Last week I saw some investors in Florida before joining my partner Henry in Puerto Rico at the national sales conference for Catalyst Funds, our mutual fund partner. The warm, sunny weather and ocean breeze stimulated much useful interaction with clients and salespeople about midstream energy infrastructure. It’s always helpful to hear firsthand the questions and concerns investors voice about what we believe is the most attractive sector in the equity markets today.

The Catalyst crowd is one that works hard. Like at my golf club, the average age keeps getting younger. Following each day of intensive meetings, the local nightlife was fully experienced, albeit not by your blogger whose postprandial preferences exclude casinos.

During several roundtables with groups of salespeople we were often asked how the election will impact the sector.

During his 1984 re-election campaign, then 73 year-old President Reagan quipped that he wasn’t going to make an issue out of 56-year-old Walter Mondale’s youth and inexperience. Similarly, we’re not too worried that a Trump presidency will once again decimate energy investors.

Huh?

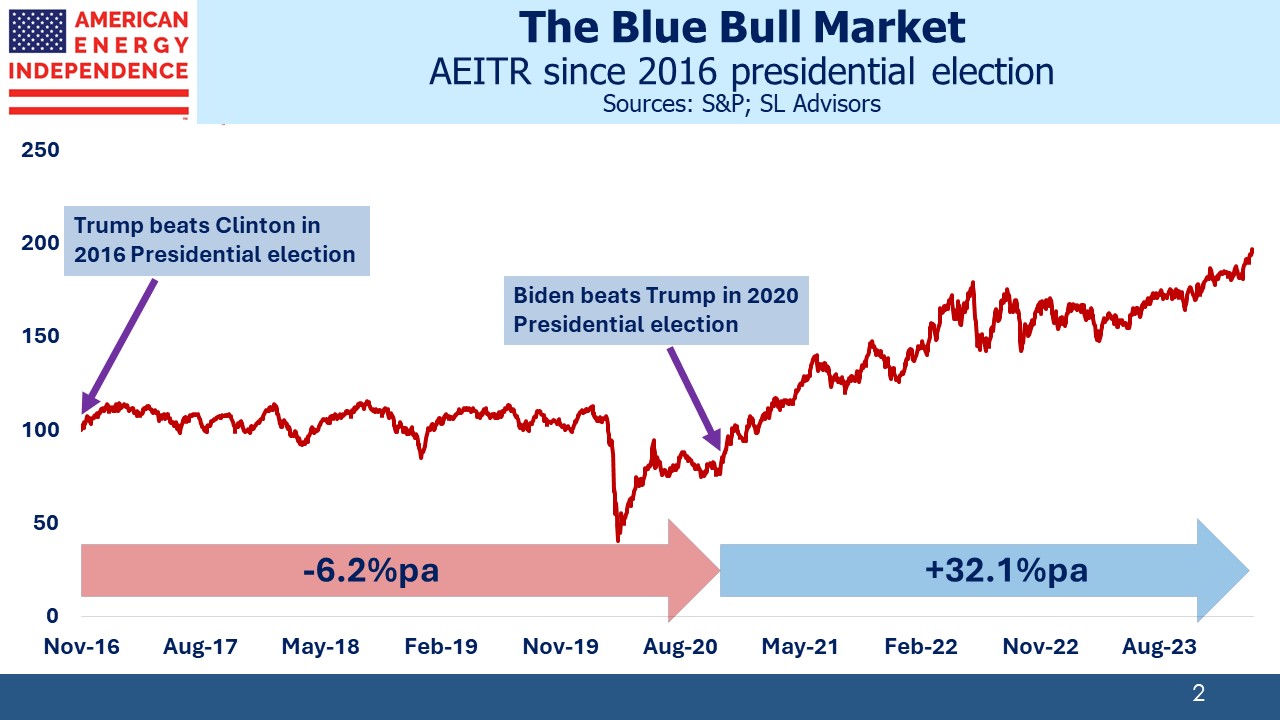

Democrats don’t like traditional energy, and left-wing progressives would return us all to living standards from the 19th century if their energy policies were followed. Therefore, it’s to their great dismay that pipelines have returned a sparkling 32.1% pa since Joe Biden won the 2020 election. Trump’s time in office was –6.2% pa.

