Key Points

- The stock market has always been a discounting mechanism.

- A ton of bad news is already built into current stock prices.

- A look at a similar period today vs. to do, (early 1970’s) could indicate what’s in store.

Bob Farrell’s rule number 9: “When all the experts and forecasts agree – something else is going to happen.”

Stocks Discount the Future.

We have all heard the adage, “the stock market is a discounting mechanism”. Stocks tell a story of the future long before the facts confirm it. Most growth stocks peaked in late 2021 and have experienced significant drawdowns ever since. In November of last year, the market was trading around 21x consensus earnings forecasts. Historically, this is a high valuation for stocks but interest rates were close to zero and inflation wasn’t what it is today. Our central bankers have largely kept rates at zero, which pushed investors out the risk curve to try and obtain an attractive return. Bonds were even more expensive than stocks with rates at zero and inflation about to go parabolic.

Fast forward to today, there’s been significant damage in the equity and fixed income markets, and cross asset volatility across the rates, currency, bond, commodity, and equity complex remains stubbornly high. Consumer and business sentiment is at historic low levels and very few investors expect trends to turn positive in the near term. The Fed is finally normalizing rates to try and combat high inflation, but the reality is, rates were too low for too long and this reset had to happen. When rates are at zero and money is free, risk taking gets aggressive and the risks of major dislocations rise over time. The longer this situation persists, the less productive economic growth occurs. Bubbles get formed and they ultimately pop when sanity comes back to the party. Unfortunately for investors, the reset creates all sorts of havoc and unintended consequences in the short-term. Make no mistake, this reset is ultimately a very healthy thing for markets and the economy but for the time being, it requires patience and a strong stomach as markets adjust for the new reality.

Anyone that tells you where the markets will bottom is guessing. Period, full stop. Everyone has a theory and rationalization, most of them sound logical and thoughtful, but in the end, the market will do what it does, and we are all held hostage for now. I’ve said this many times over the last year: the macro environment is all that markets care about currently; company fundamentals matter for a few days or weeks but macro trumps micro for now. The good news: micro fundamentals always overwhelm the macro at some point. If a company continues to execute while markets take the stock down, eventually the buyers will arrive. Real value always gets bought eventually.

There’s a Ton of Bad News Already in Prices.

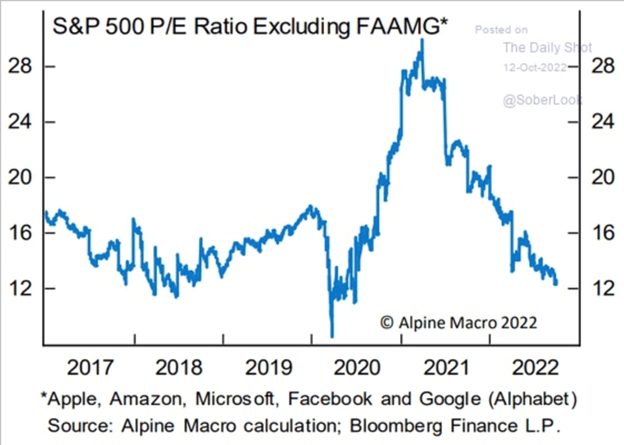

Some of the most admired, most profitable companies (brands) have fallen 30-60% in less than one year. Many of these companies have barely seen any degradation in their actual business fundamentals but the market is taking everything down because it believes all multiples had to get re-rated and earnings eventually would be affected. That’s fine and appropriate but the damage to great businesses via their stocks has likely discounted most if not all of the actual business erosion that will ultimately come as a result of a difficult macro environment and a higher cost of capital. Stocks, on average, are much cheaper than they appear on the surface. As the Alpine Macro chart below shows, if you remove five of the greatest companies ever created: Apple, Amazon, Microsoft, Meta (Facebook), and Alphabet (Google), the market is back to trading around 12-13x earnings. All but Meta deserves a premium multiple because they are superior businesses. Let’s assume that estimates have to come down for 2023 still so let’s be conservative and say the average stock is trading about 14-15x reduced numbers already.

