It’s Black Friday and let the holiday shopping games begin! American shoppers are expected to spend an average of $1,048 during the 2019 holiday shopping season. And how will they pay for it? Nearly, 60 percent of shoppers say they are likely to use a mobile payments solution for some of their holiday purchases this year, according to Ibotta.com.

Well there you have it, now we have a goal to track for the holiday spending season. For me, the biggest datapoint here is the mobile payments adoption. That’s a key theme for us as investors in global consumption trends. So, who are the winners: Apple Pay, PayPal, Square, Visa, and Mastercard as payment processors just to name just a few.

The History of Black Friday:

Black Friday is the name dubbed for the beginning of the holiday shopping season. It dates back to the early 1960’s and we have become programmed to begin our holiday shopping by visiting the retailers offering the best deals. Black Friday is often used as a barometer for how holiday retail sales will progress, so it gets a ton of media attention. Black Friday has always offered a glimpse of what could likely happen in aggregate for the holidays from a retail perspective. I suspect the importance of Black Friday has diminished given how much growth we see in online sales, however. There are some other significant “shopping holidays” like Amazons Prime day (this year it was 48 hours) as well as Alibaba’s Singles Day, which is like Prime Day. And then there’s Cyber Monday, which is December 2. In short, our consumer nation loves to find new and exciting reasons to spend our money.

That said, I like following the trends as a consumer and brands investor:

RETAIL SALES: Stable, predictable, rising steadily over time.

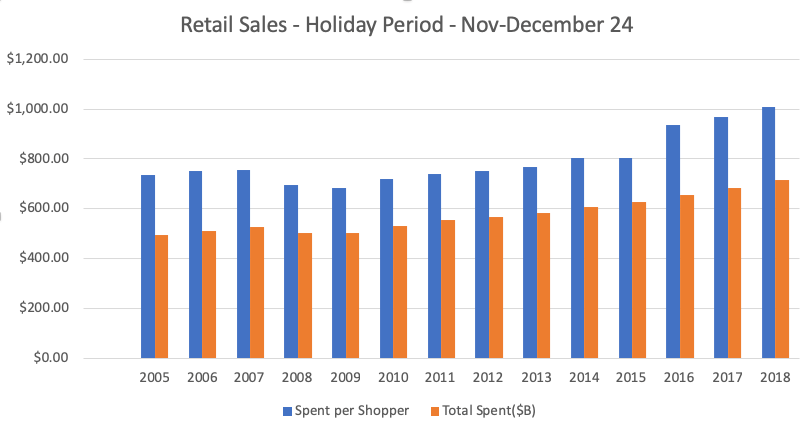

- Holiday retail sales are very predictable and continue to reach all-time highs.

- E-commerce remains the biggest investment opportunity in consumption.

- The most relevant brands should thrive this holiday season.

Holiday Sales:

Since total retail sales comprise 30% of U.S. GDP, it’s an important indicator of consumer and economic health.

Online shopping last year grew 19% year over year (source: Mastercard SpendingPulse). Online is where the real growth is but the death of local shopping has been greatly aggerated. Consumers still like to shop with friends and family, touch and feel products and enjoy a great experience. Brick and mortar traffic will begin to accelerate on Black Friday. Retailers and brands will continue to have to innovate around in-store experience as fickle consumers require more and more reasons to stay loyal.

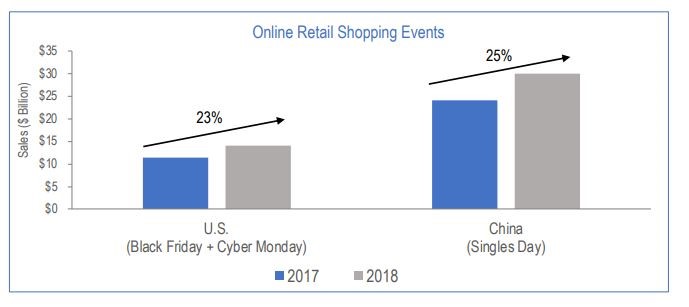

It’s important to remember event-driven retail sales are not a uniquely American phenomenon. Countries all over the world have their own versions of Black Friday or Cyber Monday. For instance, Alibaba’s Singles Day has been an enormous hit in China ($30 billion in sales estimated this year) and a major revenue generator for Alibaba shares.

The below chart highlights the year-over-year growth in the U.S. and China with Black Friday, Cyber Monday, and Singles Day.