Energy executives cheered when Trump surprised many by beating Hilary Clinton in 2016. They expected a lighter, pro-business regulatory touch. Capital flowed into the ground and hydrocarbons gushed out. The shale revolution was good for consumers but not investors as prices sagged under increased supply. Too often, capital was allocated on optimistic assumptions. And then came COVID-19, with its short but dramatic collapse in economic activity and briefly negative oil prices.

A newly elected President Biden adopted the hostile posture he promised during the campaign, immediately canceling the Keystone XL pipeline. The post-pandemic economic recovery was by then well underway, and a superficial interpretation of the pipeline sector’s performance might conclude that the Democrats have provided benign policy support allowing energy investors to profit.

Pipeline executives understand the reality is more nuanced. Democrat politicians planning to stay in office offer progressives enough to keep alive their dystopian vision of nothing but renewables while ensuring reliable energy remains fully available. Capital expenditures have remained at half the levels of five years ago partly because companies are more focused on returns versus growth. But they’re also wary about making long-term capital commitments that future policy changes may render unprofitable.

Trump wasn’t bad for energy any more than Biden has been good. Presidents have less influence over the sector than is sometimes believed. We think midstream energy infrastructure is attractive regardless of who wins in November.

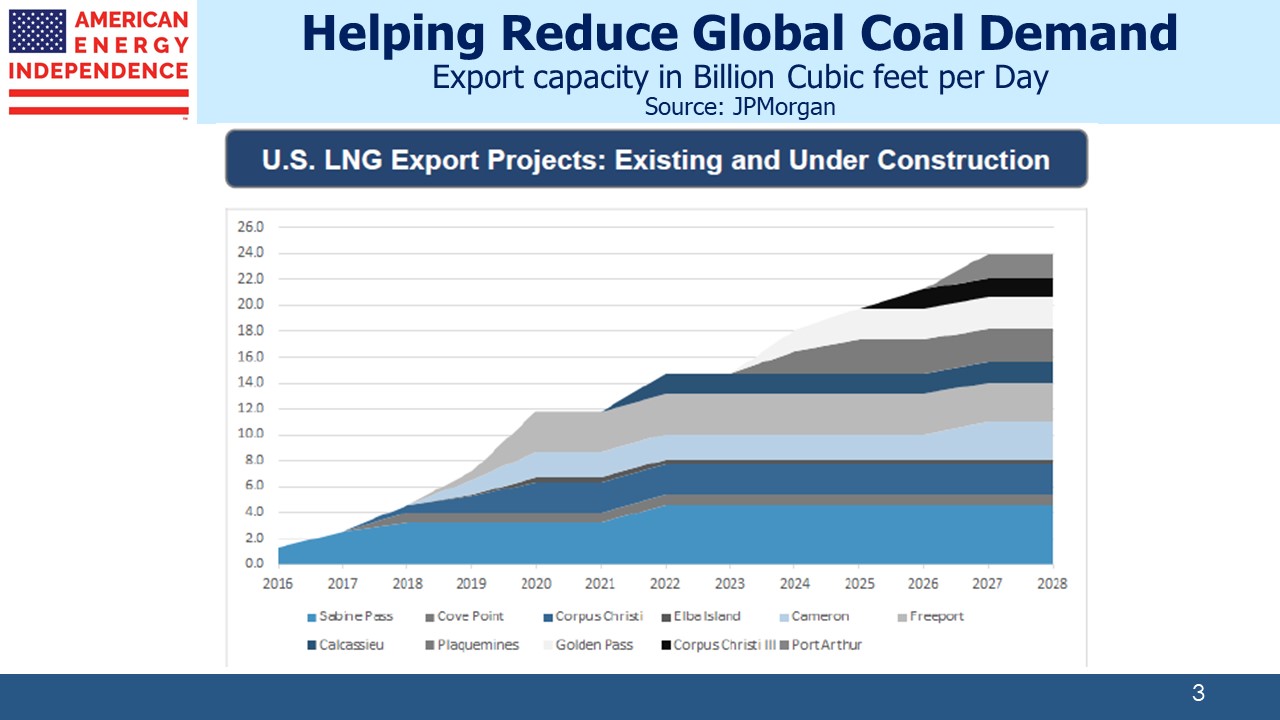

We were asked about the pause on approving new LNG export terminals. US export capacity is set to double over the next four years. The permit pause only affects projects beyond that, where construction hasn’t yet begun. See Struggling To Justify The Pause and LNG Pause Will Boost Asian Coal Consumption. The pause is poor policy and will likely be lifted after the election regardless of who wins. It does remind that Democrat energy policies are always at risk of pandering to left-wing extremists.

