Key Points

• Stock markets often over-react, the truth mostly lives in the middle.

• We have likely begun the stagnation part of our economic reality.

• Higher than average volatility with frequent spasms and a rangebound market favors active management over passive.

The Great Over-reaction:

There’s a great stat for equity markets that I think is very timely for this week’s blog post. The long-term average for the stock market return is roughly 9%-10% per year, yet very rarely does the market return this 9%-10% in a calendar year. The market typically gyrates above and below the long-term average return. The 2020 market is a wild depiction of that philosophy.

The stock market basically crashed down 30%+ in a few months on the fears that an economic depression would occur because of Covid-19. Then the Federal Reserve (Fed) and all global central banks added unprecedented monetary and fiscal stimulus measures to counter-act the forced closing of economies. This epic bazooka shock stimulated animal spirits and the equity and credit markets ripped back in a V-like fashion. I’ve stated many times in these posts, waterfalls tend to get re-traced and this time was no different but the bigger picture message: the market priced in a depression very quickly. When the depression thesis was taken off the table, the markets needed to re-price for a different outcome. I believe that process is now largely complete. For now, a sigh of relieve is what we all feel.

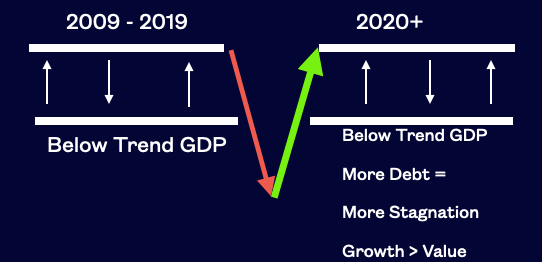

Here’s a graphical expression of our economy and markets since the March 2009 bottom and where I think we are headed over the next few years.

The Stagnation phase: The slog for traders

If the entire economic recovery from 2009 to 2019 was below trend (3.2% GDP) and averaged roughly 2.2% GDP, what should be expect with an economy with markedly more debt and the potential for higher structural unemployment? I suspect the answer is a similar experience as the cycle we just exited.

Companies will be forced to right-size their workforces for the new economic reality. More layoffs will come. More companies will implement significant cost-cutting initiatives that include more employees having the option of working from home on a full or part time basis, this requires less expensive corporate office space. Doing more with less will require significant technology upgrades, that’s a real opportunity. E-commerce will thrive as more and more consumers realize the benefits from point, click, buy, and get quick delivery. That’s a major productivity enhancer. It’s the leading brands that serve this new world that should thrive in an otherwise stagnate economic environment. There’s always winners and losers in every kind of market. For Portfolio Managers, less stocks should equate to better returns.

Higher VOL = Stay more active

In a world of stagnation, what worked in the sub-par recovery we just left will likely keep working for the foreseeable future. Remember, when growth is slow, interest rates should stay low for longer. That means bond returns should be uninspiring, at least the buy and hold bond approach. Because of stagnation, the Fed should likely stay engaged to act as the bridge to a much deeper economic malaise, which likely keeps the dollar rangebound. I expect to see frequent rolling recessions across different sectors and industries similar to what we saw in late 2015/2016.

If uncertainty will stay higher than normal, volatility spasms will be more frequent. Volatility is the friend of the long-term investor if you have the interest and skill to take advantage of VOL spasms. The equity market may stay in a wide range for the next few years versus trending in one direction or the other. That favors a more active investment/trading style and it favors concentrated strategies versus those that own hundreds or thousands of stocks. I would bet the best performing stocks will continue to be high quality, industry leading businesses that have the balance sheet, innovation focus and visionary management teams to take market share in these difficult times. The big will get bigger, the middle tier companies will struggle to keep up and the laggards will fall into irrelevancy. That’s how I think you get through a period of stagnation as an equity investor. This recovery will take time and please make sure you have sufficient exposure to more active, high active share strategies (these look very different than the indexes).

The rest of the year:

I think the easy money has been made at this point. The balance of things that could get worse and better is now back to equilibrium. How active the Fed will stay is likely very important to the direction of markets for the remainder of the year. We do have some near-term challenges with continuing unemployment payments and PPP loan ramifications and then elections. In a stagnation world, jobs will be harder to find and take longer to fill and without the bridge of unemployment, more economic downside seems likely. I highly doubt though, the Fed will have spent trillions of dollars only to pull the rug out from under this tenuous recovery. If I was forced to guess, I think the market stays in a wide range for the rest of the year. For strategies that buy and hold, that’s not real bullish, for those that tactically trade around positions, some additional attractive opportunities should exist for the remainder of the year.

The Bottom Line:

Here are some bottom-line takeaway points for investors to consider:

- The stock market very regularly over-reacts and extrapolates to extreme outcomes.

- Most often, the actual results fall somewhere in the middle. That’s what’s behind this epic rally.

- The global economy is likely to be stuck in stagnation-mode for a few years while it heals.

- We should continue to see volatility spasms and wonderful opportunities for traders.

- The best returns will likely come from: quality, leaders, concentration, and active over passive.

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.