Oil Shocks and Their Impact on the Stock Market: A Historical Overview

Oil shocks throughout history, whether caused by geopolitical conflicts or disruptions in production, have had significant effects on both the global economy and stock markets. Events like the 1973 Arab Oil Embargo and the 1979 Iranian Revolution led to sharp supply shortages, surging prices, and steep market declines, as economies struggled with inflation and stagnation. Similarly, more recent shocks, such as Iraq’s invasion of Kuwait in 1990 and Russia’s invasion of Ukraine in 2022, caused market volatility due to rising oil prices and global uncertainty. Understanding these historical patterns is crucial for portfolio managers seeking to mitigate risks during future oil disruptions.

By analyzing past oil shocks and market reactions, investors can better prepare for potential downturns and explore strategies to hedge against volatility. Maintaining a diversified portfolio and considering exposure to the energy sector are effective ways to navigate the unpredictability of global oil supplies.

Oil shocks, significant disruptions in the global oil supply that cause price spikes, have consistently influenced the stock market. Let’s delve into some major oil shocks and their market reactions:

1. 1973 Oil Crisis (Arab Oil Embargo)

- Cause: OPEC’s reduction of oil exports to the U.S. and allies in response to the Yom Kippur War.

- Impact: A 300% surge in oil prices, energy shortages, soaring inflation, and global recession.

- Market Reaction: Stock markets plummeted due to rising energy costs and economic uncertainty. Inflationary pressures, known as “stagflation,” led to a prolonged period of economic instability and market recovery.

The 1973 oil crisis, triggered by OPEC’s reduction of oil exports in response to the Yom Kippur War, was a significant shock to the US economy. The oil price surge of 300% led to energy shortages, soaring inflation, and a global recession. The stock market experienced a near-50% decline, reflecting the widespread economic uncertainty. Today, a similar supply disruption localized to Iran might have a less severe impact due to increased energy diversification. However, a broader conflict involving other oil-producing states could escalate into a much larger supply shock, potentially leading to more significant economic consequences.

