As we welcome in the new year of 2024, the inevitability of an economic downturn lingers on the horizon. The question isn’t if a recession will materialize, but rather when its shadow will cast itself upon us. This anticipation isn’t merely a macroeconomic concern but extends its reach into the personal realm of portfolio planning. As investors brace for potential headwinds, the need for strategic foresight becomes all the more crucial.

In the post-World War II era, economic cycles have consistently ushered in recessions, reshaping landscapes and redefining investment strategies. As we gaze into the uncertainties of the coming year, the challenge isn’t merely recognizing the signs but crafting portfolios that navigate the impending storm with resilience and adaptability.

Economic cycles and historical patterns are critical to the role of portfolio planning. As we enter this pivotal year, the spotlight is not only on the inevitability of recession but on how savvy investors can proactively shape their portfolios to weather the impending financial tides.

Understanding a Recession: Beyond Definitions

Defining a recession involves more than pinpointing the period between an economic peak and its subsequent trough, as outlined by the National Bureau of Economic Research. The NBER’s Business Cycle Dating Committee maintains a chronology of US business cycles, pinpointing peaks and troughs that define economic recessions and expansions. A recession, as per NBER’s definition, involves a significant, widespread, and lasting decline in economic activity. The committee relies on economy-wide measures, including real personal income, nonfarm payroll employment, and industrial production to determine peak and trough months. In making these determinations, the committee adopts a retrospective approach, waiting until sufficient data are available to avoid major revisions and ensuring confidence in the occurrence of a recession or expansion before announcing turning points.

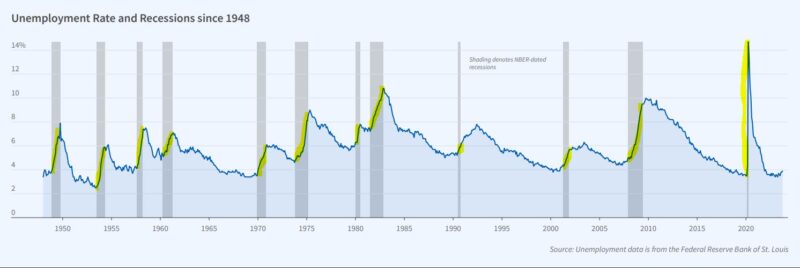

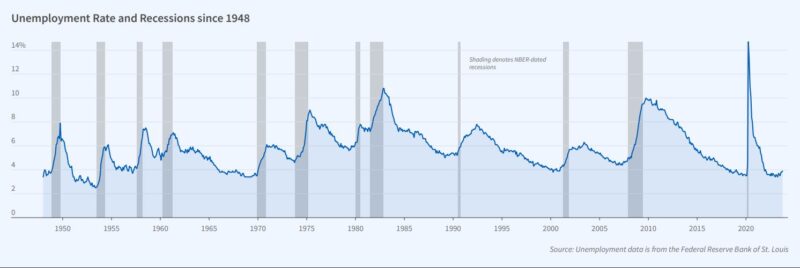

While various definitions exist, a pivotal criterion emerges — the upward trajectory of the unemployment rate. In essence, a recession manifests when unemployment rises, marking a contraction in the economy. This shift in employment dynamics is the linchpin for understanding the size and scope of a recession. As individuals lose their jobs, the broader economic landscape contracts, creating a ripple effect that underscores the gravity of economic downturns. Thus, for investors and policymakers alike, finding a predictable leading indicator to the rising unemployment rate is crucial when it comes to determining how to construct a portfolio for the year.

Tipping points

Looking back at the most recent recessions, three distinct years—2007, 2000, and 1990—stand out, each marked by an external shock that tipped the economy into a recession:

- 2007, the bursting of the housing bubble triggered the recession.

- 2000, the recession was initiated by the bursting of the tech bubble.

- 1990, an oil shock resulting from Saddam’s invasion of Kuwait led to a recession.

Shocks can be random and unpredictable, however the vulnerability to a shock is consistent. In each of the past three recessions, there was one key similarity. A fragile housing market. This weakness, influenced by an external shock, becomes a catalyst for a surge in unemployment. The housing market index, known for its acute sensitivity to the federal funds rate, acts as a barometer for broader economic conditions.

Wells Fargo NAHB Housing Index (inverted) Unemployment Rate (blue) BLOOMBERG

When a downturn in the housing market is observed, a corresponding increase in unemployment becomes apparent. The link is logical: with fewer individuals investing in real estate, the subsequent decline in demand for associated goods and services contributes to the rise in unemployment. The chart above showcases this point. We are looking at the NAHB housing market Index (inverted) with the unemployment rate in blue. Since its inverted, a rise in the chart is when the housing market is soft. A soft housing market index foreshadows a rise in unemployment. This cause-and-effect relationship operates on a delay, and projecting the unemployment rate forward by a year and a half underscores the closely intertwined nature of unemployment trends with the trajectory of the housing market. Let’s take a look at the relationship when you offset unemployment by 18 months.

Wells Fargo NAHB Housing Index (inverted) Unemployment Rate (blue, offset 18 months) BLOOMBERG

The link becomes even more clear with the offset by one year and a half later. Historically, when the housing market index falls, unemployment rises 18 months later.

History Predicts unemployment to rise.

Should we expect history to repeat itself and see the unemployment rate rise in 2024? If the historical pattern continues, unemployment will rise in the coming months, mirroring the drop in the housing index seen 18 months ago in July of 2022. Over the next 6 months, history projects a meaningful rise in unemployment.

