Last week Fed chair Jay Powell pivoted away from “transitory”, and adopted a tone more in keeping with the market’s newly revised interest rate forecast. As a result, today’s yield curve is far away from the September FOMC projections, even though they’ll be revised at this month’s meeting.

The most important question for bond investors must be the persistence of negative real rates – currently around –1.0% on the ten year. Moreover, the market has lowered expected short term rates five years out compared with their level at the September FOMC (the last time they issued projections materials). The biggest change in the meantime has been the Fed’s assessment of the inflation outlook.

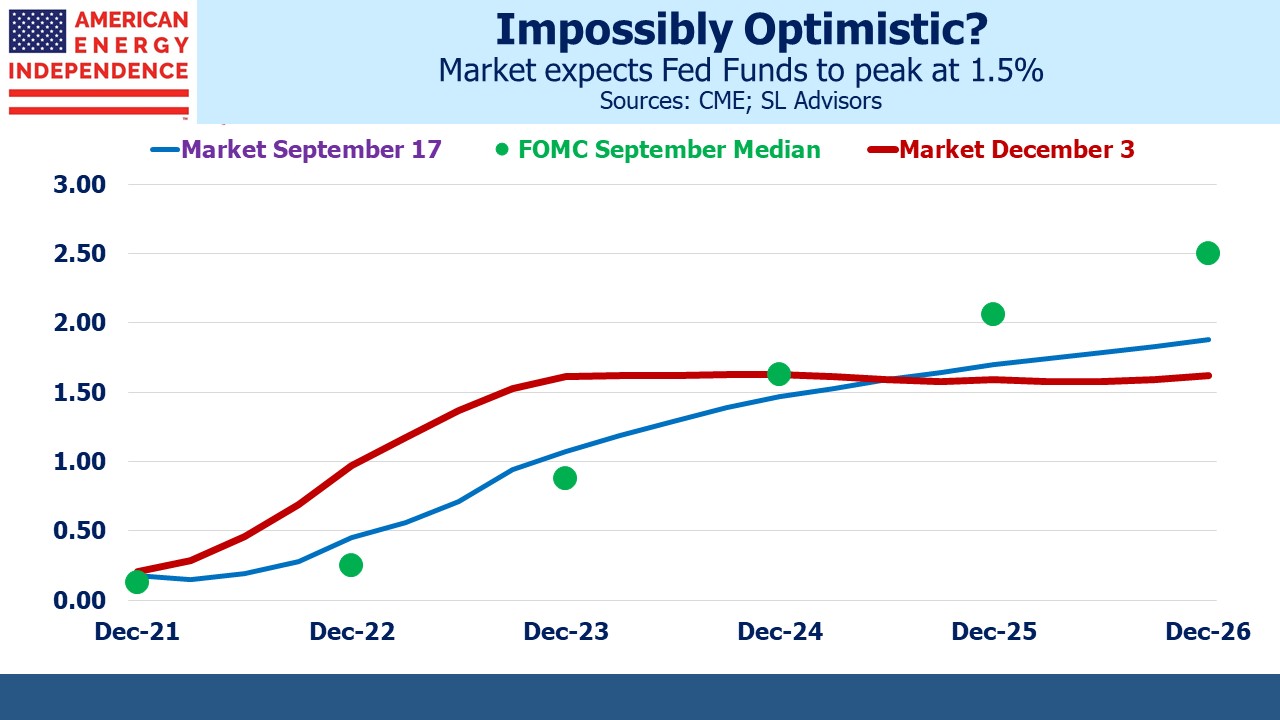

Real rates have been declining for years, and so has the economy’s resilience to high rates. The eurodollar curve is currently priced for the Fed Funds rate to peak in two years at around 1.5% and for policy to remain on hold from then on. Ten year treasury yields are inexplicably at 1.4%, with inflation running over 6%, tapering set to begin and the Fed likely to raise rates as soon as next spring if they decide to accelerate tapering later this month.

It doesn’t seem likely that the Fed will be able to restrain economic growth much without seeing long term yields rise. A 1.5% peak Fed Funds rate probably isn’t enough.

Former NY Fed president Bill Dudley recently commented that the market was extremely sanguine about how little increase in rate will be necessary to curb inflation. Five year inflation expectations derived from the treasury yield curve are 2.7%, and ten years 2.5%.

Add it all up, and the market is priced for Fed Funds to peak at 1% or so below inflation, which is nonetheless expected to moderate without monetary policy becoming restrictive. If someone articulated such an outlook, they’d be regarded as impossibly optimistic, yet it’s the market forecast.

One of the great pleasures of writing this blog is receiving comments on it. I remain in touch with many former colleagues and business associates as a result. Last week our post on the Owners’ Equivalent Rent, or OER (see The Subtle Inflation Pressure From Housing) drew an emailed response from Donald H. Layton, former CEO of Freddie Mac from May 2012 until June 2019. Now that he is enjoying a well-earned, though still typically industrious, retirement Don is writing papers on public policy with respect to housing. He has much to offer on the subject.

For 15 years of my career at JPMorgan (1985-2000) I worked under Don Layton. As vice chair, Don led global capital markets and investment banking, which included my business of US interest rate derivatives trading.

Don is one of those rare executives able to combine strategic vision with an intense focus on detail. He often kept managers on their toes by revealing more knowledge about their business unit than might be expected from one of the bank’s top three executives. He was a superb leader who inspired loyalty and respect in equal measure. To my great pleasure we have remained in touch, and our annual reunions on the golf course followed by lunch inevitably include thought-provoking discussions about finance.

A couple of months ago Don wrote an excellent blog post about OER (see What Do Runaway House Prices Mean For The US?). He noted three disadvantages of the current housing boom: increasing inequality (if you don’t own a home and/or stocks, you’re slipping farther behind the asset-owning classes); decreased home ownership (it’s harder than ever for first time homebuyers) and artificially lowering inflation (because OER fails to adequately reflect the costs of home ownership, especially for current buyers).

Don noted, as we often have on this blog, the problems with estimating the cost of shelter by surveying homeowners on the possible rental income they might earn on their home. He notes that, “while the FHFA (Federal Housing Finance Agency) is saying that house prices went up 19.2 percent over the past year, the OER says that the cost of shelter for owner-occupied homes went up by only 2.43 percent! That’s a lower percentage increase than even for the median rent of an actual rental unit.”

Don goes on to argue that, “This result fails the common sense “smell test. The OER approach may work adequately well in normal times, but it does not seem to be working properly under the stress of today’s unprecedented increases in house prices.

“Unfortunately, given the high percentage of the typical household budget that is taken up by shelter, claims of today’s inflation being transitory may therefore not be well-founded. This suggests that policymakers are flying more than a bit blind, not seeing the inflation that the citizenry feels (especially those looking to buy their first home). That does not bode well for those policymakers, especially at the Federal Reserve, making the best decisions.”

US monetary policy would be better served if such clear thinking was more prevalent among policymakers.

CPI inflation is likely to remain stubbornly higher than the FOMC might like as home price appreciation filters through to rent, and their theoretical analog OER. Market forecasts of a peak in the Fed Funds rate of 1.5% seem very optimistic.

We have three funds that seek to profit from this environment:

Energy Mutual Fund

Energy ETF

Inflation Fund

Please see important Legal Disclosures.

Please sign up here for our webinar, Making Sense of Rising Inflation and the Global Energy Crisis, on Thursday, December 16 at 12 noon Eastern.

The post The Market’s Sanguine Inflation Outlook appeared first on SL-Advisors.