Financial advisors need no reminding that performance this year has been heavily influenced by how much you invested in the Magnificent Seven (Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla). Not only have the remaining 493 stocks substantially lagged the S&P500, but the MSCI All-Country World index of nearly 3,000 companies would be down this year if not for the seven.

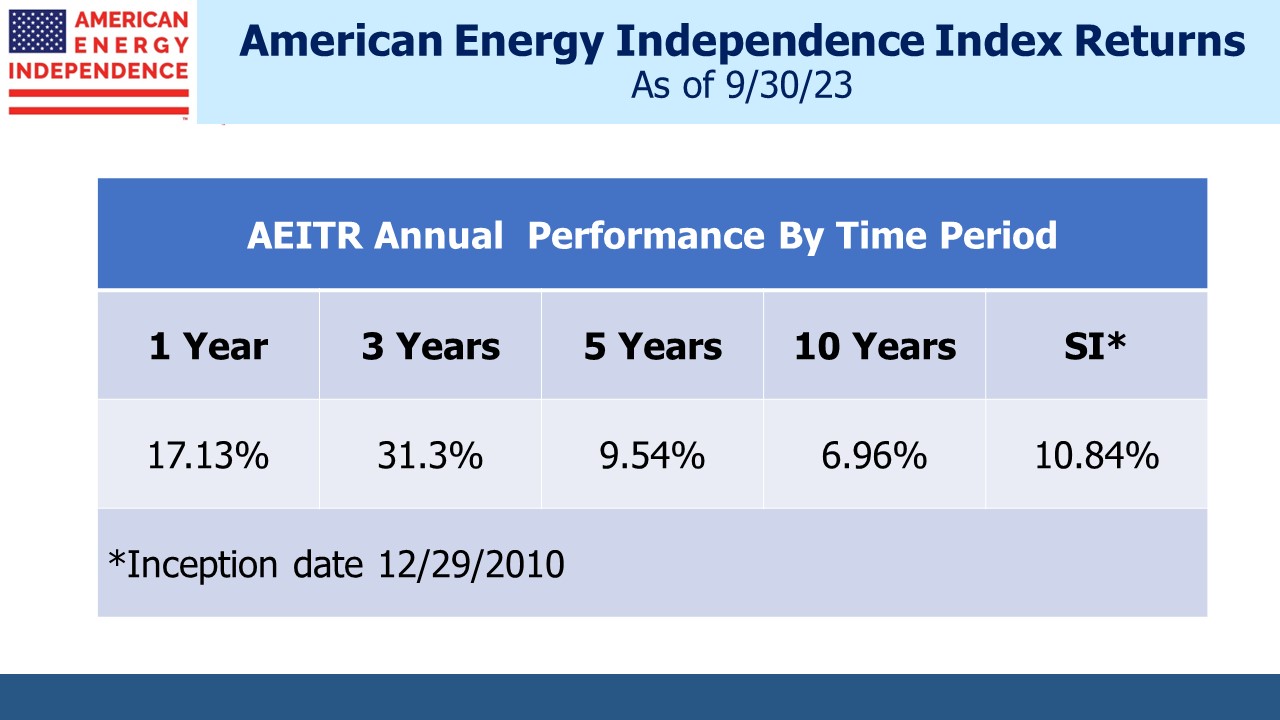

In other words, it’s been hard to beat the S&P500. And yet, midstream energy infrastructure continues to close in on a third successive calendar year of outperformance.

The American Energy Independence Index (AEITR) has its high flyers too. Magellan Midstream was up 45% YTD until it stopped trading following its acquisition by Oneok. We were not happy with the deal (see Oneok Does A Deal Nobody Needs). Nonetheless, we’ll grudgingly accept the profit while remaining dismayed at the recapture of deferred taxes that the transaction creates.

