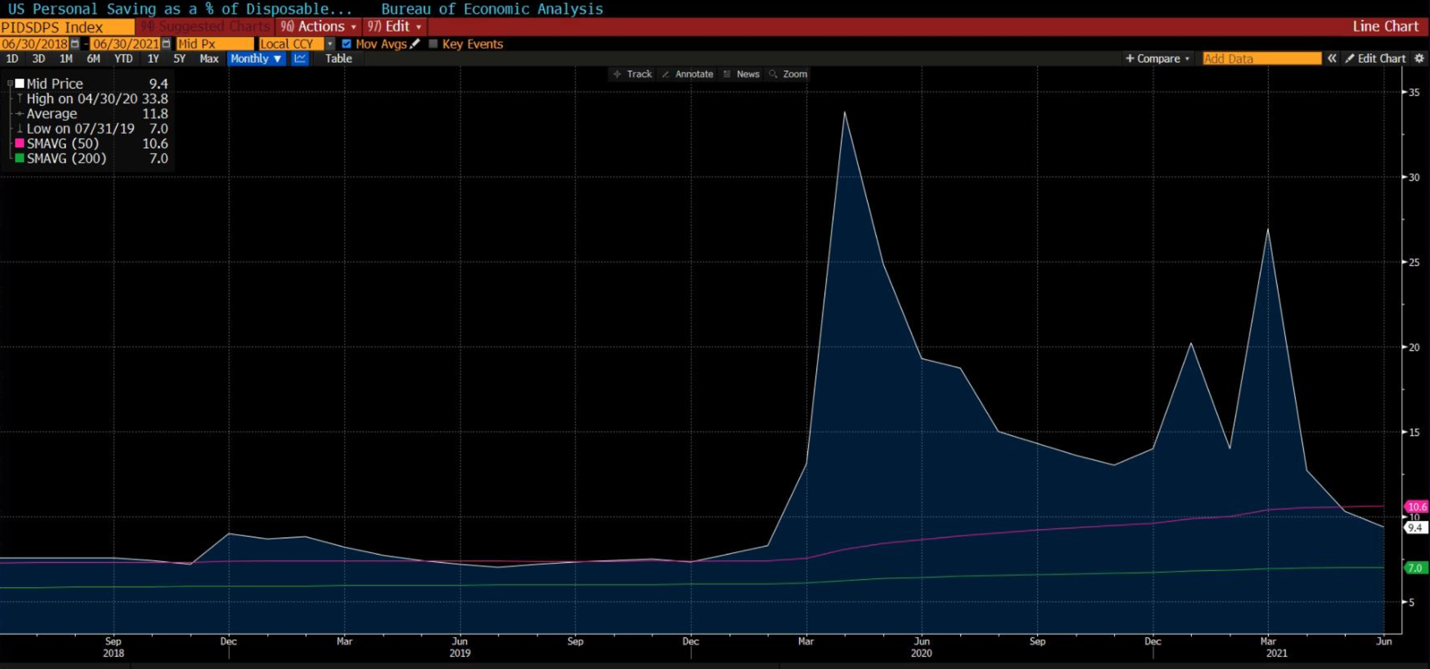

When COVID-19 shut the economy down Retail Sales fell off a cliff for a short period of time. That was also expected. The most wonderful opportunity investors in consumer stocks have had in a very long time occurred when the Retail Sales data fell through the downside of the channel. As vaccinations continue to be utilized and our COVID-fatigue grows, a normalization of Retail Sales trends will occur. Bottom line: the month-to-month changes in spending trends are just noise and do not offer much in the way of investment edges. What does offer a significant opportunity is fading or aggressively adding to great brands when the market gets irrational about frequently reported economic data. I added to my favorite retail brands on yesterday’s sell-off and I will continue to do the same on any subsequent sell-offs that occur. The consumer is still healthy and has excess savings that will be drawn down over the next 12 months. With the rolling correction that’s already occurred in markets, there’s a lot to like about the markets even though the conventional wisdom focuses only on the index-level results.

Consumer Balance Sheets Remain Healthy

Last I checked, there was still well over $4 trillion in money market funds, home values are at all-time highs, wages are increasing, and job growth is accelerating. Not to mention, consumer savings rates are still elevated at 9% vs a normal 7% level. That’s still about $2 trillion in savings that will continue to trickle into the economy over the next year or two. That my friends is a nice tailwind for the overall consumption thematic. Footnote: prices for goods and services are elevated currently so consumers are feeling squeezed from almost every angle in their consumption lives. The latest consumer sentiment readings reflect that caution. High prices forces people to prioritize purchase decisions. Which spending categories make the most sense today? Which brands are the most relevant in each of these categories to me? How much money am I willing to spend on items I need? People start deferring purchases in one area to focus on others. The cure for high prices is always high prices though.

When consumer’s stop revenge spending and get more price sensitive, competition will start heating up for the consumer wallet and lowered prices will be the net result. Some brands have great pricing power because their products and services have high demand, we try to find these stocks for the portfolio. For most industries and categories though, it takes just a few big brands getting more focused on cutting prices before most peers start following along. Overall, that’s great for spending trends and better consumer sentiment readings looking forward.

Elevated Consumer Spending: The Trend is Your Friend

The most important take-away from the first chart in this blog: Retail Sales are trending up and will remain stable while being volatile month to month. Predictability is a key item people want in a portfolio and I know of nothing more predictable than a consumers’ propensity to spend.

Let’s look at the big picture in Retail Sales:

Overall, we saw spending +13% year over year even if the data decelerated off unsustainably high levels. People love to only focus on the rate of change but let’s also realize the absolute numbers were very robust. Restaurants and bars were up 38% YOY and clothing & clothing accessories were up 43% YOY. Autos were soft likely because of difficult to find inventory, there’s clear demand across conventional and electric vehicles currently but supply is challenged. E-commerce was also a bit soft which should be expected given we are all out and about and focused on vacations.

~70% of GDP is consumer spending so no one should be surprised to see an easing of retail spending and GDP, it’s at unsustainable levels and needs to normalize. Here’s the fun part, when GDP and consumer spending falls off a cliff, there’s a high correlation of strong consumer stock returns as the normalization occurs off very depressed levels but I have found zero correlation to the direction of consumer stocks when the data is very robust and set to normalize lower. This makes these silly narratives and sell-offs a great opportunity for long-term consumer investors.

With prices high across most spending categories, we should expect consumers to be more price conscious and discriminating about what they buy, where they buy and what price they are willing to pay. With high prices, we shouldn’t be surprised by how robust the buy now-pay later business trends are. This added purchase option really helps people keep buying while helping them manage their checking balances. Eventually, supply chain disruptions will ease, shipping rates will normalize and prices of goods will fall back to normal levels. Because the disruptions have been so severe as demand returned with a vengeance, it could take a number of months longer to a return to a normal pricing environment. The brands that have the most relevancy with consumers will maintain pricing power with little change in demand. That ultimately spells better financial metrics in future quarters.

Summary:

- Current Retail Sales are in the process of normalizing from unsustainable levels.

- Overall, consumer spending should stay strong for longer given high savings rates.

- Consumers are starting to discriminate across their spending categories. Brand relevancy is critical to sustaining the current revenue and margin structure of companies.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.