Markets interpreted Fed Chair Jay Powell’s press conference bearishly last week. This was mostly because of omissions – he didn’t rule out raising rates at a faster pace than once a quarter, and he didn’t rule out beginning with a 50bp hike in March. As ever, monetary policy will be data-dependent.

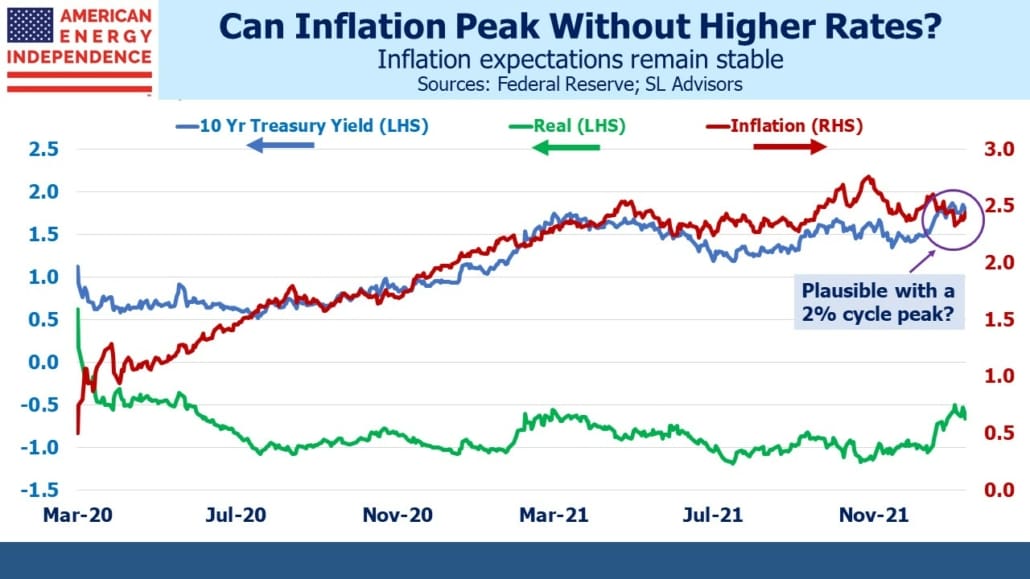

Eurodollar futures flattened further, with a faster pace of tightening being priced in while a cycle peak of 2% remains. The powerful feature of interest rate futures is that market prices rarely if ever fail to reflect available information. For the Fed to succeed in bringing inflation back to 2% without even raising rates above that level seems unrealistically optimistic, but one can scarcely suggest that investors have overlooked this implication. A substantial number must find this plausible. December ‘24 eurodollar futures yield almost exactly 2%, and to us a trade to 2.5% seems far more likely than 1.5%. The data will determine it.

The 4Q21 Employment Cost Index registered a 1% increase in total compensation – down from 3Q21 1.3% but nonetheless a 4% rate for the year. We all know businesses that are struggling to hire people. Labor is tight. PCE inflation is running at a 5.8% annual rate. Both these reports were better than expected, and bonds consequently recouped earlier losses to finish the week roughly unchanged. The Fed’s languid normalization of monetary policy reflects their expectation, or hope, that incoming data will assuage the sting of criticism from past Fed members Treasury secretaries, and others.

Critics include David Kelly, chief global strategist at JPMorgan Asset Management, who said “They are behind the curve and they are guilty of being too easy for too long,”

Wall Street tightening forecasts are ratcheting up. Goldman and JPMorgan expect five this year; Bank of America seven; Nomura expects 50bps in March. The incongruity in the market is a yield curve forecasting a 2% cycle peak along with ten year inflation expectations of only 2.5%, which with real yields of –0.7% is anchoring ten year treasury yields below 2%. It’s hard to see how both forecasts can be correct – we think inflation is most likely to be higher, but for that reason the rate cycle peak probably will be as well.

Like the Fed, the path of rates will be data dependent.

