There’s no denying that managed futures mutual funds have underwhelmed recently. There are two major reasons for this recent performance:

- Managed futures funds make much less on their cash reserves since short-term rates have stayed so low. Compared to before the pre-2008 crisis period, 3-month Treasury bills are annualizing approximately 2.5% less. That’s the return that managed futures funds would typically capture.

- Long-term trend-following, a core component within these funds, has experienced large peak-to-trough declines over this period that have wiped out gains.

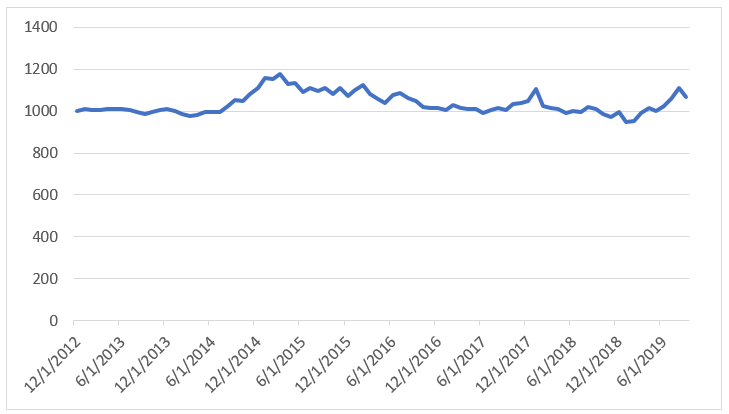

Managed Futures Mutual Fund Index since 2012

Source: Bloomberg

This doesn’t mean that long-term trend following won’t deliver like in other major crisis periods we’ve had in the past. However, this strategy can disappoint investors if equity markets tumble and recover suddenly because longer models don’t have enough time to react.

Strategies that use a shorter time frame have fared better during the worst experiences of long-term trend-following. Including these types of strategies as an extra layer of diversification has helped to prevent deeper peak-to-trough declines. Trading with a quicker time frame has also meant that these strategies have fared better in rapidly fluctuating market environments.

We can address each problem by:

- Putting our cash in managed futures funds to work by investing 70% of fund assets in the Bloomberg Barclays U.S. Aggregate Index.

- Incorporating an equal blend of shorter-term strategies with long-term in the sliver of fund risk we dedicate to the managed futures portion.

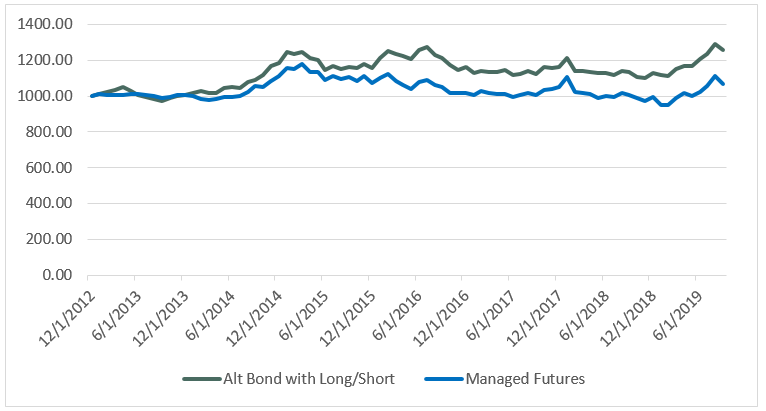

In this way, we can significantly improve upon the return profile versus a typical managed futures mutual fund, as the chart below illustrates.

Alt Bond with Long & Short Strategies vs. Managed Futures Mutual Funds 2012-2019

Source: Bloomberg

The alternative bond investment with a slice of managed futures that incorporates both long and short-term trend strategies outperforms the stand-alone managed futures fund index.

The bigger difference can be seen when we most need managed futures to count: When the S&P 500 drops. Since 2012, the cumulative outperformance of the alt bond incorporating long and short strategies over managed futures mutual funds during months that the S&P 500 was down 2% or more has been nearly 900 basis points. If we have a repeat of such a tough environment in 2018, every basis point will surely count.

Disclaimer

The performance data displayed herein is compiled from various sources, primarily Bloomberg. Portfolios are comprised solely of benchmark indices and are rebalanced monthly except where noted otherwise. Benchmark index performance shown is primarily from Bloomberg Barclays indices. Exceptions are Societe General Managed Futures Index for managed futures funds, Societe General CTA Index for long-term managed futures portion and Societe General Short-Term Traders Index for short-term managed futures portion. These indices are for the constituents of that index only, and do not represent the entire universe of possible investments within that asset class. And further, that there can be limitations and biases to indices such as survivorship, self-reporting, and instant history. Past performance is not indicative of future results.