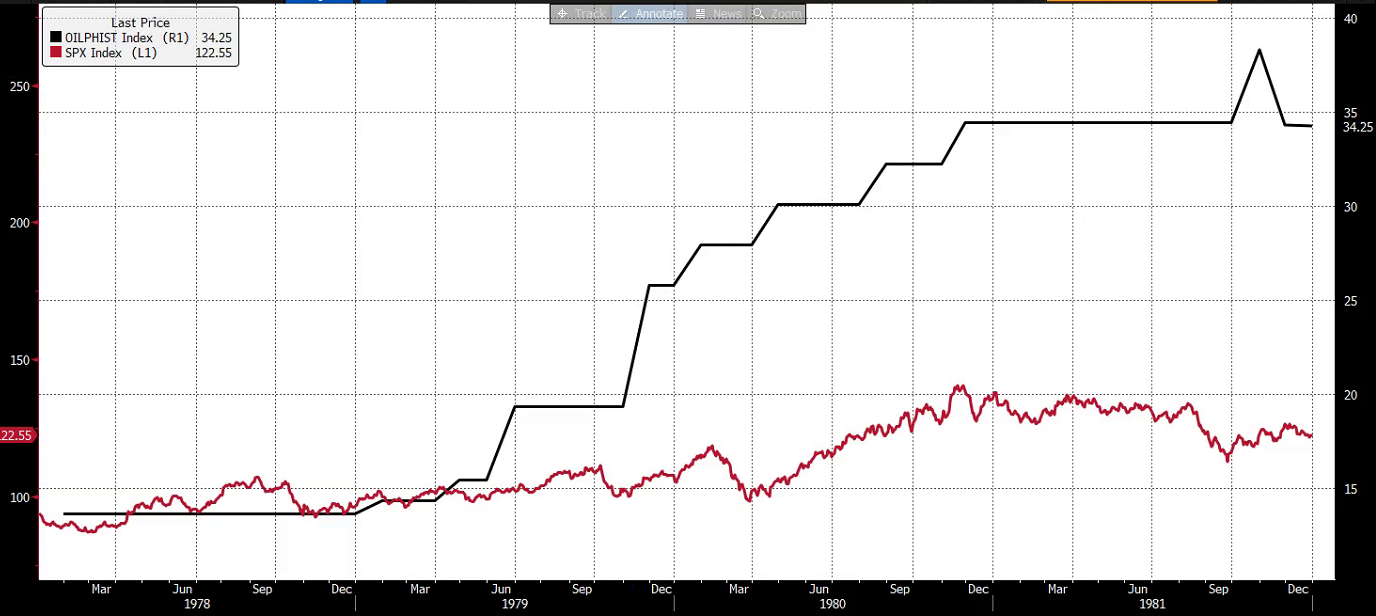

2. 1979 Oil Crisis (Iranian Revolution)

- Cause: Disruptions in Iranian oil production due to the revolution.

- Impact: A doubling of oil prices, high inflation, and economic stagnation.

- Market Reaction: Stock markets experienced another significant drop, further exacerbated by domestic inflation. Recovery was slow, with inflation persisting into the early 1980s.

The 1979 oil crisis, caused by disruptions in Iranian oil production due to the revolution, led to a significant oil price spike, doubling prices and contributing to high inflation and economic stagnation. The stock market experienced a substantial decline, further exacerbated by domestic inflation. Recovery was slow, with inflation persisting into the early 1980s. Today, a similar supply shock originating from Iran could have a comparable impact. The 1970s were a volatile period, characterized by a struggling economy and a highly volatile stock market with multiple double-digit corrections. The introduction of Reaganomics, known for its tax cuts and deregulation policies, might also find parallels in today’s economic landscape.

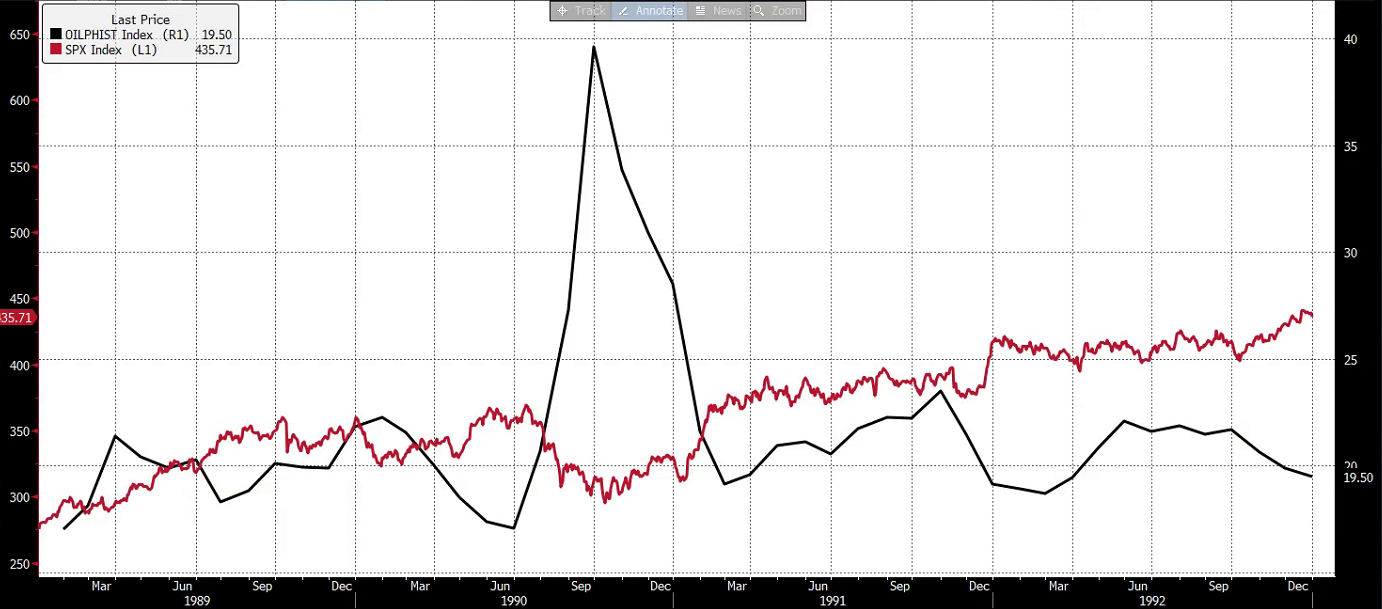

3. 1990-1991 Gulf War (Iraq’s Invasion of Kuwait)

- Cause: Threats to oil production in a major oil-producing region.