In other news, US natural gas prices drew attention when front month futures jumped sharply just prior to the February contract expiration. Volumes were low and covering by a few tardy short sellers probably the cause. Europe’s vulnerable gas supplies may be a factor, but the US has limited ability to make up any Russian shortfall because Liquified Natural Gas (LNG) export facilities are running close to capacity. The most likely result of a Russian invasion of Ukraine would be reduced European consumption as energy intensive industries are forced to halt production, either by ruinous prices or government edict.

This is turning out to be more than simply a short-term problem. TTF futures, the European LNG benchmark, have been increasing two years out, exposing the enormous strategic error planners in Germany and elsewhere have committed in relying so heavily on Russia. January ‘24 futures have more than doubled from a year ago. European households will be paying more for electricity.

The price difference to the US is easily sufficient to draw more US LNG exports if they weren’t capacity constrained. However, shipments will increase over the next year or so, which will modestly underpin domestic prices and support volume growth. Forget about what the climate extremists may strive for – global natural gas demand is going to grow, to the benefit of investors in producers and midstream energy infrastructure.

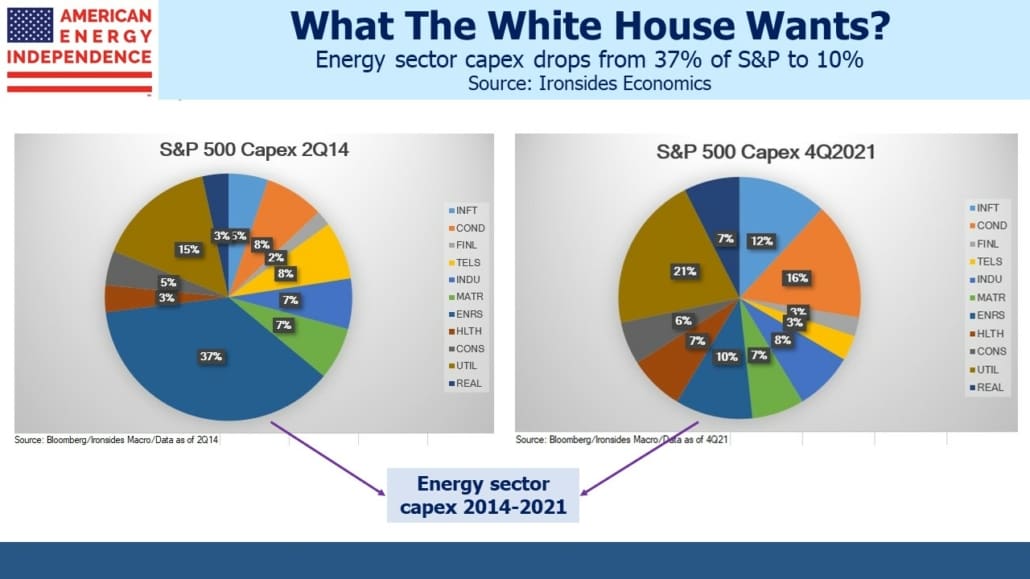

For further confirmation of the energy sector’s newfound fiscal prudence, note the decline in its share of S&P500 capex between 2014 and now. Thanks to Barry Knapp of Ironsides Economics for highlighting this in his very readable weekly newsletter. The White House is caught between proclaiming the demise of traditional energy while pleading with OPEC to increase production. Energy investors are benefiting from higher prices with less spending.

Finally, the ever-colorful Jim Cramer weighed in against the hapless Cathie Wood and her ARK Innovation ETF (ARKK) with a clip that’s gone viral. The Tuttle Capital Short Innovation ETF (SARK) bets directly against ARKK’s holdings, and Cramer memorably emptied a bottle of Cutty Sark over a table of figures representing ARKK. It’s 25 seconds of theatre masquerading as unconventional investment advice – although worth noting that in SARK’s brief existence its investors have done better than ARKK’s, since the latter are net down (see ARKK’s Investors Have In Aggregate Lost Money). Cramer must like Buffet’s quip (“If you’re not going to kick a man when he’s down, when are you going to?”) even at the cost of his chivalrous credentials.

Please see important Legal Disclosures.

The post Thoughts on Jay Powell and European Natural Gas appeared first on SL-Advisors.