This will be the x-factor for consumption stability

Key Points

- Demographics play an important role in global GDP and consumption trends.

- Trillions in cash and valuable assets are passing from older people to younger ones.

- The brands that are favored by Gen-X, Millennials, and Gen-Z stand to benefit most.

“By 2042, Baby Boomers are poised to hand over as much as $70 trillion in inheritance to their heirs…this will be the most significant transfer of wealth in American history, turning the spotlight on a newly minted nouveau riche multiracial consumer base equipped with considerable buying power“. Source: Mckenzie Research.

Demographics Matter.

I have written about the historic wealth transfer that’s just begun in the U.S. many times and with this year’s volatility across consumer stocks in particular, I thought it was important we all keep our eye on the prize so we don’t lose sight of one of the largest investment opportunities we will see in our lifetimes. Millennials and Gen-Z are likely the primary beneficiaries of the wealth that’s being transferred from Boomers & their parents. I’ve seen it firsthand across my friend cohort, a handful of friends have been the beneficiaries of some large pools of assets as their parents and grandparents pass away and their assets get passed down. Cash, real estate, art, and other monetizable, tangible assets are coming to younger consumers and the process is not expected to be completed for another 20+ years. If I could teleport myself to 2045 and inspect macro datapoints like retail sales, personal consumption expenditures (PCE), and the top line revenues from the most relevant brands, I would bet you a taco they would be among the most robust & stable data series across markets. The wo0rld has been underestimating the consumer for as long as I can remember and most of the time, that’s been a very bad bet. With trillions passing from savers who spend to spenders who save, this slight nuance should offer a significant x-factor to the consumption theme and the companies that serve this theme. Brands have always mattered, but they will really matter over the next 20 years. This is one of the reasons our team created the brands investment strategies in 2015. We were excited to build a portfolio dedicated to stable & predictable themes like consumption. Importantly, there is still no other brands-dedicated equity strategy for investors and we hope it stays that way.

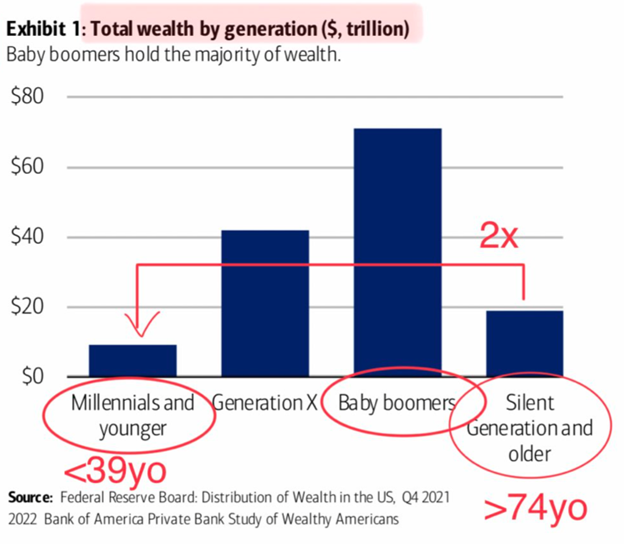

Below, I have highlighted where the collective wealth exists in our society. As you might expect, older people hold all the wealth, but younger people will receive a wall of money and assets over time. Remember, as we age, our spending begins to fall. Historically, our spending begins to peak around ages 55-60 and it deteriorates each year thereafter. Younger cohorts, however, really hit their earnings and spending stride beginning in their late 20’s as they get married, have kids, buy houses, invest in their 401(k)’s and save for college and retirement. If you want to see what happens to the economy when a large population group reaches the sweet spot of spending and earning, look no further than what the Baby Boomers did to the economy and real estate prices beginning in the early 1980’s! That was a very robust 20-year period.

The Wall of Money & Assets Coming to Younger Consumers is Historic.

Retail Sales and PCE has always been lumpy at times, but the trend with very few and short exceptions has been up and to the right. That’s what makes this investment theme so powerful. It’s also the reason the Consumer Discretionary & Tech Sectors have typically been outperformers over time. The most relevant brands tend to cluster in these two sectors making them solid long-term bets in our opinion. The best opportunities to invest in the greatest consumer brands have always been when they are in one of their underperforming periods. That’s where we are today. These rare periods never feel good, but opportunists should be licking their chops. When you know how the movie ends, you get a wonderful opportunity to buy great businesses serving U.S. and global consumers on sale. Aside from the trading community, that cares about nothing other than the next 5 days, most of us are investing for a long period of time. So, having a core allocation to the global consumption theme and adding to it during weak periods offers a wonderful one-two punch for part of the investment portfolio.