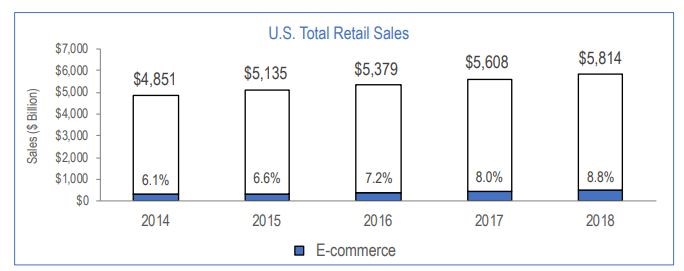

E-commerce is the Growth Engine for Consumption

Mobile phones, aka smart phones, have enabled consumer here and abroad to shop more regularly and with more convenience than ever before. Currently over 97% of global mobile phones have access to the Internet (source: Bloomberg). When you have more consumers to sell to, your revenue opportunities increase. This is a wonderful market for investors.

As an investor, we want to know what have room for exponential growth. E-commerce continues to be a place to focus. Online retail sales have been growing rapidly but as a percent of the total retail sales in the U.S., it’s still quite low at around 9%. With a Uber-connected society and the convenience of one-day or same day delivery, the growth in e-commerce seems quite assured. The table below highlights the small overall level at which e-commerce plays. (Source: Oshares).

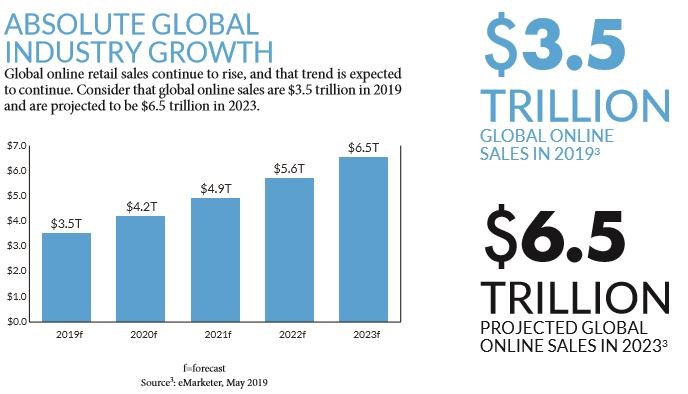

E-commerce growth outside the U.S. is also expected to rise sharply over time, warranting more attention from investors. In fact, online sales should rise more quickly in developing nations given their propensity for using mobile phones for more transactions. Think about how many countries there are that do not have the infrastructure for consumption of developed countries. With smart phone technology and high-speed Internet access, the playing field has been leveled and consumers in every part of the world can shop for goods from brands all over the world. The E-commerce boom has very long legs as shown in the graphic below (Source Amplify.com).

Potential winners this holiday season:

Consumer preferences change over time but there are a few themes that seem to have legs for the foreseeable future. The most relevant brands serving up the cutting-edge products in these categories should continue to experience strong revenue growth and in turn, attractive stock prices could follow.

- Health & wellness: Apple Watch, LuluLemon apparel, Nike apparel, Adidas apparel, Fitbit (purchased by Google). Hydro Flask and Yeti bottles. Peloton bike if you’ve been really good this year and the kids will be happy when they see apparel and shoes from Dicks Sporting Goods.

- Entertainment:

- Video gaming – Microsoft X-Box, Sony PlayStation, Nintendo Switch) plus the actual gaming brands: Activision, EA Sports, Take Two Interactive and Tencent in China.

- Movies & Entertainment – Disney Plus subscriptions, Netflix subscriptions, Roku devices, Roku Smart TV’s, Spotify subscription.

- Concert tickets to see your favorite band – Live Nation, Amazon.

- Traditional apparel favorites – UGG’s (Deckers Brand), Van’s (VF Corp), Victoria’s Secret (L Brands), Levi’s jeans.

- Gift cards to your favorite retailers and hobby stores – Starbucks, Ulta Salon, Best Buy, Home Depot, Amazon, Target, Walmart, and Nordstrom.

- Consumer technology – iPhone, Macbook, Airpods, Amazon Alexa, and Google Home.

Below I have posted two lists from research firm Netbase from a recent holiday shopping study. They focused on the youth of America (Millennials and Gen-Z), which make up 2/3 of the U.S. population and who are in their prime spending years. It’s my generation, Gen-X that’s paying for these fancy Gen-Z gifts BTW. Don’t count out Gen-X, we make more money than any other generation in the U.S. and we will be doing our part this holiday season.

Happy Thanksgiving everyone!

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.