Growth isn’t always good. The Shale Revolution led to enormous growth in U.S. oil and gas output, but abundance pressured prices and, for investors in U.S. exploration and production, it’s been a bust. Midstream energy infrastructure joined in the race for growth projects – but not every investment was accretive. Some, like Plains All American (PAGP), have seen their stock price lose 90% of its value since 2014. It’s the result of serial bad capital allocation decisions. The drop in Permian crude output caused by Covid will leave PAGP with excess pipeline capacity in the region.

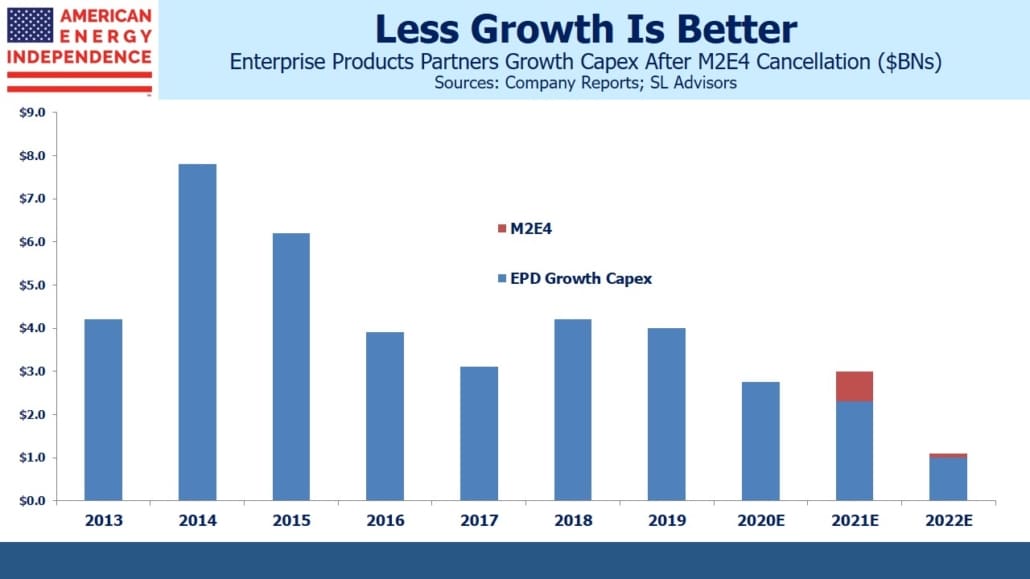

Energy investors have become so wary of growth capital expenditures that they now cheer when a company reduces future spending. Enterprise Products Partners (EPD) has managed their business better than most over the past few years. Their investment in new infrastructure plus acquisitions peaked in 2014, and had already resumed its downward trend last year before the pandemic caused an industry-wide reassessment.

EPD last week canceled their planned Midland to Echo 4 (M2E4) pipeline carrying crude from the Permian to storage facilities on the Gulf of Mexico. Although much of the 450,000 barrels per day of capacity was already committed, EPD was able to get its customers to agree to extend the term of their agreements while reducing near term volume commitments. The crude oil originally intended for M2E4 will now move on other parts of EPD’s pipeline network.

Excess pipeline capacity out of west Texas is the most visible consequence of Covid on U.S. oil output. EPD’s move helps them but doesn’t solve the problem for other pipeline operators. “The Permian will still be significantly overbuilt” warned Ethan Bellamy, managing director of midstream strategy at East Daley Capital Advisors.

On Wednesday morning when the news was announced, EPD’s stock opened strongly and outperformed the American Energy Independence Index (AEITR) by 2% on the day. EPD estimates its growth capex will be $800MM lower over the next couple of years as a result, continuing the trend of recent years.

Lower growth spending means more free cash flow. CEO Jim Teague commented that, “The capital savings from the cancellation of M2E4 will accelerate Enterprise toward being discretionary free cash flow positive, which would give us the flexibility to reduce debt and return additional capital to our partners, including through buybacks.”

This is welcome news, and represents the new normal in the pipeline business.

We expect free cash flow for the industry to more than double this year. From our calls with investors, there’s substantial interest in today’s attractive yields, especially following 2Q earnings. EPD stands out with a distribution yield 3X their 30 year debt. As the industry continues to generate more cash, equity buyers will start to appreciate the long term stability of the best run businesses, as bond buyers already do.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance. We are also invested in PAGP and EPD via the SMAs and mutual fund we manage.

The post Investors Like Less Spending appeared first on SL-Advisors.