Wells Fargo NAHB Housing Index (inverted) Unemployment Rate (blue, offset 18 months) BLOOMBERG

Can Unemployment stay low?

Corporations find themselves in a financially robust position, thanks to a surplus of cash accrued during the COVID era through various support programs. The substantial funds on their balance sheets provide them with the ability to preserve their workforce effectively. Retaining existing employees proves more cost-effective than terminating and subsequently rehiring and training new staff in the event of a business resurgence. This corporate liquidity not only offers stability but also presents the Federal Reserve with an opportunity to navigate towards the soft landing they aspire to achieve.

Interest rates are expected to drop in 2024

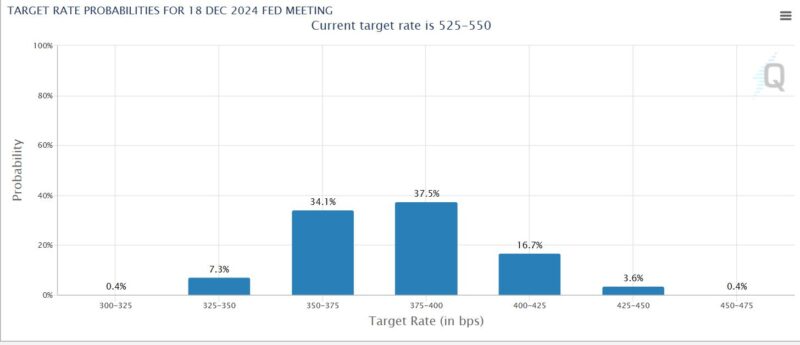

The housing market index weakness was an interesting 2023 story. Existing home sales were extra weak, as homeowners were reluctant to move, trading in a low mortgage rate with a high rate. This lack of supply caused prices to rise, which made affordability of homes unattractive to new buyers. By the end of 2023 however the market began to price in rate cuts for 2024. In fact, the market is now pricing in 150 bps of cuts for the year.

CME Fed Watch Tool CME

So much for higher for longer. Instead, the market is expecting the fed to feel the political pressure of 2024 and ease rates aggressively assuming if inflation continues its return to normalcy.

Could a recession be delayed?

While the current trend in the housing market suggests an impending rise in the unemployment rate, substantial evidence of such an increase has yet to materialize. The situation echoes the dynamics observed in 1996 when, after the Federal Reserve lowered interest rates, the housing market demonstrated resilience and strengthened rather than exhibiting the anticipated decline. Therefore, it remains plausible that we might witness a similar scenario in the current economic landscape, where strategic monetary policy adjustments could potentially bolster the housing market rather than precipitating the expected downturn in employment.

This interesting turn of events may spur a pent-up supply of existing home sales to flood the market, dropping prices at the same time interest rates fall, once again making homes more affordable. If this comes to pass, the housing market index might experience a revival.

Wells Fargo NAHB Housing Index (inverted) Unemployment Rate (blue, offset 18 months) BLOOMBERG

Prospective homebuyers who held back due to high mortgage rates in the previous year could find a fresh window of opportunity with more favorable rates in the upcoming year. Just like in 1996, when the fed aggressively cut rates, we saw the NAHB housing index improve significantly and kept unemployment low.

What is at stake?

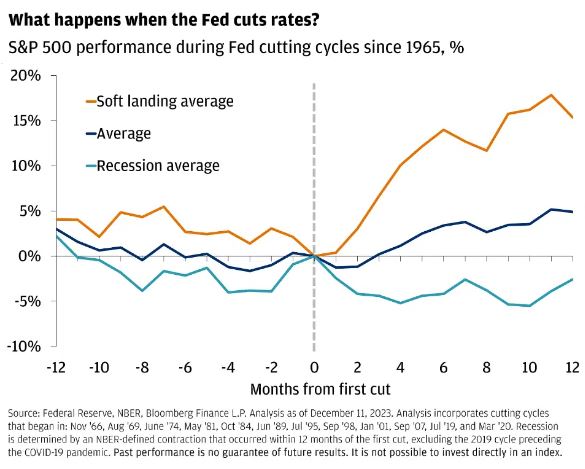

So what will be the difference whether or not the economy is in a recession, or the fed has achieved soft landing? We know the fed is likely to cut rates in the first half of 2024, here are 3 scenarios of what will happen after. We need to be prepared for all possible outcomes.

Conclusion

Whether a recession is around the corner or further in the future, one crucial barometer stands out: the unemployment rate. While predicting the precise timing of a recession proves elusive, it is equally improbable that economic downturns will never occur. For portfolio planners, anticipating the unexpected and preparing for adverse conditions is paramount.

The prospect of the Federal Reserve lowering rates introduces a potential echo of the 1996-2000 bubble. Simultaneously, a weak housing market index looms, hinting that the recession might be imminent. Portfolio managers must remain vigilant and adaptable, ready to confront each unique scenario with discipline and foresight.

A well-crafted portfolio should not merely thrive in favorable conditions but also demonstrate a robust preparedness for the unexpected. It should harness the potential of market exuberance while remaining fortified against the storm clouds of economic challenges. Striking this delicate balance requires diversification, alternative strategies, and disciplined risk management – the cornerstone elements that transform a portfolio into a versatile asset capable of navigating both the highs and lows of the market with resilience and strategic acumen.