FERC recently approved a request by Williams Companies to expand its Transco natural gas pipeline in New Jersey. As is usually the case, environmental extremists have been opposing this and other enhancements to the state’s energy infrastructure even though Williams, a commercial enterprise, is presumably meeting increased demand for its services.

Of the seven fossil fuel projects opposed by fringe extremist group Empower NJ, the one that residents surely most strongly support is the proposal to widen 60 miles of the NJ Turnpike and 64 miles of the Garden State Parkway. New Jersey is the most densely populated state in America at 1,259 people per square mile, not far behind the Netherlands at 1,355.

America has vast open areas, but not in the northeast. The situation is not helped by liberal policies that promote high-density, low-income housing. It’s likely that the people opposed to reliable energy like Empower NJ are the same ones who believe everyone who wants a home in New Jersey is entitled to one, regardless of whether that creates even more traffic on our major freeways and need for infrastructure.

Widening our highways is scarcely a fossil fuel project, and is necessary because, improbably, people keep moving to the state. Nonetheless, population growth lags the rest of the country. Therefore, New Jersey’s Congressional representation has been shrinking too. Anecdotally and otherwise it’s clear high earners, who are also high taxpayers, are leaving for states where the weather and politics are sunnier.

Empower NJ opposes expansions to the state’s natural gas infrastructure. Williams Companies recently won FERC approval to add 829 Mcf/Day of capacity to their Transco pipeline network. Empower NJ wants Governor Phil Murphy to block the Transco expansion mentioned above and other important projects. Although the governor may step in, so far he hasn’t. To be left of NJ’s governor is to be truly on the fringe of coherent thought.

Meanwhile, Goldman Sachs estimates that the mis-named Inflation Reduction Act (IRA) will cost $1.2TN, more than three times the CBO’s estimate. Energy companies are rushing to create business lines that will benefit from the many tax credits.

The promise of enormous tax credits in the IRA has boosted lobbying efforts by the energy sector, which had been falling for several years. Pharmaceuticals spend more, but the gap is closing.

Climate extremists have long promised with no empirical evidence that solar and wind are cheaper than natural gas. If this was the case our power supply would be dominated by renewables, which it isn’t. The tax credits in the IRA should make intermittent energy so appealing that further investments in oil and gas must offer extraordinarily compelling returns to compete.

Occidental’s Direct Air Capture (DAC) plans were covered recently in the WSJ. They’re building the world’s biggest DAC facility in Texas and plan to add dozens more. DAC has its critics, who contend that the 0.04% concentration of CO2 in ambient air makes capturing it uneconomic. Occidental’s ambitions extend to selling carbon credits to businesses that can’t reduce emissions (such as airlines). The IRA provides tax credits of $180 per ton for DAC CO2 permanently sequestered underground.

Groups like Empower NJ, more properly named DePower NJ, are pursuing a philosophy of making life miserable for everyone by impeding needed expansions to reliable energy. They lament completed projects such as new gas power plants and pipeline enhancements. They’re trying to foist on us the dysfunctional policies of Massachusetts and New York where access to natural gas is impeded but still needed.

The surest way to lower emissions is to use less energy, most effectively achieved by shrinking NJ’s population. Empower NJ could perform a great service to the Garden State by relocating their dystopian supporters out of the state.