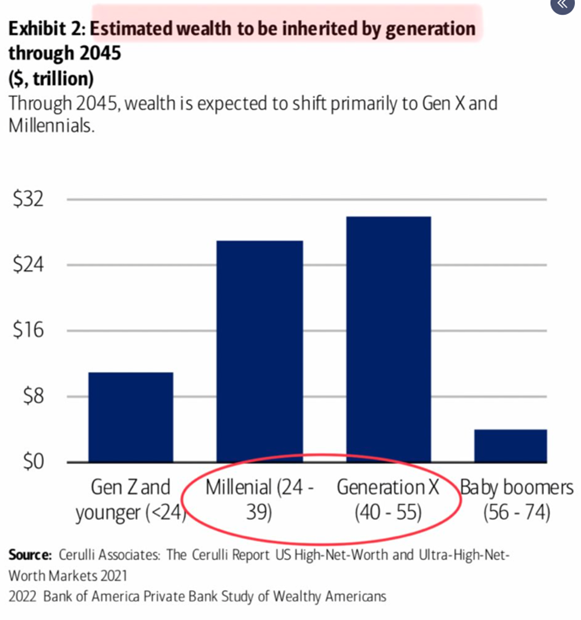

The below graphic highlights who will be inheriting the assets along with an estimation of how much in aggregate is likely to be transferred. This one graphic illustration could be one of the most powerful hints at the future I have ever seen. The key to benefitting from the wealth transfer phenomenon is to understand which companies or brands Millennials, Gen-X, and Gen-Z are fiercely loyal to. It’s these brands that have an extraordinary opportunity for strong growth and subsequently, attractive total returns for investors. That’s where our team spends a massive amount of time. To be sure, this is a slow-moving train. But if you see the big picture clearly, any weakness in these brand beneficiaries can be used to increase the positions at better prices.

Which Brands Have High Brand Love With Millennials & Gen-Z?

The holy grail of investing in brands happens when you can identify the brands that young, middle-aged, and old consumers love and when the phenomenon is global in scope. There’s 8 billion people on the planet, so if a company delights a massive demographic cohort on a global basis, the revenue and free cash flow opportunities can truly be enormous. If you want evidence, simply look at Apple with $394 billion in trailing 12-month revenue, Amazon with $502 billion, Walmart with $600 billion, and Google with $282 billion in annual revenue. These are staggering and historic levels of revenue and brand love is at the center of this operating metric excellence.

Our team does extensive research on brand relevancy and high brand love. This work is one of the inputs we use to select which brands to own in our portfolios. Today, I thought I would highlight some third-party research highlighting which brands are really resonating with younger consumers along with our own. Many of these also resonate with my generation (Gen-X) and even my parent’s generation (Silent Generation). So long as these brands continue to listen to their loyalists and continuously endeavor to build a broader, more global list of buyers, their businesses should remain attractive, and their stocks should be strong performers.

Based on our research along with the research from brand analysis firms Comparably, Morning Consult, and Moosyvania, the following brands keep rising to the top from a brand love and brand relevancy perspective where Millennials, Gen-X, and Gen-Z are concerned:

Peloton, Amazon, Google, Netflix, Apple, Costco, Delta Airlines, Uber, Zoom Video, Nike, Spotify, Southwest Airlines, Target, Walmart, Microsoft, Nintendo, Airbnb, Adidas, Starbucks, Coinbase, Domino’s, Shopify, Chewy, Zillow, T-Mobile, Coke, Marriot, Disney, Home Depot, Pepsi, Square, Tesla, McDonald’s, Sephora (LVMH), Instagram & WhatsApp (Meta), Doordash, Snap, Visa, Roblox, Lululemon, Chipotle, and Estee Lauder to name just a few.

There’s a lot of overlap across the demographic groups and not surprisingly, these brands have been stellar performers over the years. But, not all brands will hold their brand relevancy over time. That’s why it’s vital for investors to continuously pay attention to how brands engage with consumers. Once a brand becomes irrelevant, it is very difficult and expensive to try and regain relevancy. Those stocks tend to be melting ice cubes and a source of serial underperformance. Our team owns a collection of the brands above and would love to own a handful more if the prices pulled back to our buy zone. Our comprehensive research has allowed us to identify some real “emerging brand” opportunities which often offer significant returns from a stock perspective. The real magic happens when you identify an emerging mega brand or brands early and before the market sees the high brand relevancy. That’s where I enjoy spending a good portion of my research time.

Bottom line:

- There’s significant alpha to be generated when you invest with demographics in mind.

- The current wealth transfer opportunity is the largest in human history.

- There are a few dozen brands that stand to benefit the most. Their futures are very bright and their stocks are likely being under-estimated by the market today.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.