Making Sense of Rising Inflation and the Global Energy Crisis

with Simon Lack (Managing Partner, SL Advisors, LLC, & Portfolio Manager, Catalyst Capital Advisors)

On December 16, Simon Lack of SL Advisors and portfolio manager for an energy infrastructure fund at Catalyst Funds provided a market update on the current risks and opportunities in the energy sector and the latest on rising inflation. You can access a replay of the webinar by clicking here.

Some key points from the webinar are included in the summary below:

Increased Attention on Renewables, But the World Still Running on Natural Gas

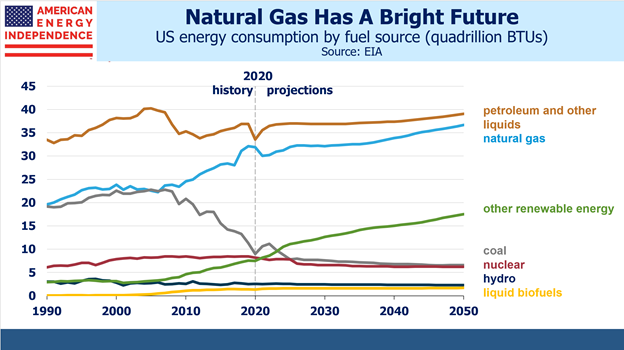

Despite commitments to renewable energy making headlines, much of the world is still powering its way with the use of natural gas. In the wake of COP26, Lack speaks to the emerging and conflicting goals the world faces: developed nations are pivoting toward future plans that favor lowering carbon emissions, but large EM economies are in a strong pursuit of higher living standards through the use of more affordable natural gas. The gap between the use of renewables and natural gas remains wide and is expected to remain this way over the next 30 years (as shown in the chart below).

Source: American Energy Independence

China also continues to lead the world in greenhouse gas emissions, releasing nearly double the amount of CO2 into the atmosphere annually when compared to the United States, which is number two on the list. Lack notes that China is currently building almost as many new coal power plants than are currently operating in the U.S. Even though the change in leadership in Washington had some natural gas investors worried, the U.S. continues to be a mega-user and forecasts are for this trend to continue. Europe has seen their energy priorities shift more aggressively toward renewables, but it hasn’t been a concern for Lack in his investment strategy.

In short, Lack explained that despite the spotlight being on clean energy, when you examine the usage data, it’s clear that many opportunities remain for investors in the mid-stream energy sector.

Inflation

Lack also discussed the outlook for inflation in this webinar, and he outlined approaches for investing given the Fed’s generous approach to quantitative easing since March 2020 and their recent hawkish December announcement.

In the webinar, he lays out different scenarios for the path of inflation in the U.S., including the idea that the FOMC will continue to tolerate high inflation with a zeroed-in focus on achieving full employment. Markets are expecting inflation to be comfortably above 2%, Lack said, potentially near 2.5%.

Given this inflation outlook, Lack notes that it is an opportune time to invest in risk assets (including pipelines and energy). The Fed’s approach also encourages investors to shift to equity given that bonds won’t be able to provide inflationary protection.

The webinar finished with a robust Q&A session that covers the potential for improving valuations and discussions on certain energy industry market leaders.

For more information on Catalyst Funds, please visit www.catalystmf.com.