Commercial banks have long benefited from depositor lethargy regarding rates. Although we now have a de facto guarantee of all commercial banking deposits, not just those up to the $250K threshold, customers are likely to pay a little more attention to return and risk, which will force banks to be more competitive.

On the asset side, capital rules that favor riskless US treasuries have encouraged banks to load up on longer maturities. Although a return of interest and principal is guaranteed, a profit is not when funded with floating rate debt. Regulatory scrutiny of banks’ duration risk will follow given the hit to capital ratios since the Fed started their belated, and therefore hurried, tightening a year ago. Bond purchases will be less eager, although the drop in rates caused by Silicon Valley Bank’s collapse has boosted bank portfolios.

The combination of having to pay more for deposits while being more cautious in taking risk represents the tightening of financial conditions long sought by the Fed. The consequences won’t be clear for months – under the circumstances a hike next week must seem imprudent. The path of monetary policy has correctly repriced to peak lower, and perhaps immediately.

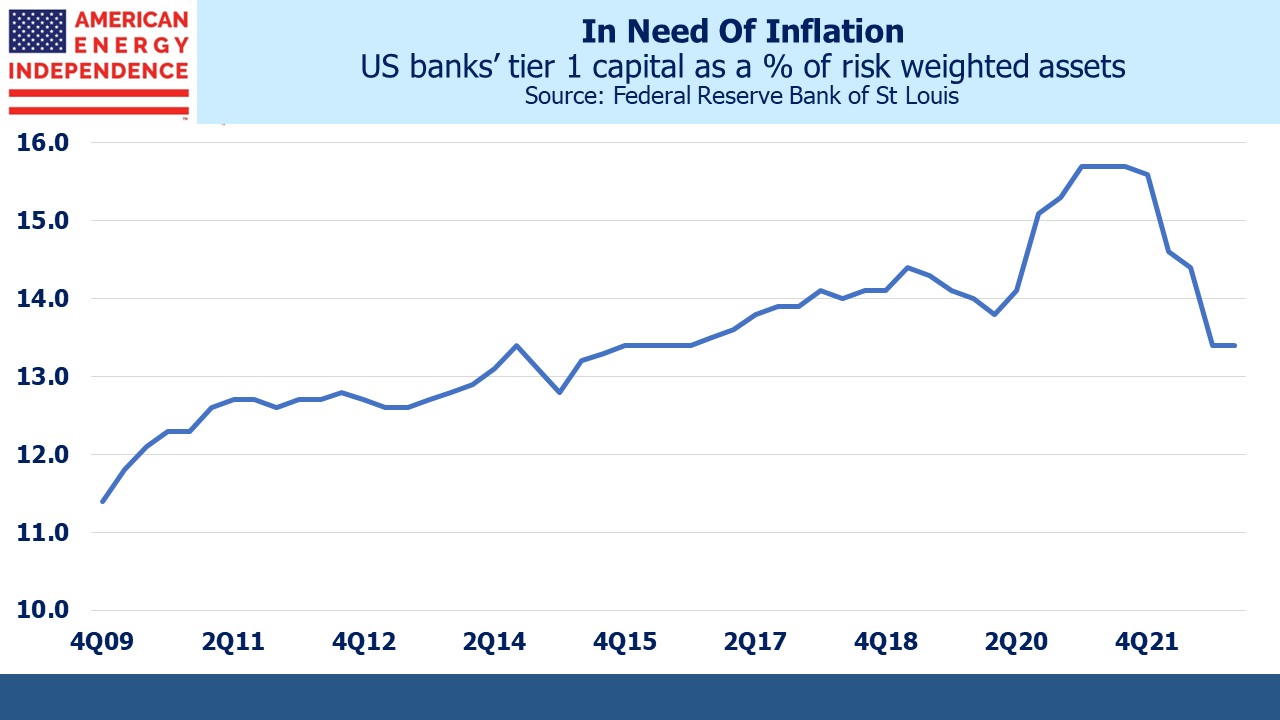

The unwitting creation of tighter financial conditions the Fed’s rapid hikes caused now needs time to percolate. Monetary policy is best implemented slowly with few surprises. We’re seeing why. Tier 1 capital ratios for the US banking system fell by an unprecedented 2.6% last year.

The Fed interprets its twin mandate of achieving maximum employment consistent with stable prices as addressing whichever of the two metrics is farthest from target. The 2019 Jackson Hole symposium sought greater employment at the tolerance of higher near-term inflation because this was stubbornly low.

Last year’s pivot was late because of their disbelief that elevated inflation was entrenched.

But sitting atop the Fed’s twin mandate is an overarching responsibility for financial stability. Assuring that now takes priority.

What’s unfolding is a significant regulatory failure – the Fed leads banking oversight and failed to make the connection between countering inflation and the financial system it oversees. As a result, they’re relying for now on suddenly lost confidence in regional banks to slow inflation since the previously communicated rate path is untenable. Not for the first time, the blue dots on the FOMC’s Summary of Economic Projections (SEP) will need to be revised towards market forecasts.

All it would have taken was a speech by Jay Powell eighteen months ago warning that banks’ increased duration risk was going to receive greater scrutiny from regulators. Under Powell’s leadership the Fed can claim credit for low unemployment but little else. It’s often said that tightening cycles continue until the Fed breaks something. They have.

What this means for investors is that inflation risk has risen because it’s no longer the Fed’s primary concern. The rising share of Federal expenditures taken up by interest on our debt (see How Tightening Impacts Our Fiscal Outlook) will, over time, impact the conduct of monetary policy.

But the banking system’s exposure to interest rate risk presents a more immediate consideration. Industry Tier 1 Capital as a percentage of risk-weighted assets fell from 15.6% to 13.4% last year, arresting a steady trend towards a better capitalized industry begun after the 2008 Great Financial Crisis (GFC). Not every bank has JPMorgan’s fortress balance sheet, and markets have quickly identified the weak ones.

Capital ratios are now a consideration for monetary policy. The rate path indicated by the blue dots in the last SEP would likely hurt capital ratios further, so that’s no longer an option. The months ahead will determine whether the Fed’s done enough. FOMC members routinely make speeches about awaiting actual evidence of moderating inflation before slowing tightening. Circumstances now dictate that they must pause and await developments.

Yesterday’s CPI report exposed the Fed’s dilemma. Even though it showed that inflation remains elevated, tightening next week is hard to justify given recent events. Shelter was also a significant factor and this element provides a flawed reading of the housing market that lags behind actual developments by at least a year (see The Fed Is Misreading Housing Inflation). The FOMC might be relieved to explain this away as not indicative of underlying trends.

For now inflation expectations remain sanguine. Ten year TIPs imply 2.3% CPI over the next decade, not much changed since last summer. For those unconvinced that price stability will return so easily, energy infrastructure offers 5-6% yields from companies whose cashflows are linked to inflation via tariff price escalators.

The case for infrastructure, particularly in the energy sector, remains as strong as ever.

The post The Fed Pivots To Financial Stability appeared first on SL-Advisors.