That’s one massive re-rating in under a year. Yes, the macro environment is filled with uncertainty and potential deeper issues, but that’s why stocks have de-rated so quickly and violently. There is a clear buyer-strike right now which allows markets to get pushed around in both directions and without warning.

Until we have some more certainty around how restrictive monetary policy will be and when the Fed will reach its desired policy rate, markets will stay volatile and great stocks will be on sale for opportunistic buyers with time on their side. Now is the time to start accumulating more exposure to the best business models. These big dips are gifts if you have time on your side.

A Look into the Past for Clues About the Future.

Alpine Macro Research does some great work. In a world with opinions and biases, I prefer to anchor to historic data to try and get some clues that help me deal with the likely path in the future. Today’s period is unique to today but there have certainly been other periods that looked similar, so inspecting these periods for some clues about our future seems prudent. The inflation-driven 1970’s seems to be a decent analog to today’s world of high inflation, restrictive monetary policy, and tight supplies of things like energy, food, and now labor. Because of our poor policies in Covid and the clear over-steering of the car by the Fed & politicians, a lot of changes have come very fast to markets and the economy.

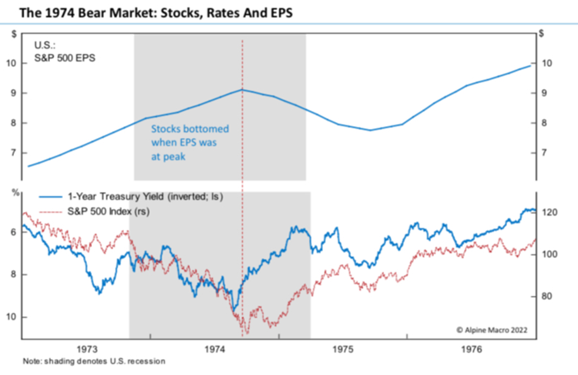

The conventional wisdom says this first stage of the bear market was induced because multiples were too high and rates and inflation were rising rapidly so a reset needed to happen. Check, we have seen the re-rating and then some. The second stage of the bear, they say, will come from the earnings degradation that ultimately will follow all the macro carnage. I cannot disagree with that premise but is it really possible to separate the current drawdowns into just inflation and rates and/or the earnings misses that could come? How does one know how much is enough or what percent of the drawdown is the inflation and rates and then how much more downside is appropriate from earnings misses? The below chart highlights what occurred in the early 1970’s bear market with regard to prices and earnings estimates. In my opinion, this is as plausible an outcome as any I have seen. Only in time will we know the right answer.

Pay attention to the red dotted vertical line in the above chart. Stocks bottomed in the ’73-’74 bear market at the same time as earnings peaked. That runs contrary to popular opinion today. “The stock market does not discount recession twice…The anticipation of lower bond yields (at peak short rates) will dominate support for multiples more than the recession will depress nominal profits.” That’s a fancy way for Alpine Macro to say, if stocks follow a similar path from a similar period, stocks will bottom after the inflation damage has occurred and when the Fed stops tightening even if the lagged effect from this tightening ultimately causes earnings to fall. Again, no one knows where the market will ultimately bottom but I absolutely agree with the notion that stocks will bottom long before the effects from this tightening ultimately work their way into actual corporate results.

The Fed already told us all their tools cannot fix the unique inflation we have from poor Covid policies and over-stimulating the economy with low supply. They will continue to talk tough, but they have just a few more rate hikes before getting to a much more appropriate and long-term healthy policy stance. Once that occurs, or they break enough things that force it to occur, stocks will bottom and more certainty will enter markets. Until then, some of the most profitable brands the world has ever seen are on mega-sale. Using a tranche approach to leg into these great businesses is highly advisable. For reference, here’s a recent blog where I show the benefits of holding a core allocation to great brands and show some real-world examples of how cost averaging after big drawdowns can lead to even stronger returns.

Read More in “Cost Averaging Really Works”

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.