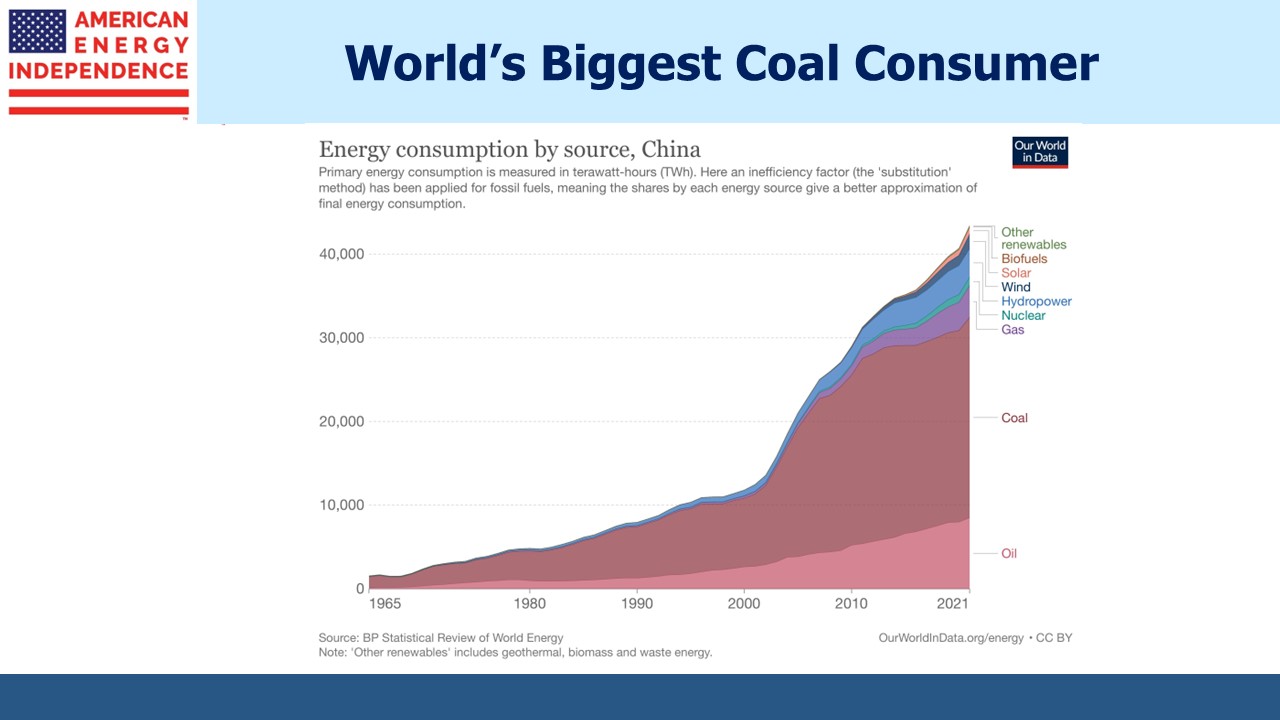

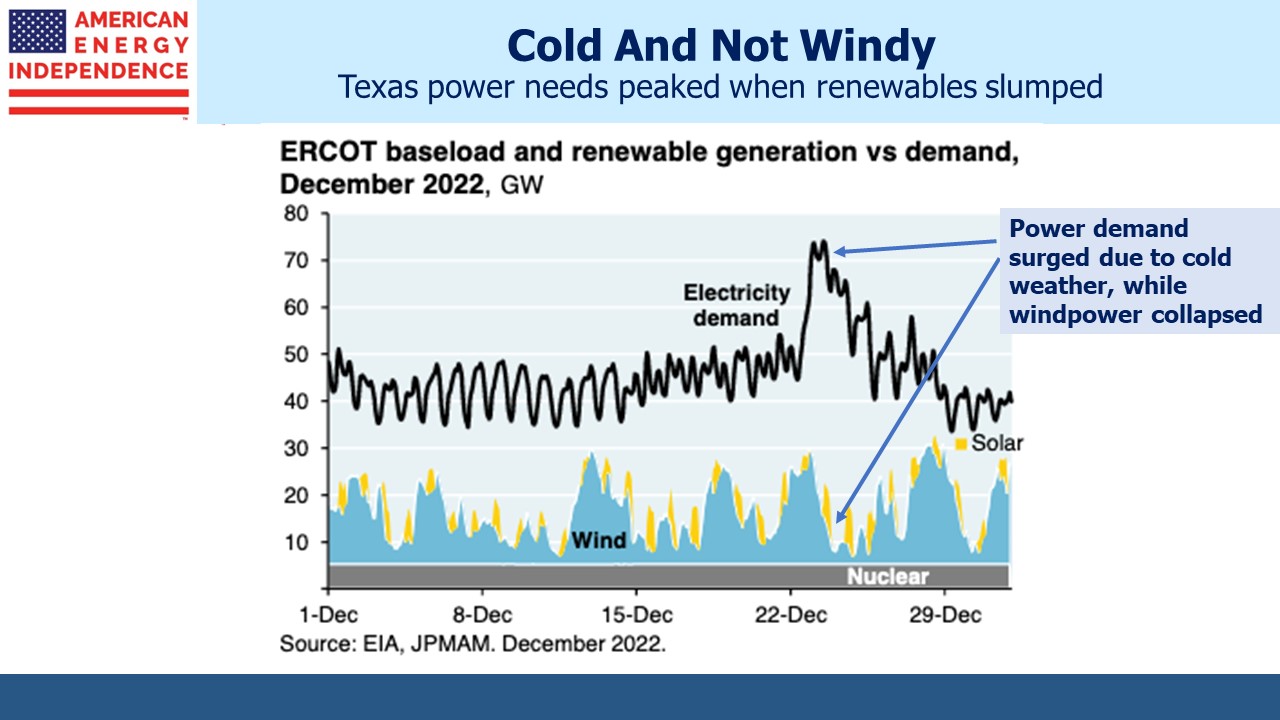

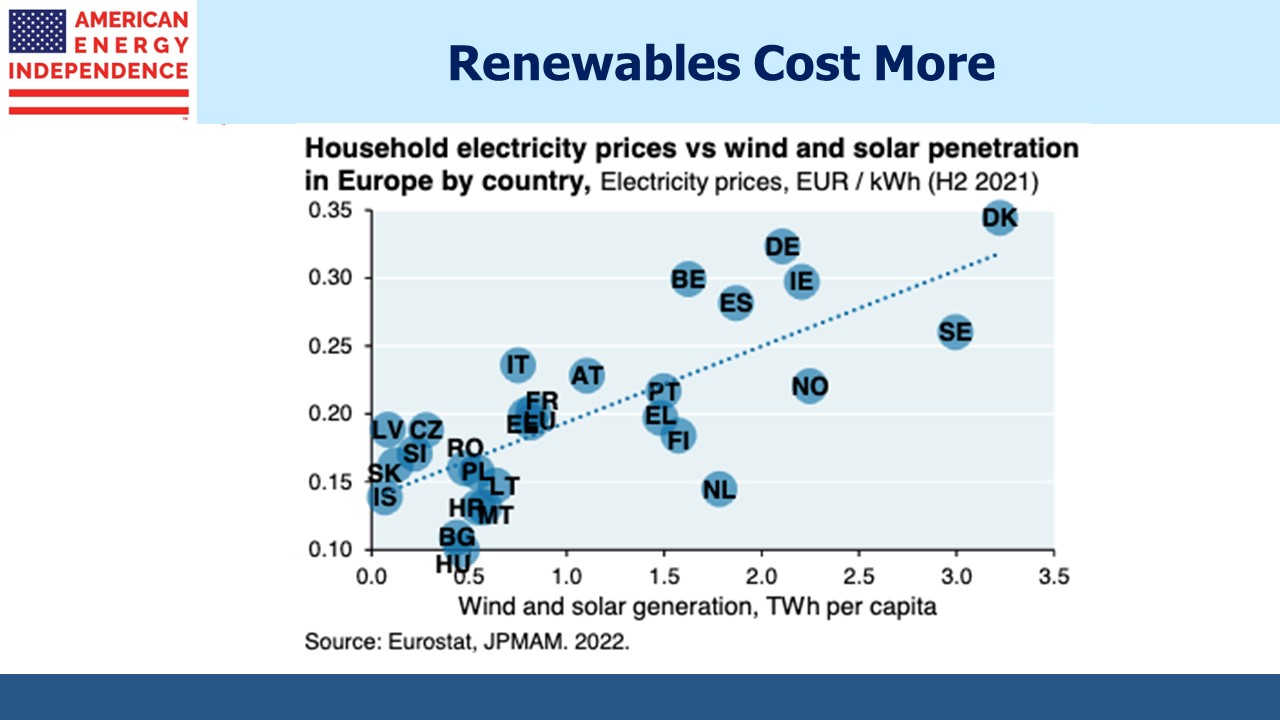

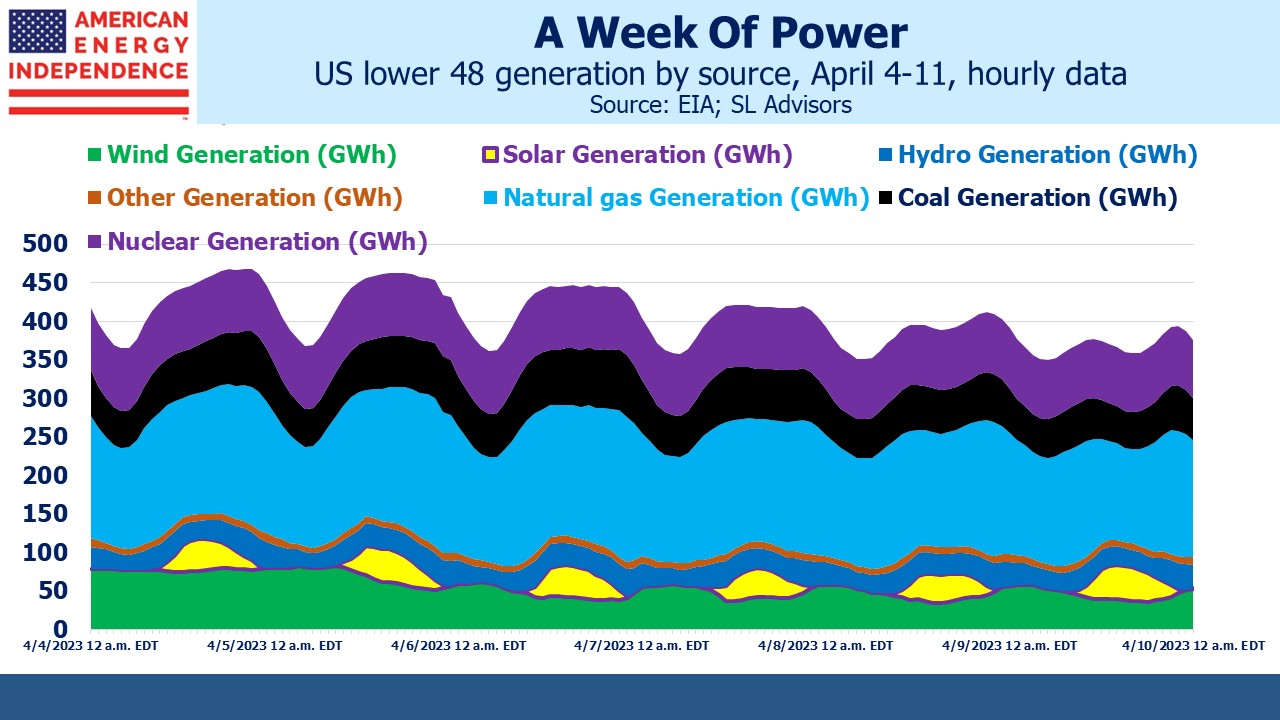

The charts below provide a helpful reminder of key points in considering the world’s use of energy.

China is by far the biggest user of coal, the most prolific source of greenhouse gases. Meaningful progress on climate change won’t happen without China’s