While the first quarter’s CPI prints this year were above expectations, one needs to ‘look under the hood’ to have a better view on inflation (where it was and where it is going). We have written over the past year that inflation was on a downward trajectory and have been correct. The head fake that occurred during the first quarter with ‘apparently’ high inflation may likely be the nail in the coffin for the economy. We suggest this because most market participants, financial news pundits, and even the Federal Reserve Board of governors (including the Chair) succumbed to bullying on the heels of misleading, if not outright fake, data. We believe their delay in lowering rates will likely tip the economy into stall speed, if not, recession.

Progress on inflation has been great, even with the elevated readings during Q1 2024. All of the inflation in Q1 was attributable to two things that together have a roughly 50% weight on the reading. Those two items were rent and auto insurance. The rent component is ridiculous because all actual real time data suggest that new rents are not going up, but on the margin, going lower over this past year. The methodology used by the BLS is flawed, which includes literally calling random people and polling them on how much they think their home would rent for. This is obviously flawed, and importantly, highly lagging at best.

Auto insurance inflation was in catch-up mode; nothing overtly troubling about this. The fact that car prices rose for the last couple of years as well as repair shop costs, etc mean it was only time before auto insurance rates reflected this. Also, it is important to note that auto insurance is inelastic with respect to price. People are legally bound to have this and therefore, irrespective of interest rates or price, it must be purchased. We also suspect insurance company’s horrible portfolio performance stemming from investments in long duration assets as well as commercial real estate mezzanine loans may be a contributing factor to their need to increase revenue. They likely have hundreds of billions of unrealized losses on their balance sheets, yet the focus has been squarely on regional banks instead.

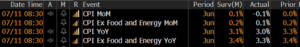

Now July’s print … Vindication.

Source: Bloomberg, LP.

Not only did the headline CPI print indicate deflation, the obsessed over core number came in at an unrounded 0.006%. We think with revisions, it may come down to 0%. The ‘super core’ which excludes housing was negative for June (the second negative super core reading in two months).

Other anecdotal data suggest the service part of the economy is under pressure. Earnings from airlines, trucking companies, restaurant companies, and other consumer durables show a pricing and outright buying revolt from consumers.

More shocking was this month’s ISM Services read, which came in below 49 (any number under 50 indicates contraction). In its 27-year history, ISM services have previously only printed below 49 in 2001, 2008-2009, and Covid time of 2020. We are surprised this data point did not get more attention.

If the Fed and its talking heads actually looked beyond the headline data, they would have seen the same story we have been highlighting. Most components within the CPI basket are experiencing deflation, not inflation. However, the skewed headline numbers driven by factors that are misleading or uncontrollable by Fed policy have driven them to put rate cuts on hold and likely derail the economy.

The Fed has a dual mandate; maximum employment and price stability. Finally, in his two-day testimony in front of Congress, Chair Powell exhibited elevated concern regarding their employment mandate. Unemployment has been rising steadily for the last 6 months and now crossed an important Sahm rule. The Sahm rule suggests that a rise in the 3-month rolling UER of 50 basis points portends a greater than 90% chance of recession.

Unemployment has risen by 70 basis points from its lows (3.4% to 4.1% now) and shows no signs of slowing down. The Fed’s own summary of economic projections indicated a 2024 year-end unemployment rate of 4% (we are now at 4.1%). Continuing jobless claims have been rising almost weekly, now up almost by one million. The household survey shows significant job losses, not gains like the highly skewed nonfarm payroll report (which uses a birth/death model to falsely predict job growth). The JOLTS data suggest a collapse in available jobs. All of this together does not auger “strong economy”. This phrase is being parroted by politicians and financial talking heads and we think they are dead wrong.

Now the tricky part is figuring out where bond yields will head with political uncertainty (and economic policy of certain candidates), a bloated budget deficit, and unstainable fiscal path for the country. Therefore, we will not prognosticate on the path of the longer end of the yield curve, but one thing seems almost certain. The front end is going lower, and likely lower by more and faster than markets are pricing. We think there will be the first interest rate cut in September and depending on the incoming data, it could be 50 basis points. The longer the Fed waits to arrest the dramatically slowing economy and rising unemployment, they will have created another classic policy mistake, still spooked by their failure to see and react to inflation back in 2021.