Happy July 4 week. This week’s post will be short and have plenty of charts.

I like to monitor mutual fund, ETF flows and other data to see where positioning is and is not. For the bulk of the last 18 months, most equity markets have been consolidating. Equity sentiment got to extreme levels both in January 2018 and September 30, 2018. Looking at recent data, it appears the pendulum has swung back in the opposite direction and is currently just as extreme.

As one would expect euphoric periods offer poor returns and periods with horrendous sentiment tend to offer more attractive returns. Let’s see where the crowded trades are now:

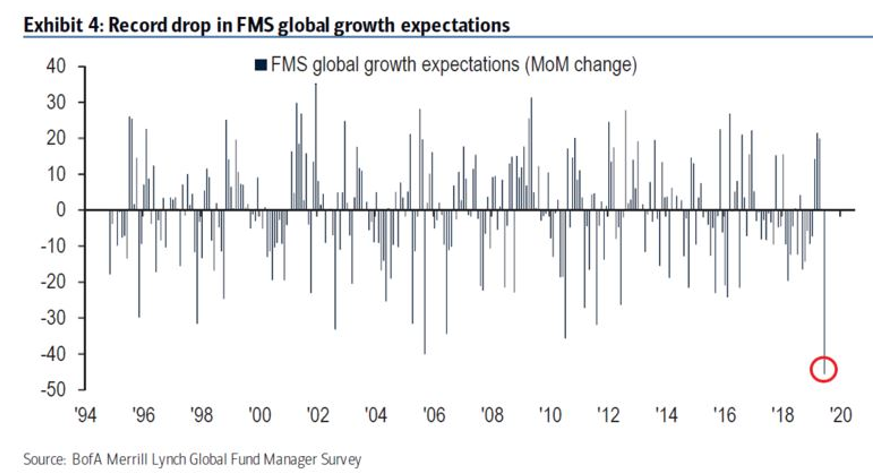

#1 Global Growth Expectations are Very Low – Room for improvement

Merrill Lynches Fund Managers survey highlights global growth expectations have fallen to the floor. Maybe the masses are right or maybe the world’s allocators are too pessimistic. Time will tell but low expectations appear to be an extreme view.

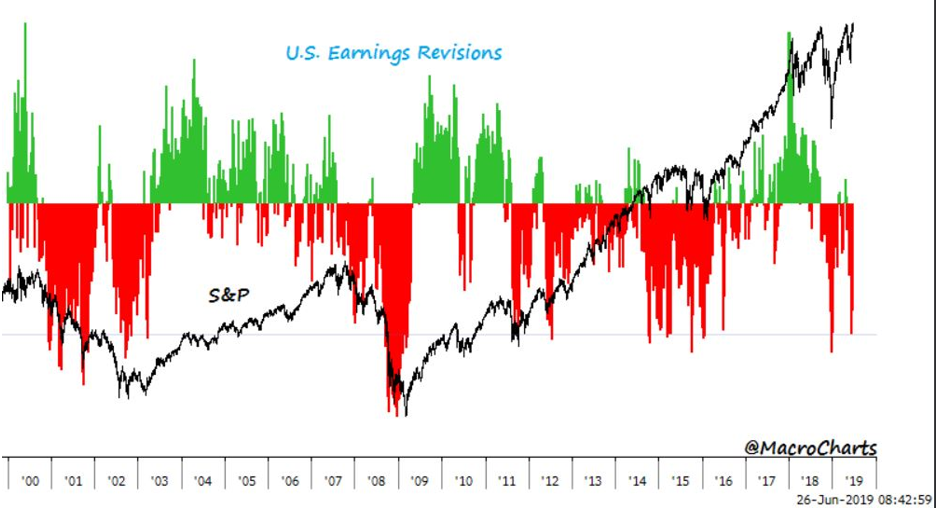

#2 U.S. Analyst Earnings Revisions are Pointed Nose Down – Room to Improve

Again, perhaps analysts are correct and earnings continue to slow further but unless your base case is an imminent recession, there appears to be significant room for upside surprise currently.

#3 Half of Equity ETF Flows into the Two Biggest Low Volume ETFs, according to ETF.com

Even in equity-land, the only appetite I can see is for low volume equities or what’s commonly referred to as bond proxies. It’s been a great trade this year as rates have fallen but it’s clearly a bit crowded if half the flows are going to just two ETFS, USMV, and SPLV.

