This week marks the beginning of a significant earnings season, with reports expected from several major companies including NFLX, ASML, JNJ, BA, MS, UNH, TSM, and GS. This occurs amidst a recent correction with the market shifting from mega-cap companies to small-caps.

The MAG 7 has risen extremely high, posing a risk for the market. Following the CPI report, the MAG 7 pulled back, however, the market did not! Despite the changing market activity, the SPX trend line continues to perform fantastically, with the upward trend line marching even higher.

SPX 2 Year Trends

The skew remains low. We continue to see increased call buying at this range, indicating that the bulls still control the market despite last week’s hiccup.

Skew 2 Year

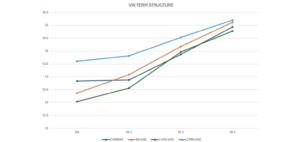

The VIX futures curve merits attention, with the August future showing a notable premium at $14. Expectations vary regarding volatility normalization. The upcoming October futures are anticipated to show elevated levels. It’s crucial to remember that volatility changes can have far-reaching effects across different market segments.

VIX Futures Curve

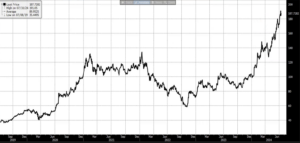

Big Story: Russell 2000 Catchup

Small caps have lagged behind for the past couple years–moving nowhere. A very good breakout developed this past week (testing the all-time high). This signals that the economy is in good health and a recession isn’t likely. AI (mega-caps) will likely start to filter out through the rest of the economy

Russell 2000

In the tech sector, TSM continues to play a pivotal role in the AI revolution. Their performance is closely tied to NVIDIA’s success, as TSM produces the chips utilized by NVDA. Current demand for TSM’s products remains strong, with production seemingly unconstrained by market absorption capacity.

TSM Chart

The current market landscape presents a fascinating dichotomy. Market Conditions: The market is bullish (upward trend) despite a high MAG 7 (risk indicator). This week’s earnings reports will be crucial in determining whether this upward momentum can be sustained. The Russell 2000’s recent breakout suggests a broadening of market strength beyond the mega-caps, potentially signaling robust economic health. Meanwhile, the tech sector, particularly companies like TSM, continues to play a pivotal role in driving market trends. As we navigate through this earnings season, investors should remain vigilant, keeping an eye on volatility indicators and sector-specific developments that could influence the overall market direction.