Last week, we looked at the bull case for equities, but this week it’s time to consider the bear case. There are several factors that the bears are closely watching, including a slowing economy, corporate insider selling, low volatility as a contrarian indicator, and credit tightening. Each of these factors could contribute to driving the market lower in the coming months.

Economic Slowdown

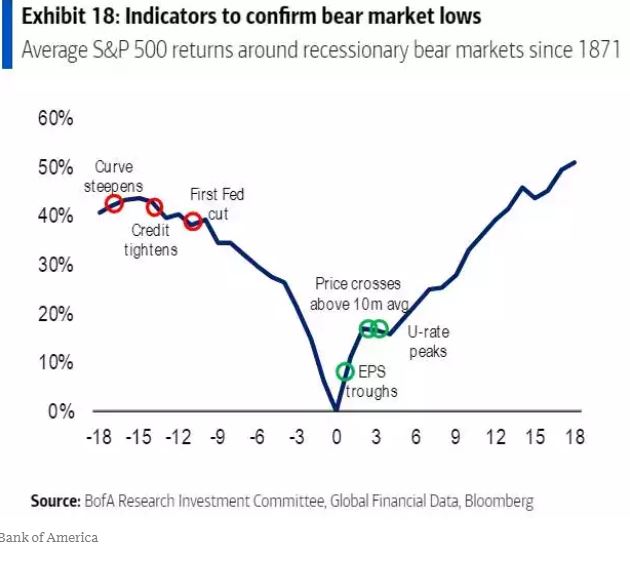

As the business cycle progresses, stocks tend to perform poorly as the Federal Reserve pivots its monetary policy. Historically a fed pivot is a disastrous omen for the stock market, due to the fact that the fed is reacting to a deteriorating economy and using its tools to prevent further damage. However, history doesn’t have to repeat. It remains to be seen whether the Fed’s pivot will be due to a sharp economic downturn or due to rapidly improving inflation. That said, if historical patterns to hold form, there is a lot of risk to the downside should the economy experience a recession. Investors need to be prepared for the possibility of a bear market and have a plan in place to protect their portfolios.

Insider Selling

One of the most worrying signs for the bears is the recent increase in corporate insider selling. Insiders have been selling their shares at an increasing rate, which has historically been a sign of market tops. When insiders sell, it suggests that they may have inside information about the company or the broader economy that is causing them to reduce their exposure to the market. This trend has continued to accelerate in recent weeks, which is a concerning sign for investors.

Low Volatility

Another factor that the bears are closely monitoring is the low level of volatility in the market. The SPIKE index, which measures volatility in the S&P 500 ETF $SPY, has been hovering at the lowest levels in 2 years. This has been a contrarian indicator in the past, signaling that investors are becoming complacent and that it may be a good time for bears to initiate new short positions. A sudden increase in volatility could catch many investors off guard and lead to a sharp decline in the market.

Credit Tightening

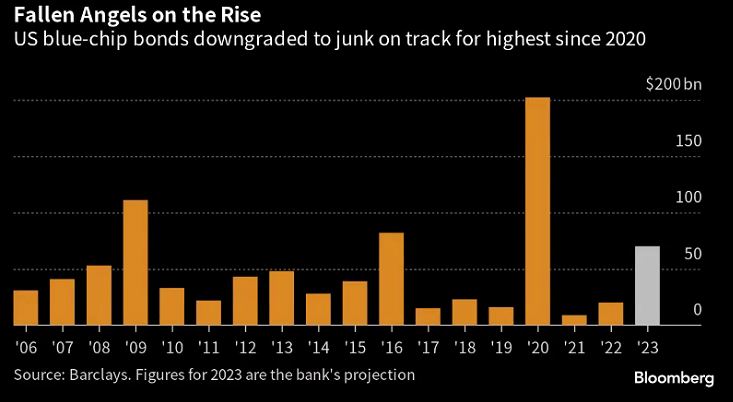

Finally, credit tightening is another concern for the bears. Regional banks are being squeezed as they are forced to raise their money market funds to keep assets on their books. This means they are now writing fewer loans at higher interest rates, which could slow down economic growth. In addition, the number of US blue-chip bonds downgraded to junk is at its highest level since 2020. This means it will be harder for companies to get loans or refinance, which could lead to a fresh wave of bankruptcies later this year.

In conclusion, there are several factors that the bears are watching closely that could contribute to driving the market lower in the coming months. A slowing economy, corporate insider selling, low volatility as a contrarian indicator, and credit tightening are all concerning signs for investors. While it’s impossible to predict exactly when the market will turn, it’s important to be aware of these risks and to have a plan in place to protect your portfolio in case of a downturn.