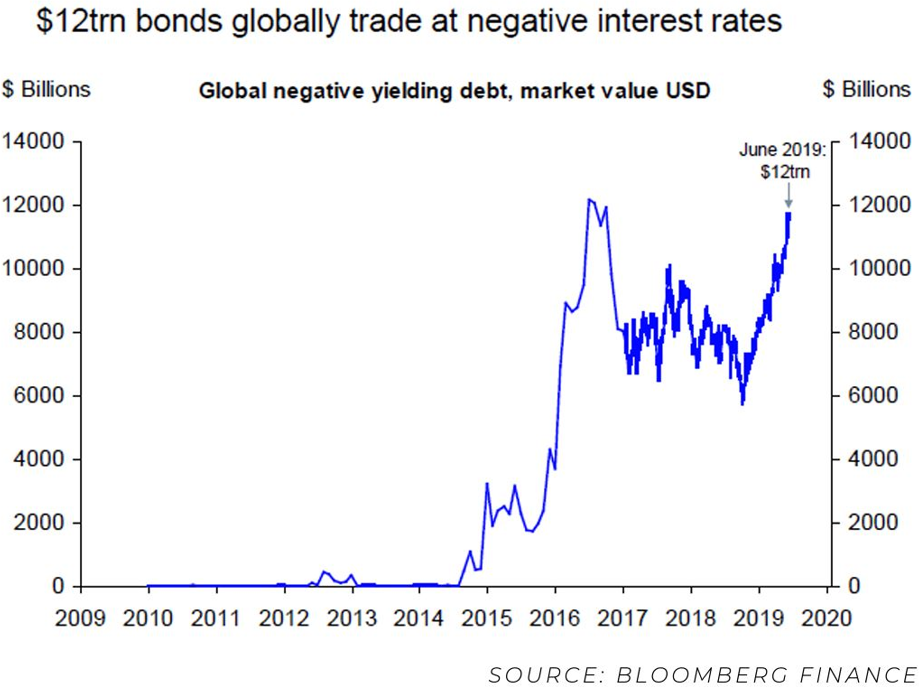

#4 The World’s Most Crowded Trade Continues to be in Bubble Formation

Investors around the world continue to accept a negative yield for the right to buy a bond in the hopes that they can sell that bond to someone who thinks yields will go further negative before the madness ends. Here’s the most important thing to consider: the global bond market is 3x+ larger than the equity market so what do you think happen to stock markets around the world when even a small amount of this money finally seeks a better potential profile? That’s a very large amount of money that could head to a much smaller market in equities.

