Earnings season for pipeline companies has provided few surprises, offering little to offset fund outflows, which continue to weigh on performance. Therefore, the Tallgrass (TGE) call last Wednesday promised to be more interesting than most. Blackstone’s (BX) offer to take private the 56% of TGE it doesn’t already own has focused attention on a sideletter many investors find objectionable.

In January, BX bought 44% of TGE at $22.43. The General Partner (GP) of TGE, owned by CEO David Dehaemers and others, was separately valued at around $480MM, which meant that these insiders received $26.25 for their TGE units. A sideletter agreement allowed that if BX buys the rest of TGE within a year, regardless of price, the insiders will receive at least $26.25 for their remaining units (see Blackstone and Tallgrass Further Discredit the MLP Model).

To his credit, Dehaemers confronted the sideletter issue during the earnings call. He understands that resolution of BX’s offer is the biggest question hanging over the stock. Investors who long believed they were invested alongside management feel betrayed, because the sideletter places a floor under management’s sale price without providing similar protection to other investors.

Dehaemers seems to think critics are overlooking the fact that his GP stake justified additional value, and that the special terms for management are fair. The problem is not the additional value extracted for selling the GP, even though its valuation seems arbitrary. Breaking the alignment of interests is what’s so offensive.

The sideletter’s result is that Dehaemers and his management team are indifferent to the price BX offers for the rest of the units below $22.43, since in any consummated transaction they are assured of receiving $22.43 (plus $3.82 per unit for their GP stake, or $26.25 in total). This is why BX’s $19.50 offer is so galling. Perversely, as TGE’s stock price weakened in August, it increased the likelihood of BX offering to buy the rest of the company. Therefore, as TGE fell it raised the probability of management receiving $22.43 for their units. Dehaemers was completely misaligned with his investors. Blaming TGE’s stock weakness on institutional sellers misses the point. Dehaemers had willingly given up his right to acquire any units in the open market, and had little incentive to provide business updates that might have arrested the decline.

Dehaemers insisted on a floor to sell his remaining shares, guaranteeing him the original price, as a pre-condition to staying invested and agreeing on a non-compete if he leaves the company. Because this changed his incentives relative to other investors, maintaining alignment with them required that he either obtain the same floor for all investors, or not seek one for himself. In doing so he violated their trust, which relied on this continued alignment of interests.

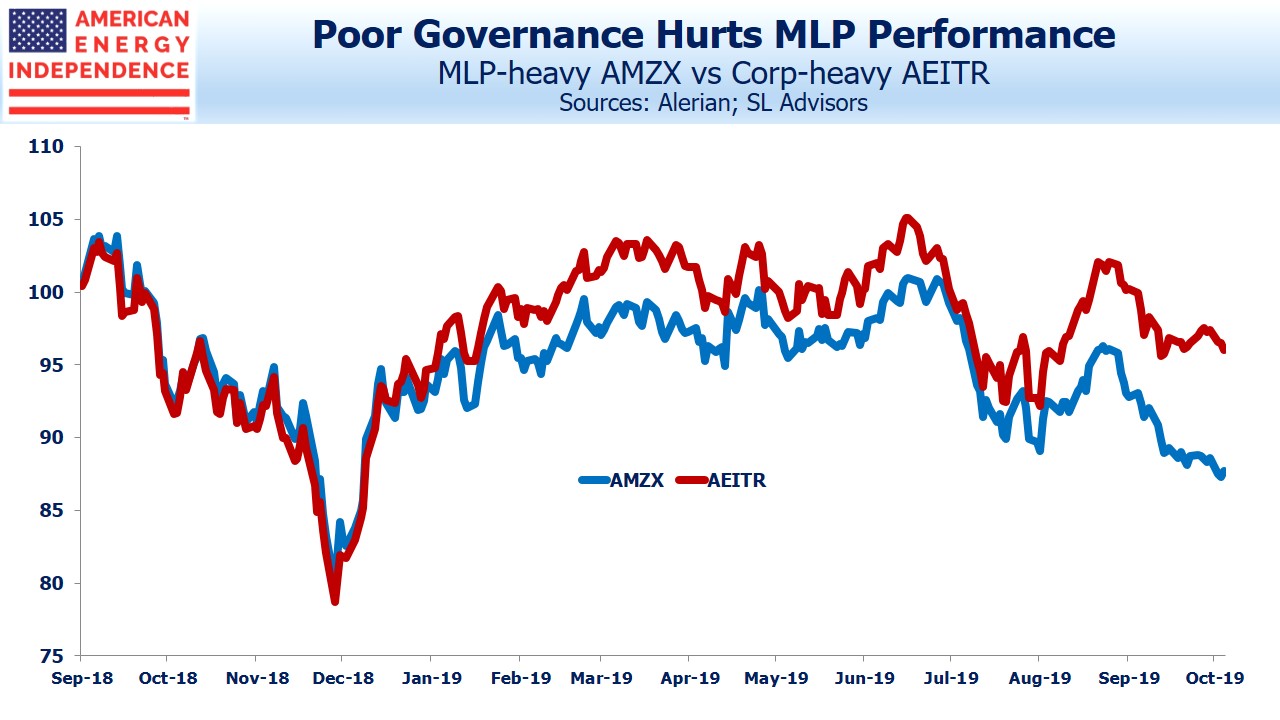

The consequences extend beyond just TGE. By demonstrating how easily the senior managers of a partnership can negotiate preferential terms for themselves, TGE has followed in the steps of Energy Transfer (ET), whose 2016 issue of convertible preferred securities to management on highly attractive terms led to a class action lawsuit (see Will Energy Transfer Act with Integrity?). Partnerships trade at a valuation discount, reflecting the weakness of investor protections (see Energy Transfer’s Weak Governance Costs Them). The MLP-dominated Alerian MLP Index (AMZX) has lagged the corporation-dominated American Energy Independence Index (AEITR) by ten percentage points this year (see MLPs No Longer Represent Pipelines).

Regardless of how the BX offer is resolved, MLP investors now have to consider the possibility of management crafting lucrative deals for themselves, a risk typically not present with conventional corporations because of tighter governance. It’s why the biggest ESG funds invest in pipeline corporations but not MLPs (see ESG Investors Like Pipelines).

The post Tallgrass Responds to Critics, Missing the Point appeared first on SL-Advisors.