participation. Energy consumption has never fallen in human history, yet UN forecasts showing emissions falling assume this will happen.

Output from renewables has an unfortunate tendency to slump during extreme weather when it’s most needed.

Higher renewables penetration equals more expensive electricity. This may be a price worth paying to reduce emissions, but climate extremists ignore it.

Daily power demand follows a predictable cycle, peaking around dinner time. Solar peaks at noon. Wind is unpredictable but is often highest at night.

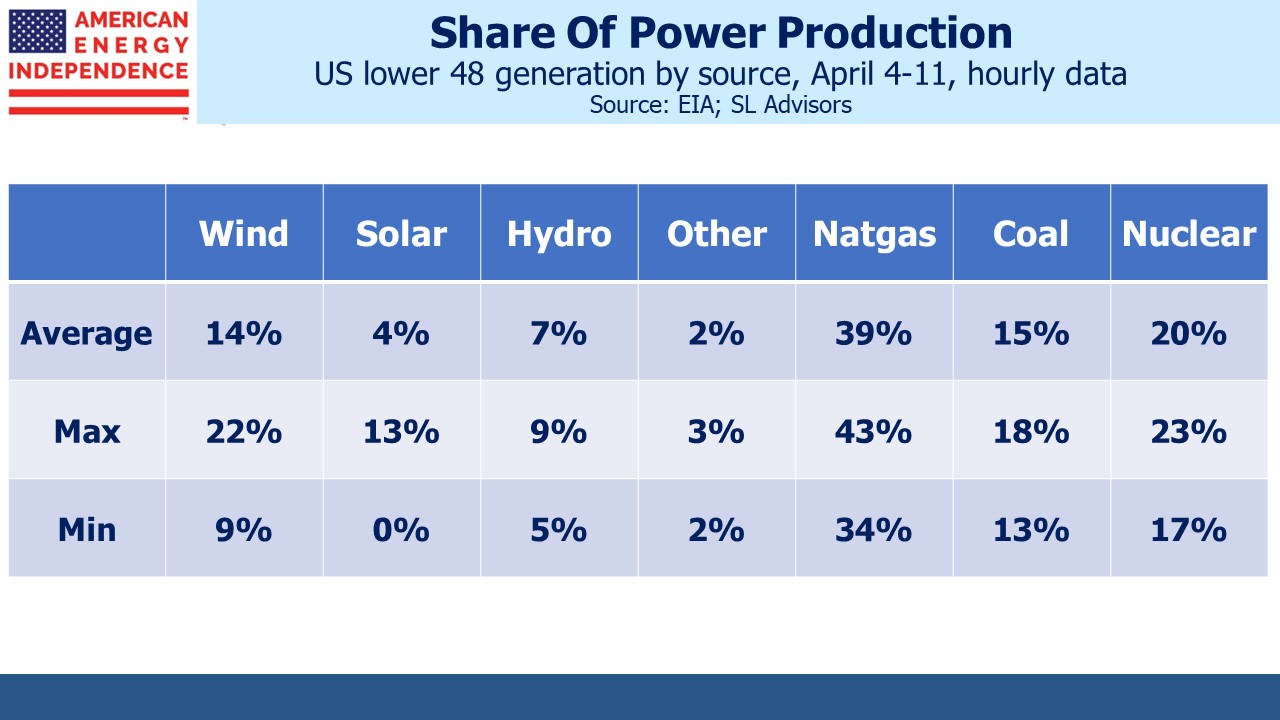

Solar and wind contribution to total power generation varies widely and unpredictably. The challenge this creates for grid operators balancing supply with demand increases sharply with more renewables.

The post Political Energy appeared first on SL-Advisors.