Key Points

- The Services Sector of the economy continues to snap-back but has much further to run.

- Live entertainment, amusement parks, and lodging/travel remains the biggest opportunity.

- Very few investors have sufficient exposure to the services economy, now is a good time to add.

Consumer Services Rebound

I have written several blog posts talking about what the economic recovery could look like and what sectors and industries might benefit most. Here’s the link to my April 8, 2021 post:

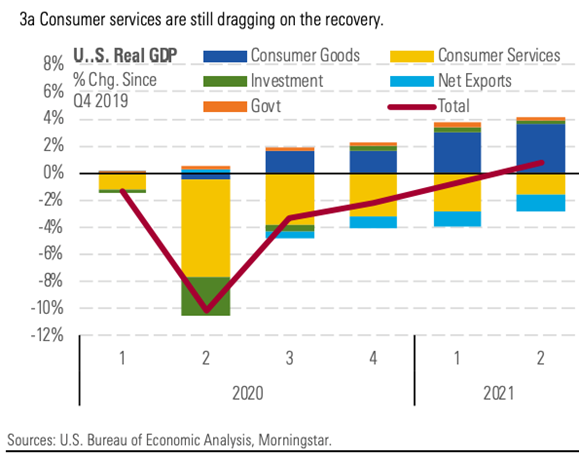

As the chart above shows, the Consumer Goods category (blue) has largely been the driver of U.S. GDP over the last year, from a consumption perspective. Many of the best brands that dominate these industries have shown incredible resilience during difficult times and their stocks have performed very well. At this point, though, the wild tailwinds are likely now turning to headwinds from a year-over-year comparisons perspective and from a valuation perspective.

In my opinion, this group has carried the consumption component of GDP as far as it can, and the real opportunity continues to be in the recovery of the Consumer Services segment (yellow) of the economy. Services fell off a cliff in Q2 of 2020 for obvious reasons and they have been steadily recovering, albeit in a lumpy fashion due to Covid-variant persistence.

With vaccinations and boosters continuing to be adopted, covid fatigue that is real, and a move towards ultimate herd immunity, the mean reversion in the services sector could accelerate even faster. Our covid-fatigue and the desire for normalcy should keep consumers focused on services after they have binged on goods consumption for the last 18 months. People are just worn out and tired of having Covid & restrictions hold them back from some of their favorite experiences. That’s the real opportunity for investors in my humble opinion. My team and I are very focused on finding the best potential winners for 2022 and many of them will likely come from the services sector.

The Opportunity in: Recreation, Travel, Experiences, Personal Services

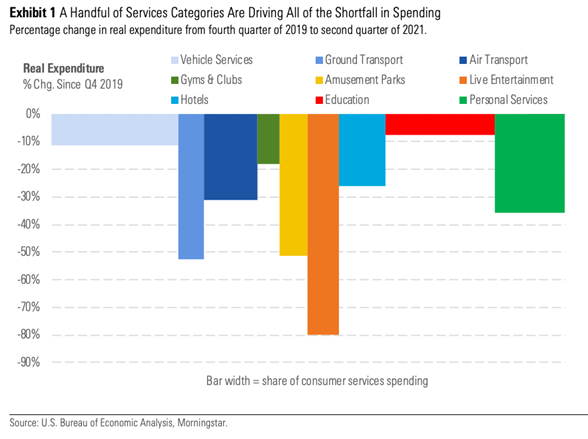

The above chart spells out a wonderful investment opportunity for astute investors. What industries and stocks normally do well, have resilient and in-demand business models, and are still depressed relative to long-term norms? Services like live entertainment, sporting events, concerts, air travel, lodging, amusement parks, gyms and health clubs, and ground transport, including ride sharing.

In order to understand where the real opportunities are though, one must do some additional work. Because of massive stimulus from the Fed and politicians, many of these stocks are already trading well above their 2020 peaks. Additionally, some of the travel stocks in particular had to raise tons of debt just to survive through the pandemic (cruise lines is an example). Significant levels of debt often act like an anchor to a company’s potential growth and add risk to the busines if they cannot grow their way out of the additional debt.

