A wood-burning fireplace on a cold day is a welcoming sight. The crackle and smell of combusting organic matter has provided a place for humans to bond for millennia. Coal replaced wood as the developed world’s chief source of energy in the 19th century. Because of this some feel a misplaced sentimental attachment to burning firewood. Environmental extremists pursue policies intended to return living standards to pre-1850, before the onset of the industrial revolution with its increase in anthropogenic (ie human-generated) CO2. So it’s not surprising that they’d favor that era’s main energy source.

Coal displaced wood for fuel because it was more efficient. Coal is more energy dense, so generates more BTUs by weight. The ratio depends on the type of coal and wood being compared, but 2X is a fair approximation.

Wood also generates lots of fine particulate matter. That fireplace is cozy, but it’s also a toxic environment. The US Environmental Protection Agency warns of the dangers presented by wood smoke, especially indoors. It’s a big source of pollution and respiratory problems across Africa and in other developing nations where wood is commonly used for cooking and heat. The UN has initiatives aimed at reducing the pollution and CO2 emissions from poor families using wood.

There is plenty of evidence that burning wood is bad for the planet. Left-leaning outlets such as NPR and the UK’s Guardian have been critical.

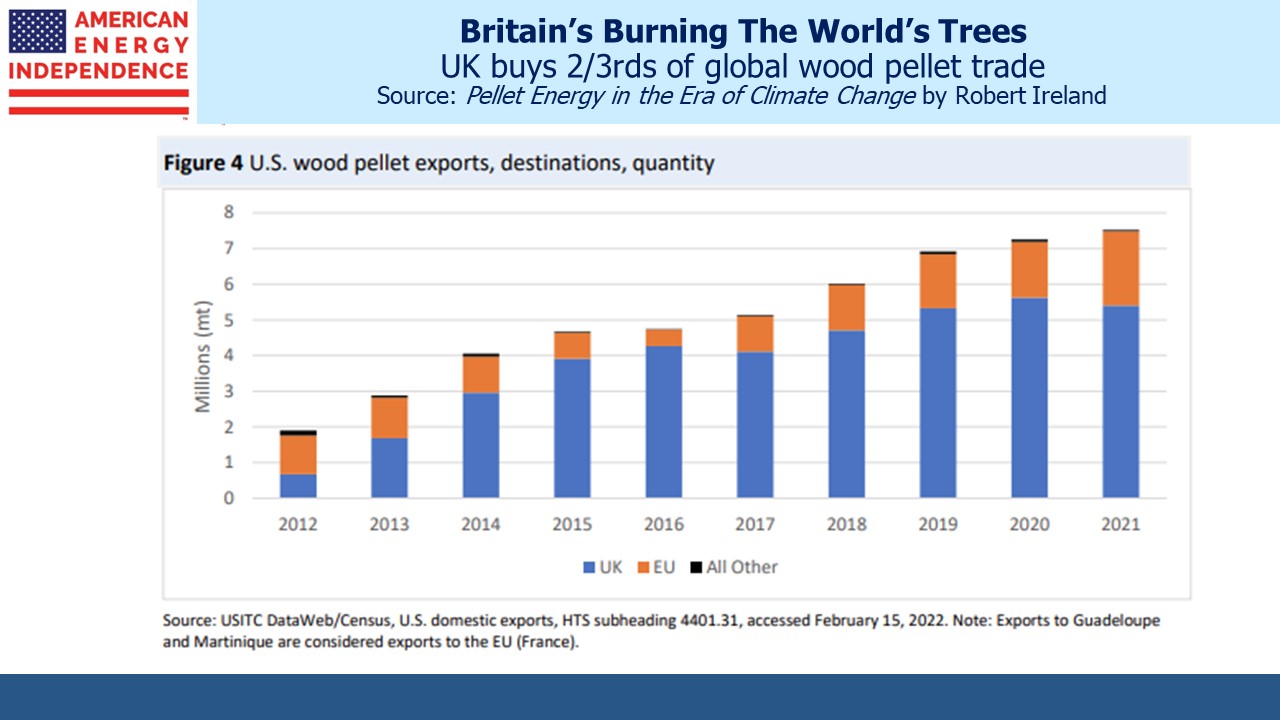

Nonetheless, the world is burning more wood to generate power, especially in the UK and EU. Fuzzy math in accounting for the CO2 generated from using wood pellets to produce electricity classifies it as clean energy. This means their CO2 emissions aren’t counted. The US is the largest exporter of wood pellets, often sourced from forests in the south east. Canada is #3. The UK is by far the largest importer.

The companies that produce and consume wood pellets seem to be exploiting a hole in the EU’s climate change policies (known as RED II).

Wood pellet producer Enviva argues that wood pellets are produced from fallen branches that would otherwise sit on the forest floor and decay, or that only trees cut down for “thinning” a forest are used. But drone footage and Enviva’s public filings show that they’re using freshly cut trees.