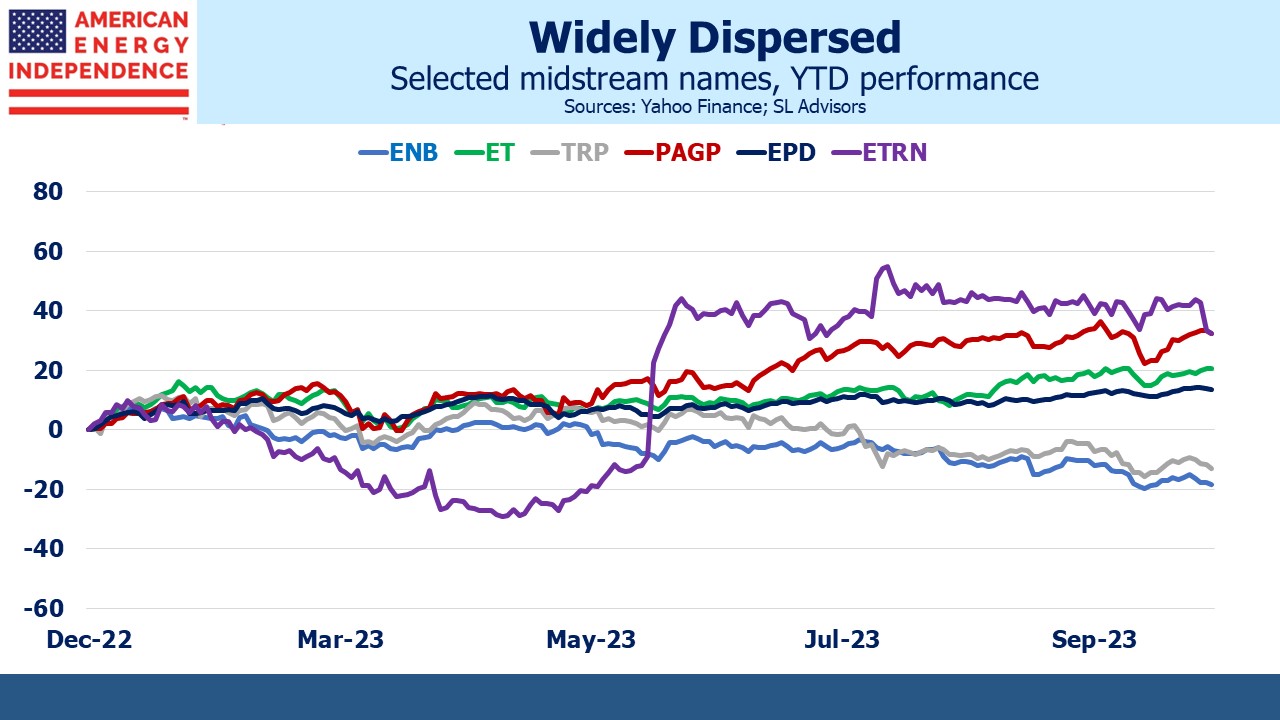

Equitrans (ETRN) is +43% YTD thanks to the Mountain Valley Pipeline’s (MVP) inclusion in the recent legislation to raise the debt ceiling. MVP’s completion suffered another delay last week when ETRN disclosed challenges hiring workers to finish the job. The constant risk that a judge will issue a construction halt in response to a challenge from an environmentalist makes those jobs less appealing.

Plains All American (PAGP) is +37%. The M&A activity in energy hasn’t hurt. Exxon’s acquisition of Pioneer (see Exxon Buys More Of What The World Wants) is estimated to increase crude production out of the Permian by 350 thousand barrels per day over the next four years, which is good if, like PAGP, you own and operate crude pipelines there. Chevron’s deal with Hess is another example of capital being allocated on the premise that oil has a bright future ahead of it.

The International Energy Agency expects global crude oil demand to flatten out within the next five years before declining (see The Super Cycle Or Peak Oil?). That’s clearly not what Exxon or Chevron expect. The WSJ cheekily suggested that weakness in electric vehicle sales suggests they could peak first, before crude oil consumption (see Chevron Bets on Peak Green Energy).

Energy Transfer (ET) is +24% YTD. With a 17% 2024E Distributable Cash Flow yield (according to JPMorgan) and 7.1X Enterprise Value/EBITDA, it is the cheapest large business in the sector. It always is. ET is the most commonly owned pipeline name when we talk with financial advisors who pick individual stocks. Years ago management cemented their reputation for abusing their investors when they issued dilutive and very attractive convertible preferreds to management (see Energy Transfer: Cutting Your Payout, Not Mine from 2018 and Is Energy Transfer Quietly Fleecing its Investors? from 2016).

ET’s issuance of these offending securities led to a class action suit in Delaware which the company won. Even though they enjoyed a victory in court, they still didn’t do the right thing. Ever since, the stock has traded at what we’ll call a “Kelcy discount” (Kelcy Warren is Executive Chairman and former CEO) to its peers.

But ET knows how to run a business. Their casual relationship with fiduciary responsibility hides behind well-honed commercial instincts. When Texas suffered widespread power outages during Winter storm Uri in 2021, ET enjoyed $2.4BN in windfall gains by providing natural gas to a market that was short (see Why The Energy Transition Is Hard). Many financial advisors are drawing some satisfaction that this long-time holding is finally rewarding their faith.

The midstream energy infrastructure sector may not have the Magnificent Seven leading the market higher. But we have these Fab Four that have all handily beaten the averages. Since we’re down to three, Enterprise Products Partners (+20% YTD) can take Magellan’s place.

The laggards this year are Canadian companies. TC Energy (TRP, -10%), Enbridge (ENB, -13%) and Pembina (-11%) share the stability of utilities, a quality investors don’t value with rising rates. Their conservatism is being challenged. ENB is leaning against the trend in buying three utility businesses (see a comment on this in Fiscal Policy Moves Center Stage). ENB and TRP are both projected to have leverage above 5X Debt: EBITDA through the end of 2025, meaningfully higher than the 3.0-3.5X that prevails among their investment grade peers. TRP has the more pressing need to shed assets to fund their capex program, but both companies are comfortable that their debt levels are manageable.

Here I’ll switch to briefly indulge in a personal anecdote. My wife and I recently met John Cleese after watching him on stage. Americans are most familiar with Cleese through Monty Python but Fawlty Towers is among the greatest comedies of all time. Cleese plays Basil Fawlty, the irascible hotel owner constantly berating the guests whose presence is often an inconvenience or worse. Quotes from these twelve episodes have featured in our family discourse for decades. Since Cleese has been an enduring source of laughter for us, it was my great pleasure to tell him personally. True to form, he was charming and then told us to “buzz off” as there were others waiting to shake his hand.

We have three have funds that seek to profit from this environment:

Energy Mutual Fund

Energy ETF

Inflation Fund

The post The Magnificent Fab Four appeared first on SL-Advisors.