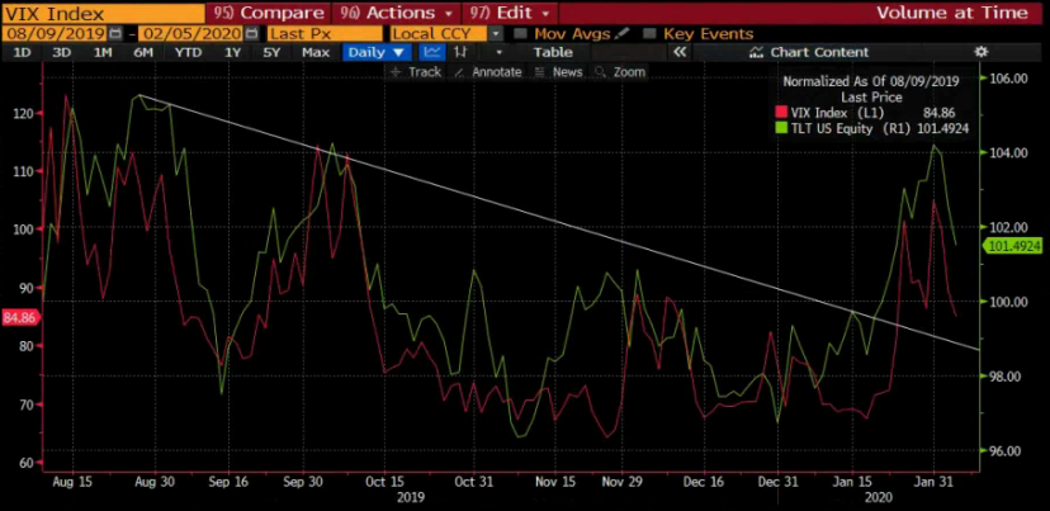

I’m sorry to bring this to your attention, but as a close watcher of the Cboe Volatility Index (VIX) for the past 20 years I felt it was my duty to bring to light some ominous notes, unfortunately, and see below two charts comparing TLT (ETF that tracks long-term Treasury bonds) and the VIX.

Over the last six months or so, there has been a real correlation between Treasury bond prices and fear or volatility. So, what does this mean for market sentiment?

Historically, or at least over the last few years, these two prices move opposite to one another because the stock market becomes more fearful and volatile when liquidity is leaving the system and interest rates are rising. Meaning, as interest rates rise and bond prices fall in value, the stock market typically becomes a bit more volatile and the VIX rises as the liquidity for investing becomes a bit harder.

Lately, however, the VIX has gone up and down with bond prices, not opposite. I think the market is really starting to worry about a recession and how the 2020 election will play out for the economy. Long-term Treasurys rallying and interest rates falling have been a sign of a flight to quality and conservative investment strategies. The fact that a lower interest rate environment is causing more volatility in stocks is a bit concerning like we have seen to start 2020. Since the start of the year, the tide of coronavirus and the Presidential election 2020 has risen all boats. Bonds have rallied, stocks turned themselves around and rallied up over 2% for the year in the S&P 500, and VIX (volatility and fear) has risen. This is not normal, at all. The reason I believe this is happening is that strong earnings and jobs numbers are forcing stocks higher, yet bond traders and VIX traders are starting to be concerned about valuations and the sustained growth we have experienced coming to an end.

So, when was another time we saw this occur? Bond price up, stocks up, VIX up? Uh oh, the end of 2007. Yes, throughout the one-year time frame from August 2007 to August 2008, bond prices moved lock step in correlation to VIX.

And guess what happened to trigger this strange correlation in both time frames? An inverted 2-year and 10-year yield curve. We all know the data on a “yield curve inversion” issue and it being a predictor of a recession 12 months or so down the road. I believe that with the fear of a pending recession always looming over investors’ heads, VIX and fear rise anytime people see long term interest rates fall as market participants anticipate the end is near and fly into government debt.

Growth stocks have been the real story over the last year, and with the amount of volatility on the rise, I think it is prudent to diversify some of that exposure into value, volatility, short term bonds. I’m not saying get out and the end is near, but I am saying a rebalance or underweight growth is prudent because with higher volatility also comes faster moves to the upside so you can still get portfolio appreciation from the FAANG or growth ETFs like VUG but you will get it that much faster, thus a lower allocation is worth it in order to reduce risk.