- Impact: A temporary increase in oil prices, but less severe than previous crises.

- Market Reaction: A temporary decline in stock markets, followed by a relatively quick recovery. The economic damage was less pronounced.

The 1990-1991 Gulf War, triggered by Iraq’s invasion of Kuwait, disrupted oil production in a major oil-producing region. This led to a temporary increase in oil prices, although less severe than the previous two crises. The stock market experienced a temporary decline, but recovered relatively quickly. The economic damage was less pronounced compared to the earlier oil shocks, despite the significant disruption in oil supply caused by the war.

4. 2008 Financial Crisis

- Cause: A global economic downturn triggered by the housing market collapse.

- Impact: Decreased oil demand and a temporary drop in oil prices.

- Market Reaction: A dramatic collapse in stock markets worldwide, with the oil sector hit hard. The market experienced a prolonged recovery with high volatility.

The 2008 financial crisis, triggered by the housing market collapse, represents a distinct departure from previous oil shocks. While there was no supply-driven disruption, the global economic downturn led to decreased oil demand. The oil sector was significantly impacted, and the stock market experienced a dramatic collapse. The unusual circumstances of the crisis, including the collapse of banks and disruptions in global trade, led to a prolonged period of market volatility and economic recovery.

A key factor contributing to the economic downturn was the sharp rise in oil prices during the early stages of the crisis. These elevated prices further exacerbated the economic weakness, creating a vicious cycle of rising costs and declining demand. Ultimately, the weak economy forced a decrease in oil demand, leading to a decline in oil prices.

While there were various factors influencing the oil price increase, including speculation and geopolitical tensions, the overall economic weakness played a significant role in driving prices down. This unique combination of circumstances made the 2008 oil shock distinct from previous events.

5. 2022 Russia-Ukraine War

- Cause: Sanctions on Russia, a major oil producer, following its invasion of Ukraine.

- Impact: A sharp rise in oil prices, increased inflation, and economic uncertainty.

- Market Reaction: Initial stock market declines due to fears of prolonged conflict, followed by volatility and a surge in energy sector stocks. The long-term impact remains uncertain.

The 2022 Russia-Ukraine War, marked by sanctions on Russia, a major oil producer, closely resembles the current economic landscape. The sharp rise in oil prices, reminiscent of previous oil shocks, has contributed to increased inflation and economic uncertainty. While the potential for increased US oil production could help mitigate price increases, the current situation has exacerbated an already challenging economic environment. Similar to past oil shocks, the rise in oil prices has contributed to higher inflation, leading to stock market declines.

Key Takeaways:

- Oil shocks can lead to significant short-term volatility and long-term economic impacts.

- The severity of market reactions varies based on the duration and magnitude of oil price spikes.

- Economic conditions, interest rates, and investor sentiment also influence stock market performance during oil shocks.

- Understanding the historical context of oil shocks can help investors better anticipate and navigate potential market disruptions.

While it may be tempting to increase our energy allocation in response to rising oil prices, it’s crucial to maintain a cautious approach. Predicting the future direction of oil prices is challenging, as various factors, including geopolitical events and global economic conditions, can influence supply and demand.

One potential scenario is an attack on Iran’s oil facilities, which could significantly disrupt global oil supply. However, it’s equally possible that the market is already anticipating such an event, leading to increased oil production elsewhere. This uncertainty highlights the importance of remaining flexible and prepared for potential volatility.

As a portfolio manager, it’s prudent to maintain our appropriate allocations while incorporating additional volatility measures. By remaining diversified and considering potential market swings, we can better manage risk and position our portfolio for long-term success.