Sales of Electric Vehicles (EVs) have been flattening. I regularly hear from happy Tesla owners, all of whom own a second car for long journeys. I also have frequent conversations with investors and others who can’t see the point in dealing with the inconvenience of charging. This view seems to be ascendant. Some states are increasing fees on EV owners to compensate for foregone taxes on gasoline. US crude oil demand looks stable, and globally it’s still rising.

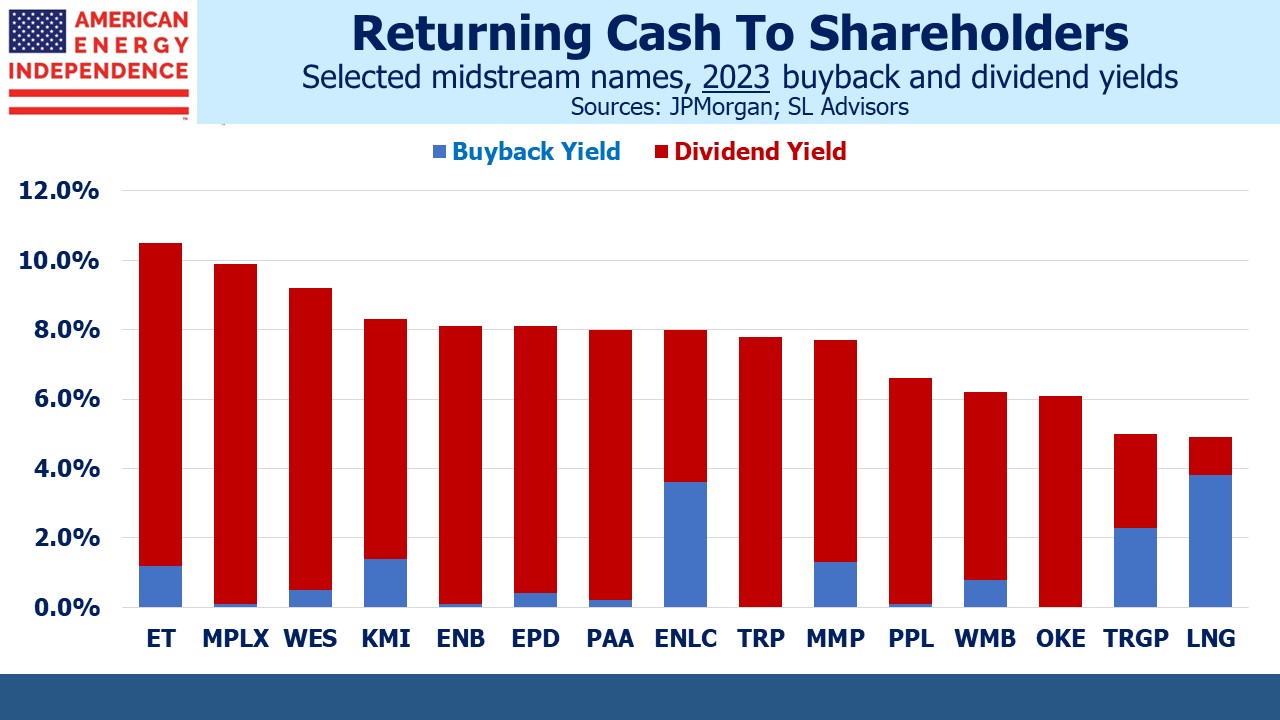

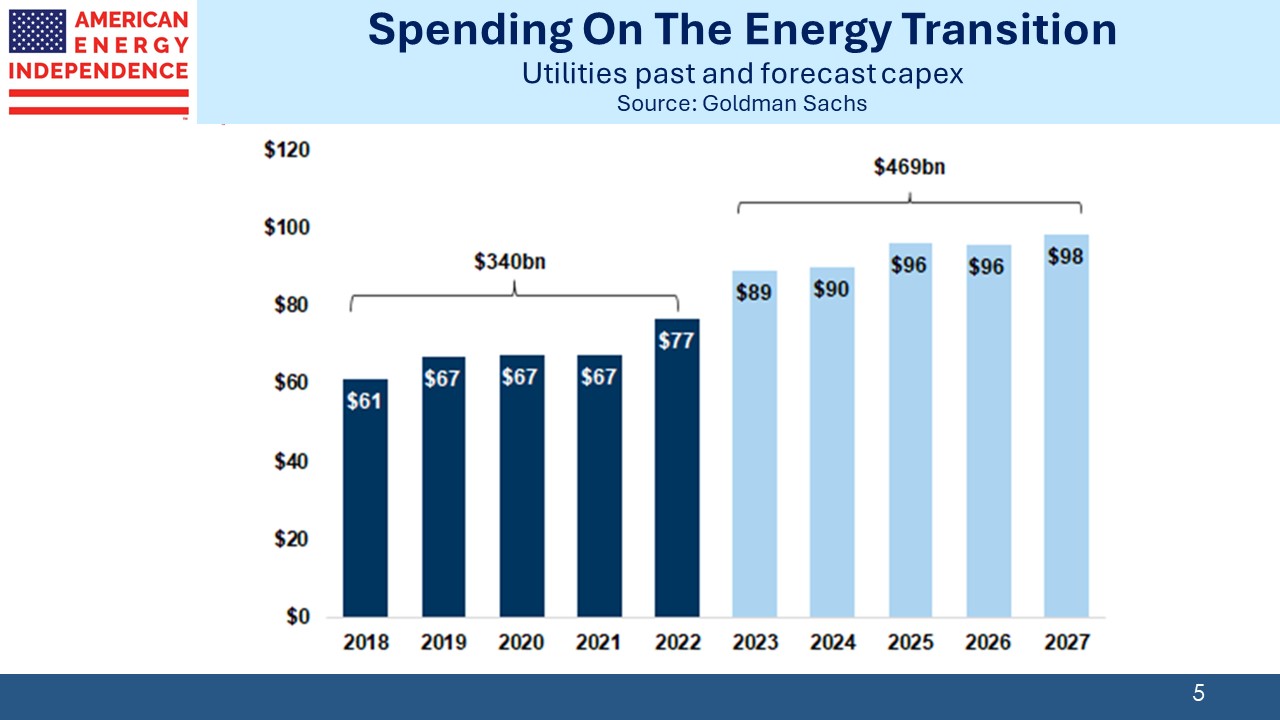

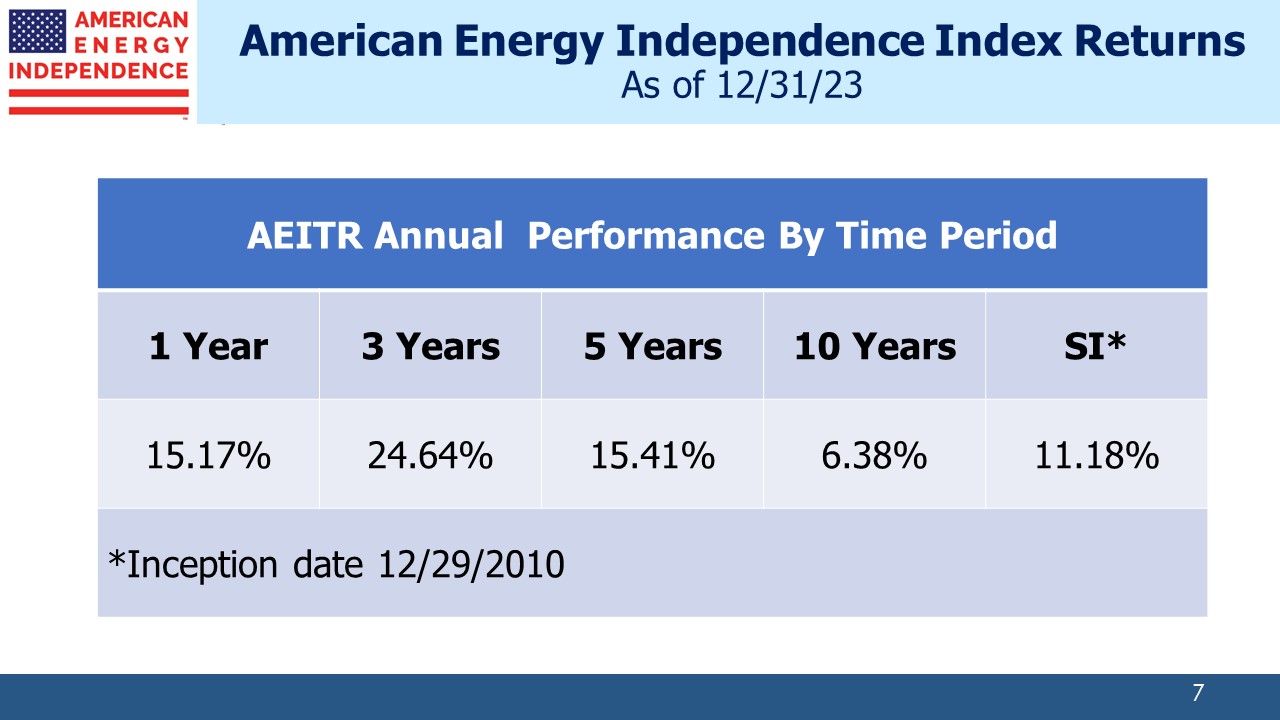

Below are some of the slides we use to highlight the attractive positioning of pipelines today. Dividend yields of around 6% are growing, with buybacks further augmenting the total return of cash to shareholders. While midstream capex is constrained, among utilities it’s being boosted. The energy transition must be paid for, and delivering increased