Energy remains probably the least loved of the S&P500’s 11 sectors. Over-investing in new projects has turned off many investors, who would like to see more cash returned via buybacks and dividends. And the Democratic primary debates remind that an anti-fossil fuel stance is needed to excite the party’s hard core, introducing some electoral uncertainty to the outlook.

The good news is that cash flows are growing, as pipeline companies are responding positively to investor feedback (see The Coming Pipeline Cash Gusher). And the aspirational goals of some Democrats to phase out oil and gas will collide with technical realities and popular reluctance to return to 18th century living standards.

Earnings season is generally confirming the positive free cash flow story we’ve articulated for midstream energy infrastructure (see The Coming Pipeline Cash Gusher). Enterprise Products Partners (EPD) continues to execute well, beating EBITDA expectations by around 10% with 18% year-on-year growth. Williams Companies (WMB) modestly exceeded expectations and provided good guidance, boosting the stock. This highlights that weak natural gas prices, which had kept the stock under pressure for a couple of weeks, have little impact on operating performance.

TC Energy (TRP, formerly known as Transcanada) reported another solid quarter. And Oneok (OKE) reported Distributable Cash Flow (DCF, the cash generated from existing assets after maintenance expense), of $541MM, $100MM ahead of expectations. Only Western Gas (WES) bucked the trend, with poorly-timed lower guidance just when Occidental (OXY) is considering selling their position following the acquisition of Anadarko (ADC).

Midstream energy infrastructure has undergone a transformation in recent years. Predictable and rising distributions were abandoned when the Shale Revolution required new pipelines. Income seeking investors felt betrayed, and many big MLPs converted to corporations so as to access a far broader set of investors (see It’s the Distributions, Stupid). Today, MLP-dedicated investors are missing two thirds of the sector including most of the big companies.

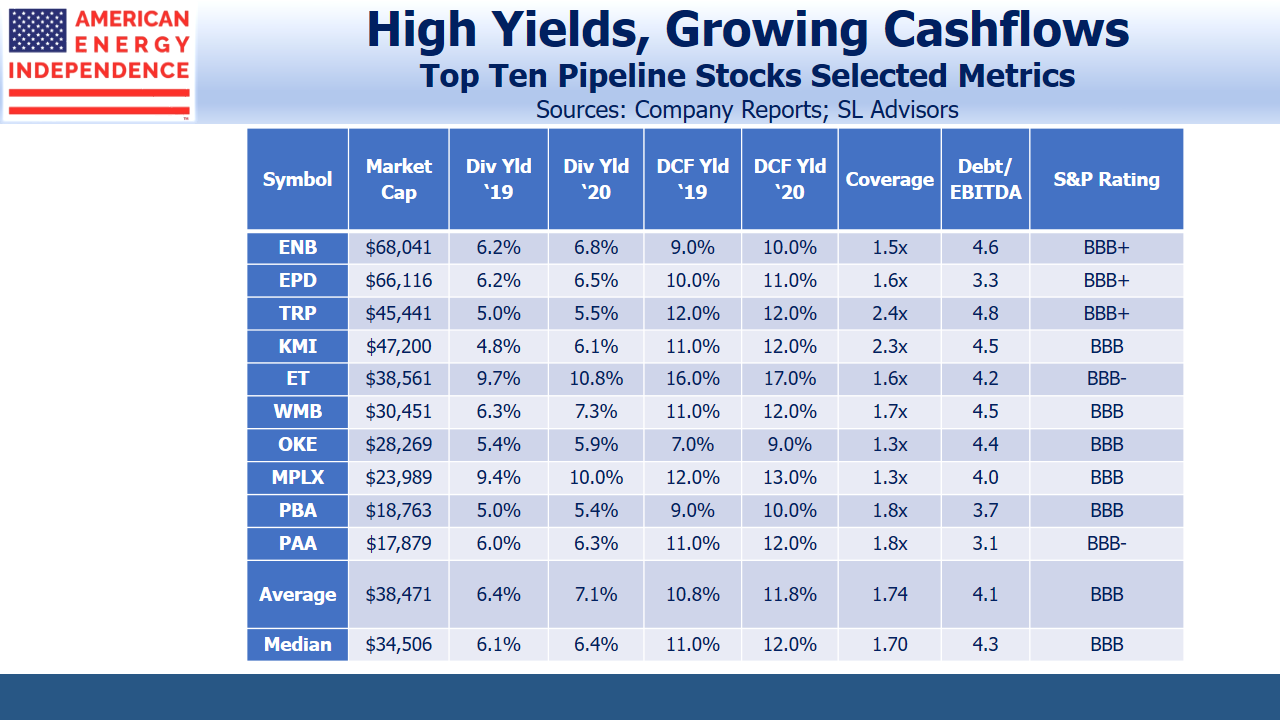

The ten biggest companies comprise the bulk of the industry. Dividends average 6.4%, comfortably covered by 10.8% DCF, which is growing at 9%. Leverage is down, at 4.1X Debt:EBITDA, and all are investment grade. Yields on their bonds are typically less than half their dividend yields, revealing that banks and rating agencies, with their access to proprietary information are far more optimistic than equity investors.

The positives include:

- Capex on new projects, which continues to fall from last year’s peak

- Improved governance for those MLPs that have converted to a corporate structure. This makes them more attractive to institutional buyers.

- Stronger balance sheets, especially compared to more levered sectors such as REITs and utilities where over 5X Debt:EBITDA is common

- Low borrowing costs

- Interest from private equity, whose managers see better value in public markets. IFM’s acquisition of Buckeye Partners for a 27.5% premium earlier this year was an example

- Free Cash Flow growth which is on course to leap from $1BN last year to $45BN by 2021, based on our analysis of the companies in the broadly-based American Energy Independence Index.

2Q19 earnings reports are so far confirming all the positives noted above. Midstream is out of favor, cheap and poised to rise.

We are invested in EPD, OKE, TRP, and WMB

The post Pipeline Earnings Confirm Positive Trends appeared first on SL-Advisors.