The Duration Equation:

- What is duration? It is a risk by definition. The risk that the value of a fixed rate bond will decline or rise as a result of a change in interest rates.

- As the name implies, fixed income instruments fix their coupon rate for a longer term. This does not adjust no matter what happens to interest rates or what adjustments the Federal Reserve will make to its interest rate policy, as they have recently indicated.

- This is the rate sensitive part of fixed income that exposes investors to duration.

- Rising rates are a headwind to traditional fixed income portfolios (Treasuries, municipal bonds, investment grade bonds, high yield bonds, emerging market bonds, etc.) as holders of these instruments would now be able to obtain a theoretical higher rate of return than the one locked in at purchase of their fixed rate coupon.

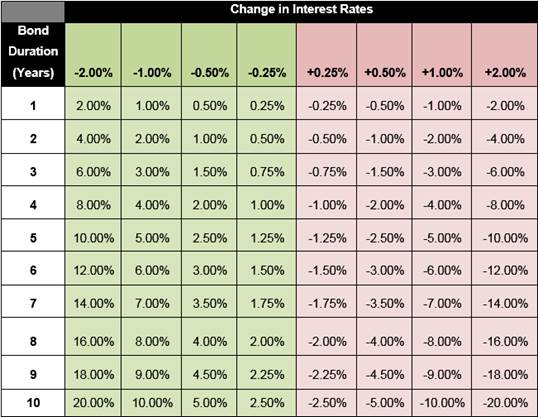

- How much pain can duration create in YOUR fixed income portfolio?

- Historically, if interest rates change by 1%, a fixed income instrument’s price is likely to experience an inverse change by approximately 1% for each year of duration.

- Here is the duration math at a glance –

[vc_btn title=”Download this Article as a PDF” color=”primary” link=”url:https%3A%2F%2Fcatalyst-insights.com%2Fwp-content%2Fuploads%2F2021%2F06%2FThe-Duration-Equation-I-Catalyst-Insights.pdf||target:%20_blank|”]