My team and I have been doing rigorous research to identify the brands that have the best snap-back opportunities. We are particularly interested in those that do not have excessive debt that will curtail forward growth. Many of these industries will see a significant resurgence in business and their stocks could benefit greatly as money seeks out the best 2022 opportunities. It’s important to remember though, some great businesses will use any lift in their stock prices to raise capital to pay off near-term debt. Short-term, that could be dilutive to shareholders, but it will ultimately help these companies reduce debt and re-invest back into the business to re-build their workforce and offer consumers better experiences. We couldn’t be more excited to be investing in some very relevant brands across the services and experiences segment of the economy.

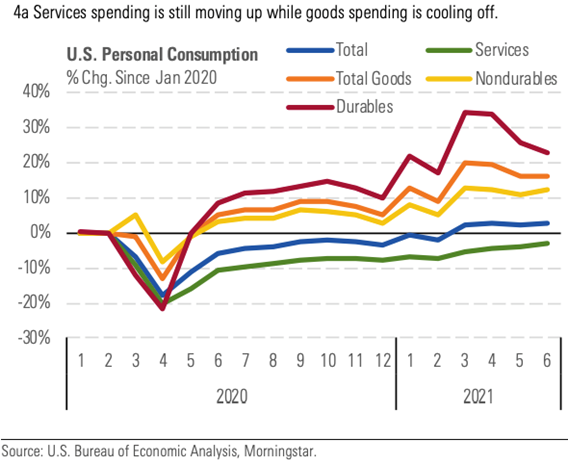

Consumer Services (green line) versus Total Consumption: The Tailwinds Are Clear

When we know how consumers behave on a regular basis, we sometimes get an opportunity to invest in short-term anomalies as mean reversion opportunities. Today, these anomalies are what gives us confidence to be overweight the best brands navigating inside the green line above, Services. As the chart shows, this component of personal consumption remains the only one still under the zero line. It has a long way to go to get back too “normal.” That’s the opportunity for investors today unless humans will stop wanting recreation and travel. Important: this is not a one or two quarter phenomenon; this is likely a multi-year opportunity.

A Look Inside the Services Sector

Source: U.S. Bureau of Economic Analysis, Morningstar.

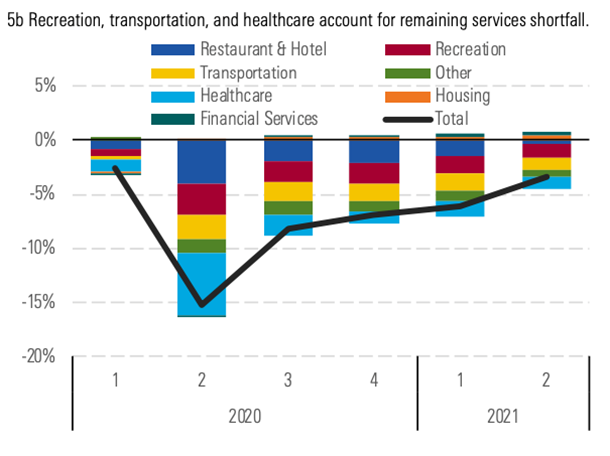

Within the services component there are sub-components to analyze. The investment opportunities we see today, generally live in the sub-segments that are still lagging versus “normal.” These include healthcare services which people have avoided, if possible, to lower the risk of being exposed to Covid. Transportation businesses like ride-sharing appears to be rebounding finally as well. Uber recently reported their business took a step-forward and the stock instantly re-rated by >10% on the day.

Air travel has softened a bit after a robust summer, but this struggling industry also appears to be on the mend. The stocks have been relative laggards and appear to be lifting off currently. Hotel and leisure brands also appear to be big winners as consumers begin booking travel for the holidays and those important winter vacations. The travel platforms like Expedia and Booking.com will likely have robust tailwinds for the next few years. Restaurants and bars have already reached peak 2020 levels even as they struggle to find enough staff to create a great consumer experience. You know we love something when we are happy to pay more and get less service just to be doing what we love. That’s the situation we have in the travel & leisure sector currently. Over time, hiring will begin to accelerate and prices to consumers should ease which could drive even more growth in the sector. The time is now to get some dedicated Consumer Services exposure, this one has a lot of room to grow over the next few years as we get back to “normal”.

Summary:

- The Consumer Services segment of the economy continues to heal slowly.

- The experiential part of the economy still has enormous room to expand.

- Most investors do not own a dedicated allocation to Consumer Services stocks, now is a wonderful time to add this exposure. Most of the leading Consumer Services brands should have wicked 2-year tailwinds making an investment here a likely winner.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.