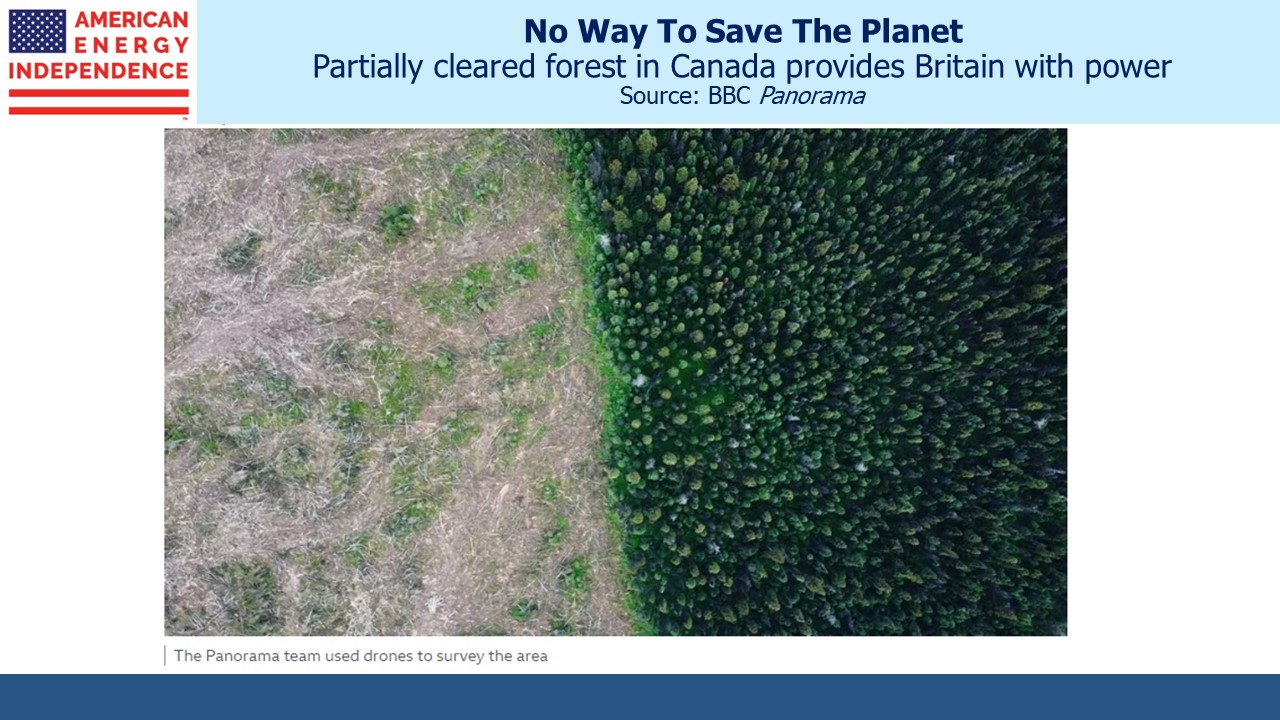

Drax runs the UK’s biggest power station, and thanks to £6BN of UK taxpayer subsidies converted a coal burning power plant to run on wood pellets that provide 12% of the UK’s “renewable” electricity. A BBC documentary found that Canadian forest was being cleared and used for wood pellets.

Trees are nature’s way of absorbing CO2 – research shows that global CO2 levels fluctuate with the seasons. A felled tree stops absorbing CO2, and burning it releases the CO2 it held. Apologists argue that by replanting new trees in the same forest they’ll suck those emissions back in. But researchers at the Massachusetts Institute of Technology have concluded that not only does wood burn dirtier than coal, it takes at least 44 years for replanted trees to absorb the carbon released from burning the ones they replaced.

It seems so obvious that chopping down trees to produce electricity is a dumb idea. Because trees grow back again wood pellets are classified as renewable. That doesn’t mean they’re clean. But since the EU and UK have legal requirements to lower emissions, they’re resorting to slick accounting because solar and wind aren’t going to do it.

It’s too early to say whether the Inflation Reduction Act’s subsidies for biofuels (the catchall within which wood pellets sit) will encourage the same perverse policies the UK has pursued here in the US.

Sometimes it seems as if the lunatics are running the asylum.

My thanks to good friend Mike Shinnick of Naples, FL for bringing this topic to my attention.

Kinder Morgan (KMI) reported earnings last week. They were ho-hum. The quarterly dividend was raised by 2% to $0.2825. A decade ago then-CEO Rich Kinder reacted angrily to criticism from Kevin Kaiser, then at Hedgeye. But within a couple of years they slashed the dividend from $0.51 to $0.125. KMI has an attractive 6% yield because they have a long and mediocre record of capital allocation, which is why the dividend is only slowly recovering.

However, in the press release current CEO Steve Kean, who will soon step aside for CFO Kim Dang, commented on the continued failure of Congress to deal with reforming infrastructure permitting. Kean added that the difficulty in building pipelines in America, “…increases the value of our existing natural gas pipeline systems, which results in a favorable recontracting environment.”

The continued delay in completion of the Mountain Valley Pipeline is frustrating Senator Joe Manchin and is the best example of what’s broken. However, the environmental extremists whose court challenges are the cause are unwittingly increasing the value of existing infrastructure. This is another reason why it’s a good time to be a pipeline investor.

Climate extremists aren’t always deep thinkers in the policies they pursue, but they’re not all bad. If you meet one, give them a hug and offer a drive to their next protest.

The post Renewable Energy Doesn’t Mean Clean appeared first on SL-Advisors.