Key Points:

- Brands across every consumption category are rapidly accelerating their digital initiatives.

- Consumers’ loyalty to the brands serving them best in this pandemic will thrive.

- The most relevant anchor tenants have extraordinary leverage over landlords.

Digital

If you’re a highly relevant brand with a significant online presence, you’re likely performing very well in the deepest recession of our lifetimes. If you have been slow to adopt an online presence, you’re behind the eight-ball now. With revenues down and your capital expenditures to build the digital capabilities heading higher, the laggard brands will fall further behind while the leaders build an even bigger lead. Target and Walmart reported stellar earnings this morning and they are proving how important their digital spending over the last three years has been. The most innovative and relevant brands spend on growth initiatives on a constant basis. Ask Jeff Bezos at Amazon if their spending cycles have added meaningful revenue and market cap growth once the initiatives go live.

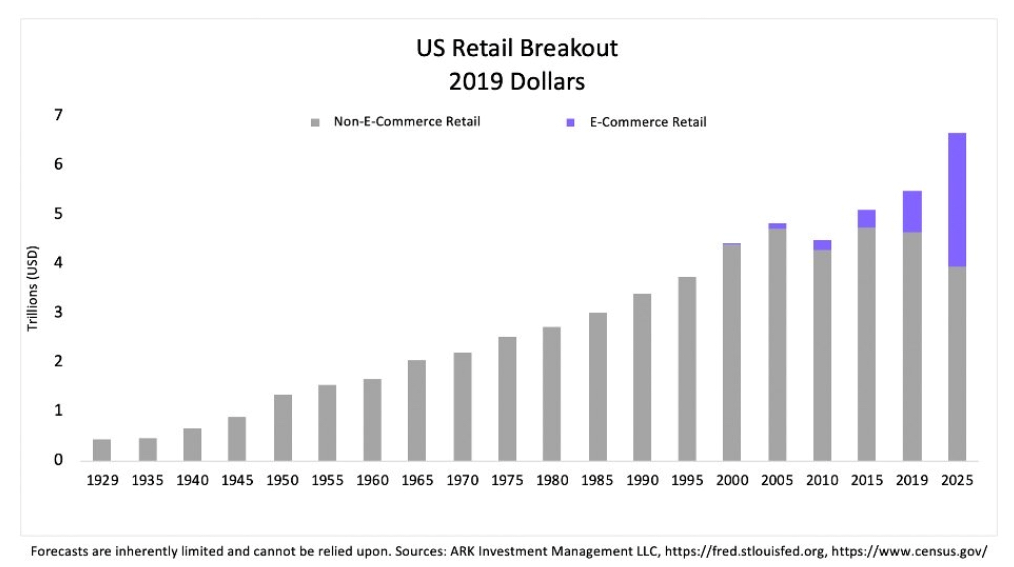

The chart below highlights how e-commerce growth is inflecting and beginning the hockey stick growth curve. This is just the beginning.

Loyalty

The most powerful brands get stronger and take market share during slowdowns, not expansions. Economic expansions allow more companies to thrive while contractions allow leaders to sling-shot further ahead when others contract. As we go through this horrible economic environment due to the coronavirus, we get to see which brands built deeper ties with consumers and which brands become irrelevant. The first quarter earnings notes offered a glimmer of the future and July earnings will likely shine a very bright light on the have and have-nots.

As I have written in many of these blogs, e-commerce is where the growth is where retail is concerned. Yes, there’s a handful of brands experiencing strong physical store growth, but the scalable and global growth is coming from the e-commerce winners. If you want to know what brands are winning most with customers, just lock down most of the economy and see where the aggregate sales come from. Based on the current earnings releases, the winners are clearly Amazon, Walmart, Target, Costco, Home Depot, Lowes, and Dollar General. Let’s look at a few earnings reports and themes that I believe will continue for the rest of the year:

Walmart

Walmart operates across the globe and under a variety of different brand names. Currently, Walmart operates roughly 11,300 retail stores under 58 different banners and in 27 countries. Their e-commerce capabilities span across 10 different countries and growing. They are the largest grocery store in America and through the Jet.com acquisition four years ago, their digital capabilities have increased at warp speed over the last few years.

Their earnings report highlighted the strength in the digital business with comparable store sales +10% and e-commerce +74%. Revenues rose 8% to $134.6 billion. That’s about $1.49 billion in sales every single day. Walmart has been on a hiring binge and continues to be the largest private employer in the country. Management has added bonuses to workers amid the pandemic, so they are spending like crazy but benefitting from increased traffic. I expect their spending to be elevated but I also expect that to translate into higher operating metrics going forward as the spend eases.

Target

Target operates about 1,840 stores throughout the U.S. Target was slow to adopt digital but has accelerated back into relevance over the last few years as they rapidly build their online business. Comparable store sales grew 10% and the average cart total rose about 12% as consumers visited less store and bought more items. Target’s e-commerce business grew +141% year over year. Along with Walmart and Amazon, these great brands are in major spend and grow mode, but we have significant history to suggest the spend now will create higher growth and cash flow later. It’s this kind of spending and innovation that will put the second-tier brands on their heels even further. One thing was clear though, it was the “necessities” that drove sales growth, not discretionary items. In aggregate, consumers were in survive mode and building inventory across the household and personal products categories. And grocery was a critical component of this growth. This is just the beginning of the grocery renaissance.

Home Depot

Higher costs have been a frequently cited reason for missing earnings estimates across retail. Paying your employees more during a pandemic and being focused on keeping them safe builds significant loyalty across the employee base. Being an essential retailer is a very good thing for building loyalty and adding to future revenue growth. Home Depot is an example of a retailer that still needs to add more digital capabilities, but they had higher cart prices through this slowdown. The good news, 2020 should be a peak investment year in digital so next year and beyond they should benefit from the last few years of spending.

Leverage

There is real carnage happening in the commercial real estate space currently. Out of chaos there is always opportunity. Overall, the net losers should be landlords and the winners should be the big, relevant brands that are high profile, anchor tenants. I don’t know if you have noticed any additional vacancies in your local strip shopping centers but there’s a significant amount of vacancies in San Diego. It’s heart-breaking. Many of these stores were thriving mom and pop stores and they are disappearing at an alarming rate. I have a few friends in commercial real estate and here’s what they are seeing:

- Most tenants are asking for rent abatements and many are not paying rent with stores closed.

- Landlords, in aggregate have been willing to be flexible and are playing ball with tenants for the moment.

- Most landlords have a finite ability to be flexible because they also have loans to pay.

- Many landlords, particularly those that have purchased commercial space in the last three years did so by using a set of rent and income assumptions that are now not possible. They could be in trouble as rents come down and fewer strong tenants are available.

- Bottom line: Rents broadly need to come down, there are significant loan defaults to come if America stays closed for much longer. Small businesses are struggling to compete with the biggest brands that have been deemed “vital” and have stayed open.

Who wins? The most relevant brands. They have significant leverage over their landlords and will begin to have lower long-term rents which should offer margin expansion opportunities in the future. When your cost structure goes down and revenue stays consistent or recovers off abnormally low levels, the profits begin to return in a big way. Additionally, the biggest, most relevant brands will use this economic slowdown to accelerate store counts, which will add to overall revenues over time. There will also be a significant amount of retrofitting of stores to account for the demand of drive-through, walk-up window and order online and contactless pick up. The big will get bigger, this I am confident about.

Bottom Line:

Here are some bottom-line takeaway points for investors to consider:

- The brands with the best digital capabilities will increase their lead over competitors.

- Because scale matters, these economic slowdowns should allow the most relevant, largest brands to take market share over peers.

- E-commerce was already the growth engine in retail and this pandemic has allowed this to accelerate.

- Consumers remember who served them well in difficult times. Loyalty will be strengthened.

- The leading anchor tenants have significant leverage over landlords now.

- The top anchor tenants should experience significant profit enhancements over time as their cost structure per store gets more attractive with lower rents.

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold, or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.