The disinflationary impact of Fed policy on equities is coming. There is currently much debate in the mainstream media suggesting investors should ignore Fed rate hikes. To wit:

History suggests U.S. stocks are poised to experience more volatility following the rise in rates. But that doesn’t mean the bull run is over. In fact, in the previous eight hiking cycles the S&P 500 was higher a year after the first increase every single time, according to LPL Financial.” – Bloomberg

Such is a pretty compelling argument on the surface to stay the course with portfolios. However, as is always the case, every market cycle is different. Let’s look at a chart of Fed rate hiking cycles from 1980 to the present.

Historically, Fed rate hikes have consistently led to poor outcomes for investors. However, since the Fed policy takes about 9-months to impact the economy, LPL’s chart doesn’t show you “what happened next.”

Furthermore, out of the last 8-rate hike cycle, 80% of them occurred during the secular bull market cycle that started in 1980. During that 20-year cycle, the deregulation of the financial industry led to a massive debt-driven consumption boom, combined with consistently falling inflation and interest rates.

Even with those tailwinds, the Fed managed to create crisis after crisis by hiking rates.

QE Is Disinflationary For Stocks

Here is another problem for the “don’t fear Fed rate hikes” thesis.

For the last decade, the primary bullish thesis for chasing equity markets remains “Don’t fight the Fed.” While the “bulls” are adamant that you shouldn’t “fight the Fed” when monetary policy is loose, as evidenced by LPL, they say the same when it reverses.

However, logic would dictate that outcomes can not be different UNLESS the changes to monetary policy have NO impact on equity pricing. That was a point previously made by Minneapolis Fed President Neel Kashkari once stated that the Fed’s QE program does not affect the financial markets.

“QE conspiracists can say this is all about balance sheet growth. Someone explain how swapping one short-term risk-free instrument (reserves) for another short-term risk-free instrument (t-bills) leads to equity repricing. I don’t see it.”

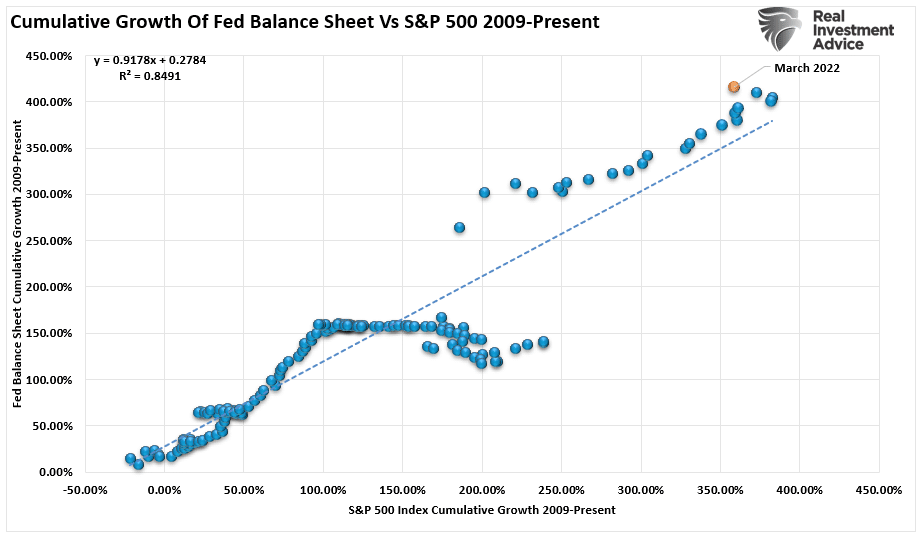

While he may be “technically correct,” as noted, there is ample evidence of a direct impact on financial markets. As discussed in “Past Performance Is A Guarantee:”

“Given the high correlation between the financial markets and the Federal Reserve interventions, there is credence to Minsky’s theory. With an R-Square of nearly 85%, the Fed is impacting financial markets.“

The inflation of assets was not isolated in the U.S. but globally.

“If you run a simple regression since June 2009, the starting point of the biggest monetary experiment ever, you will find that the G4 Central Banks balance sheet explains 90%(!) of the MSCI AC World Index level.” – @TheMarketEar

Given the high correlation to asset prices, logic suggests any contraction of the Fed’s balance sheet is disinflationary.

That contraction is coming, and if correlations hold, the disinflationary impact on equity assets should logically follow.

Selling Rallies

As noted, monetary policy has a lag effect of about 9-months before it becomes evident in the markets and economy. As shown, with market sentiment so extremely negative, a market rally is certainly possible.

However, as my colleague Albert Edwards recently noted:

“Surely all of us working in finance realize by now that something is likely to snap in the financial system and probably quite soon. The rapidity of current market moves and the polarisation of the now extreme Fed (hawkish) and BoJ (dovish) policies almost guarantees that outcome.“

Notably, while discussing the disinflationary impact on equities (lower returns), such does not necessarily mean a “bear market.” There is certainly a possibility the U.S. could avoid a major bear market as long as global inflows continue at the current unprecedented pace.

Unfortunately, history suggests that such an optimistic outcome is rarely the case, given higher rates, less monetary accommodation, and slower economic growth.

QT Now, QE Later

While many believe the Fed will hike rates in their quest to battle inflation, that fight will end quickly when “financial instability” arises. As Former Dallas Fed President Richard Fisher noted:

“Let’s face it, Joe…the market has worn beer goggles for the longest possible time. They just believe the Fed’s going to bail them out.

I think the strike price on the Fed put has moved significantly [lower]. Unless we have a dramatic turn in the markets, it can infect the real economy.“

How would such a dramatic turn occur?

- At 20%, margin calls will begin to rise, putting pressure on asset and high-yield credit markets. (Such may have already started as witnessed by recent actions.)

- Yield curves will fully invert as the market declines by 25% and economic growth crashes.

- At 30%, corporations will lay off workers and move to protect profitability.

I suspect, as noted above that somewhere between a 20-30% decline, we will see the Fed return its focus to “market stability.”

Selling rallies certainly seems to be the prudent course of action at this stage of the equity cycle.

The post The Disinflationary Impact Of Fed Policy On Equities appeared first on RIA.