electricity from renewables is their job. It’s not easy to reconcile political promises that solar and wind are cheap with the immutable reality of miserable returns on clean energy.

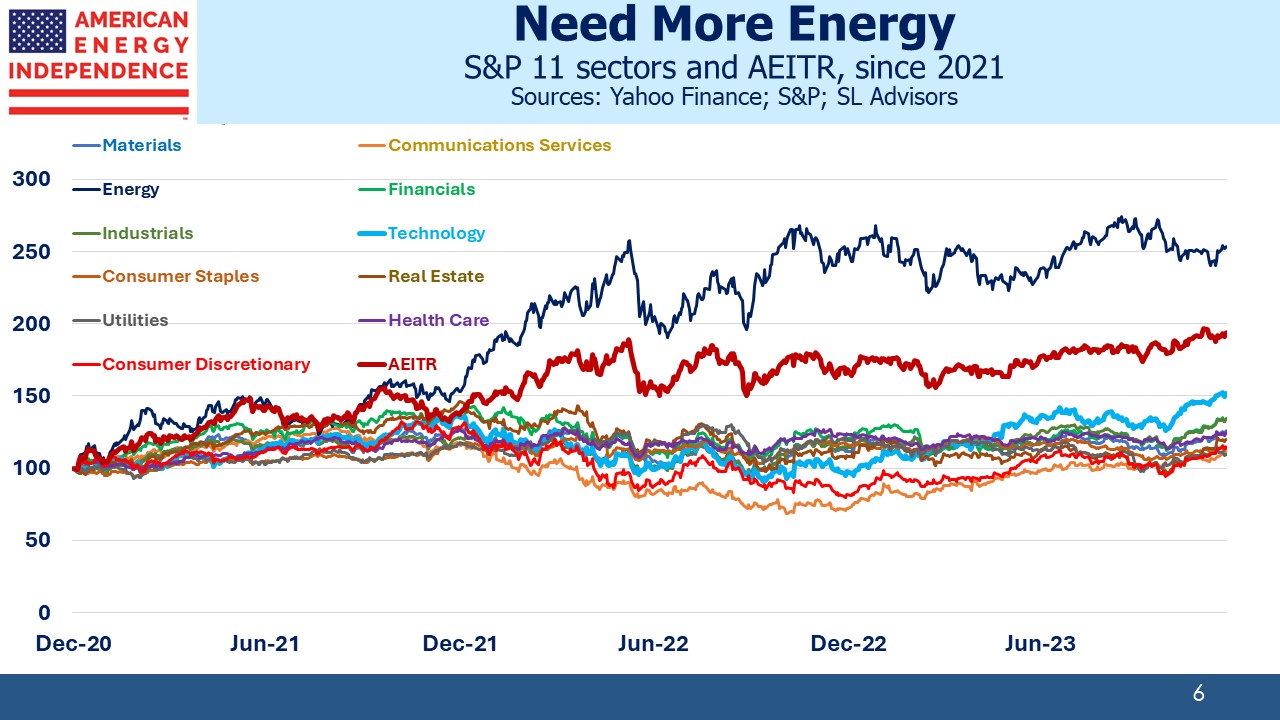

Energy returns have been the best of all eleven S&P sectors since 2021. Yet the sector still looks cheap, midstream especially so. Many investors already agree.

The post Who Do Energy Investors Want In November? appeared first on SL-Advisors.