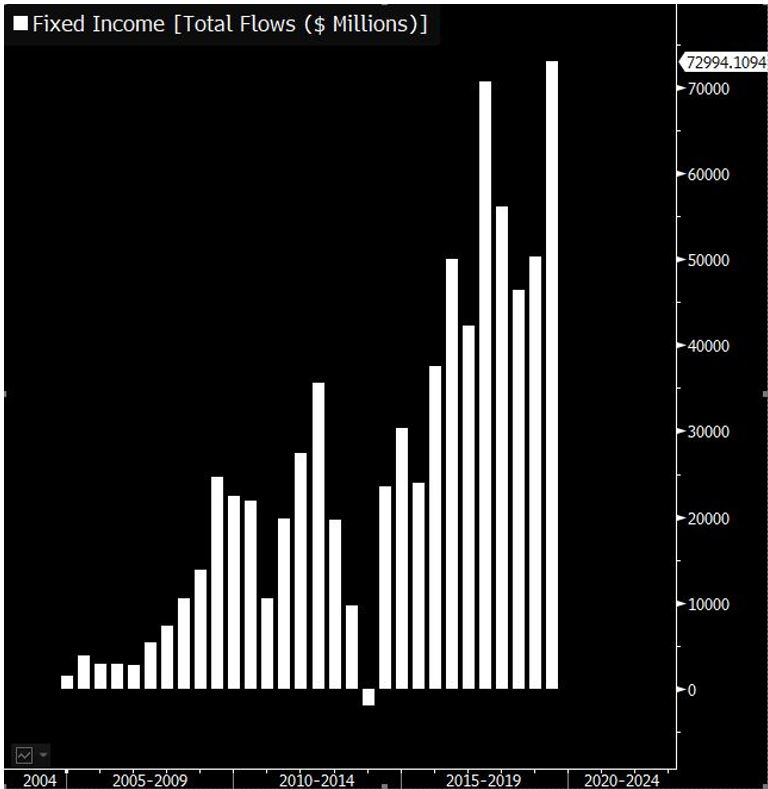

Bond flows in ETF’s also offer an extreme view of overall sentiment. Here’s a great quote and chart from ETF analyst Eric Balchunas @EricBalchunas on Twitter.

“To get an idea of how big a year 2019 is for fixed income ETF’s, here’s a look at historical flows broken down semi-annually.”

Source: Eric Balchunas, @EricBalchunas on Twitter

#5 Central Bank Policy and the Liquidity Spicket is Wide Open

I have a lot of respect for the research done at Leuthold Group. Here’s a tweet from July 1, 2019.

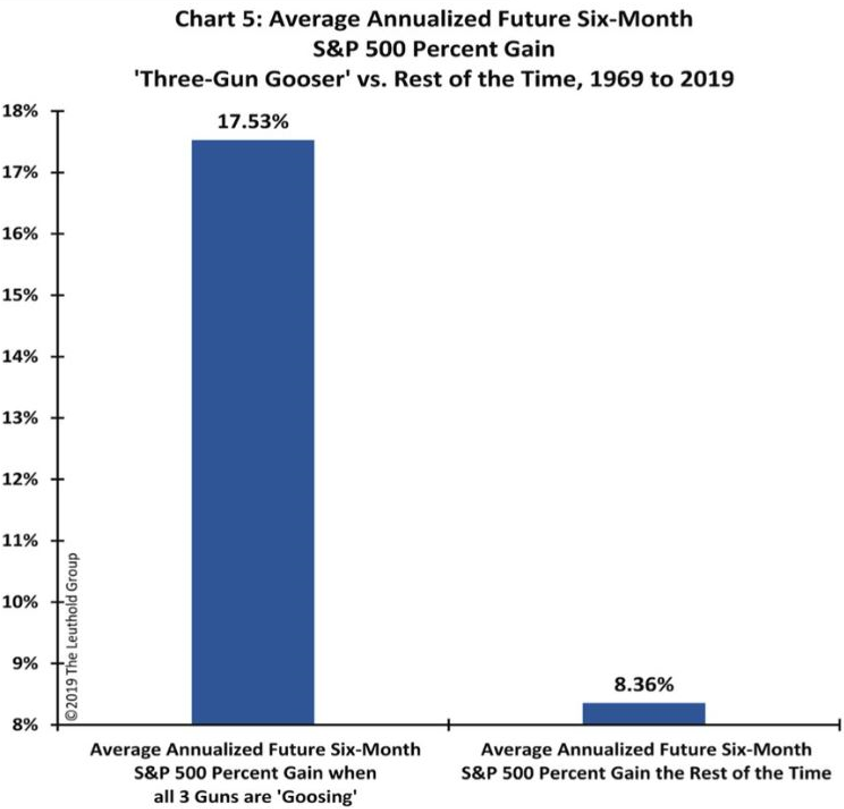

Don’t fight the “Three-Gun Gooser:” Policy support is now coming from the 1) Fed, 2) The Treasury, and 3) Bond vigilantes—a rare combination. The simultaneous support of all three major policy guns has historically been productive for the stock market.

Source: The Leuthold Group

Bottom Line:

Sometimes the masses get caught up in “group think.” When “group-think” gets clustered into extreme views and positions, it’s often a great time to start fading that trade and to become a contrarian. Right now, a contrarian would fade the fear, uncertainty, and doubt associated with being clustered in perceived safety assets like bonds and bond proxies because sentiment is extremely negative about global growth, equities, and earnings. Maybe it’s a trade opportunity and maybe the stock market has just been consolidating and working off its extreme euphoric conditions over the last 18 months. I have no special insights into the short-term future but for now, there’s a massive amount of bond money and cash that could rotate back to equities if things don’t turn out to be as negative as the masses think. That’s a very big wave that could come to a smaller shore.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts.