First and foremost, we extend our deepest sympathies to the families experiencing pain and hardship from the current public health crisis and its resultant economic paralysis. We pray for a speedy recovery for those impacted. We have taken our own initiative and donated to local restaurants, charities, and other organizations in our community to help those in need.

These disruptions and the liquidity shock to the system following the outbreak of Covid-19, however, has created an unprecedented investing opportunity, specifically in seasoned, senior, unlevered RMBS. Even though there are many unknowns, we believe there to be extremely low credit risk to many bonds that we can buy in this “once in a life-time opportunity” for the second time in my 15-year career.

What caused this?

The forced liquidation of some very large mutual funds, levered REITS, and some levered hedge funds, which own subordinated paper, has created a “name your price” buying opportunity. Funds often sell what they can sell, which typically includes their best assets. While some assets are likely to face fundamental impairment (those have declined by 50% in value in many cases and likely have further to drop), the result has been a huge price dislocation in “money-good” assets.

The Opportunity:

We see an opportunity today that may persist only for several weeks. It is possible that the short-term IRR could exceed 20% to 40%+ for these securities as selling pressure abates and spreads normalize. While it is difficult to predict the timing, I would surmise that the rebound in the safest assets will occur rather quickly (2-12 months from now).

The opportunity timeframe may be very short for two reasons: #1 quarter end is upon us and April 1 may open the flood gates for bank buying, #2 we are hearing of a number of large hedge funds and private equity funds either returning to the space or raising new capital to take advantage of this opportunity immediately.

It is very important to distinguish between risky assets and those that we focus on. Risky assets included long, thin, levered RMBS mezzanine bonds, CLOs, CMBS, Aircraft ABS, consumer ABS, etc. We do not focus on these nor are we looking to because there are too many variables and unknowns now. We remained focused on seasoned RMBS with structurally unlevered cashflows.

Legacy RMBS remains among the safest asset classes:

-

- Legacy non-agency RMBS are now 13 to 20 years old, originated in 2000-2007.

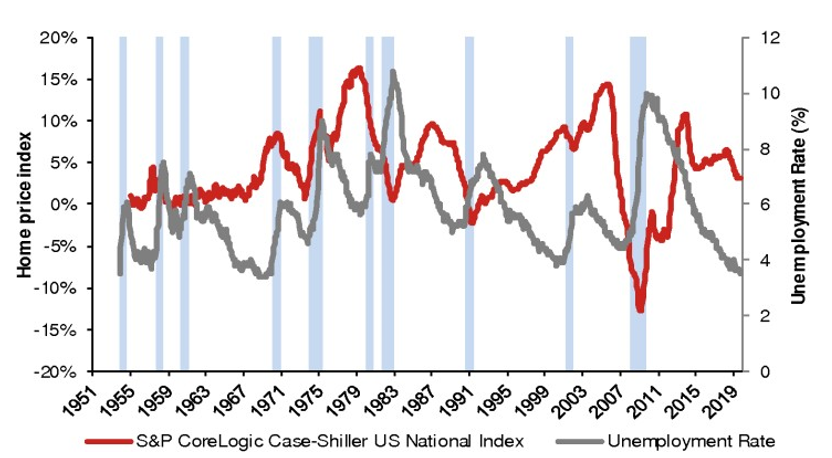

- These borrowers made it through the worst housing crisis in history (2008/2009).

- They have on average 40% to 60% equity in their homes today with 150-250 months payment history.

- A significant portion of the underlying borrower’s payment is principal (it takes 20 years to amortize roughly 50% of one’s mortgage).

- Many of the legacy bonds are still likely to be paid off at or near par and are now trading at steep discounts (10-30 points depending on coupon and duration).

- 10 out of the last 11 recessions have had minimal impact on housing.

- Most expected job losses are not for those who own

-

- Homeowners less likely to have negative income shocks on average: Although overall income growth is likely to be negatively impacted, the lowest wage earners should see the biggest hit, as they are less likely to have paid sick leave and tend to work in industries that are prone to declines from social distancing. However, these workers are also less likely to be homeowners. According to Census data, households with family income less than the median family income have a homeownership rate of 51% versus 79% for households with incomes higher than the median.”

Housing-related policy responses could have some effect in offsetting headwinds as well; the temporary suspension of foreclosures and evictions announced this week by HUD and FHFA could be a small positive for home prices as distressed sales should be kept in check over the next couple of months. In addition, Governor Cuomo announced temporary mortgage payment relief for New York borrowers; similar measures in other areas would support borrower incomes in the coming months.Source: Nomura Research

- Homeowners less likely to have negative income shocks on average: Although overall income growth is likely to be negatively impacted, the lowest wage earners should see the biggest hit, as they are less likely to have paid sick leave and tend to work in industries that are prone to declines from social distancing. However, these workers are also less likely to be homeowners. According to Census data, households with family income less than the median family income have a homeownership rate of 51% versus 79% for households with incomes higher than the median.”

- The Government has in the past and now has made it clear that they will provide mortgage assistance programs to keep homeowners in their homes.

- While this may portend some disruptions in cashflows, we think it has a very muted, if any, impact on seasoned seniors, unlevered cashflows.

Sample Bonds:

Having been active in the marketplace, we want to offer a real-world example of a recent trade. We may not be able to buy this specific bond, but we can source many similar situations. This is just to illustrate the risk type and where it is now trading.

CMLTI 2005-OPT1 M1 – This bond was trading near 100 in February and now traded at 73 on 3/20.

- This bond has two IG ratings (BBB/Baa3), which is very rare and something that makes this bond very appealing for banks.

- 5% to 100% slice in the capital structure meaning it has no structural leverage

- This means you would need to have greater than 65% of the loans default with a 50% loss severity in order to take loss on this bond (actually more because of excess spread, but let’s assume no excess spread for even greater conservative approach).

- Currently ~11.5% 60+ day delinquent loans.

- It is current pay and failing triggers, meaning no cash will be leaked to the subs below it.

If you buy 5 mm original face of this bond, the proceeds at $73 would be $2,734,776. The total cashflow owning this bond until it pays off would be: $3,843,773, which creates a 41% total return, to be completely paid off in full by the end of 2028. However, the IRR would be significantly higher if the bond returned to normal pricing in the next 12 months.

To learn more about the non-agency RMBS space, please read my previous blog looking back at the financial crisis and how and the sub-prime market meltdown was the was the epicenter of that crisis. Today in a low interest rate environment that has persisted since the crisis however, investors have been searching for yield. That said there’s a growing interest in the non-agency RMBS space. In the blog, I address what is driving that interest and discuss some of the opportunities the asset class can offer investors.