Last week Oneok (OKE) did a secondary offering of 26 million shares. It was priced at $32, and diluted existing shareholders by around 7%. Although a healthy discount from two years ago when they raised $1BN at $54.50, it was nonetheless encouraging that a pipeline company could raise equity. On March 18, when the sector was roiled by desperate selling from incompetent closed end fund managers (see The Virus Infecting MLPs), OKE traded at $12.16.

In reviewing OKE’s recent stock price performance, a good friend of mine recounted some sage wisdom he once heard from a big investor: It’s never a bad thing to let your new investors make money.

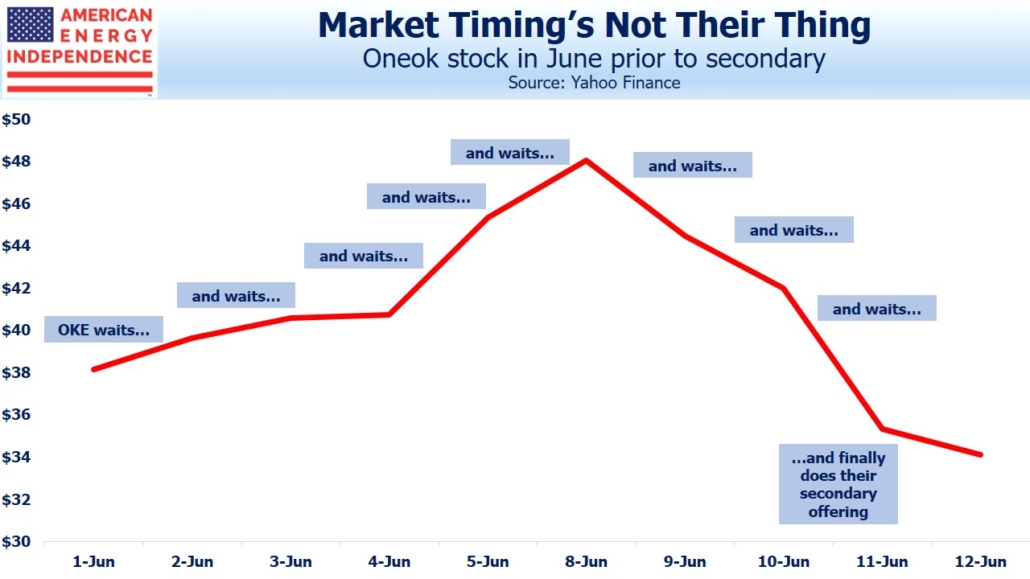

Like most of the sector, OKE rallied strongly from late March. Energy led the rebound in stocks, and on Monday, June 8 OKE traded briefly over $48, almost 4X its low in March. This would have been a great opportunity to do a secondary offering, within touching distance of the price from two years earlier.

OKE management may have been thinking about it – judging from the stock’s subsequent fall, they were likely even discussing it, and perhaps injudiciously. But the announcement finally came two days later, after trading last Wednesday, June 10, when OKE closed at $41.98.

OKE quickly sank on Thursday, dropping $4 on the open and closing down $6.65 at $35.33. The secondary was later priced at $32, a third lower than its price at the beginning of the week.

Most of those involved must be very happy. Buyers of the secondary never saw a loss on their investment, and by Tuesday 16th the stock had rebounded to $38. The underwriters clearly did well, and even existing holders who didn’t participate in the offering can draw comfort from OKE’s now improved financial strength. OKE followed my friend’s advice to let its new buyers make money.

Nonetheless, a more adept management team would have been preparing earlier to fully exploit the market’s newfound passion for pipeline stocks. They would have been ready at $48, rather than chasing the market down to $32. Secondary offerings can be executed quite quickly.

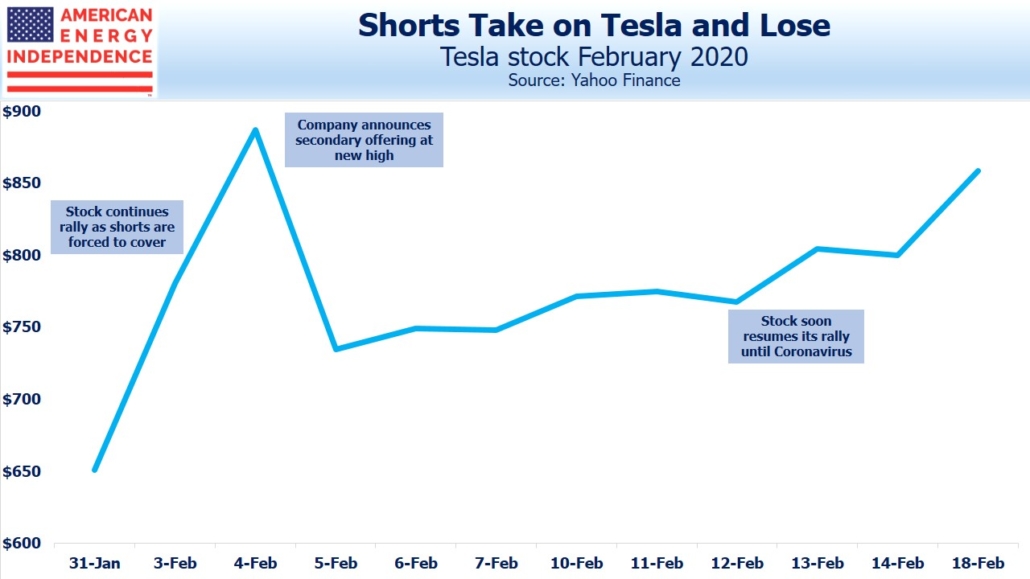

By contrast, consider Tesla (TSLA). Given the trouncing he has handed short selling hedge funds and other skeptics, it’s likely CEO Elon Musk’s photo adorns many dartboards in Greenwich. The case for shorting TSLA was widely made and not that complicated – they were going to run out of cash. It was just a matter of when. Inconveniently for naysayers, this date with financial destiny kept being pushed off, as TSLA’s operating results continued to surprise.

Losses on short positions expanded steadily late last year as TSLA rallied. In January, as the stock exploded upwards like a SpaceX launch, shorts capitulated and joined the indiscriminate buying. On February 4th, the day TSLA traded at $969. Elon Musk gracefully allowed the shorts an exit, via a $2BN secondary offering of 2.65 million shares. This was priced $200 lower, at $767, but since it was less than 1.5% of shares outstanding the dilution was inconsequential.

Coronavirus subsequently wiped out half the company’s value, which likely caused the embittered hurling of a few more darts at Musk’s likeness in Greenwich. But TSLA, like OKE and the rest of the market, has made a strong recovery since. However, the buyers of OKE’s secondary are probably happier than the buyers of TSLA’s. We think they’ll have more to cheer.

We are invested in OKE

The post Oneok Hands New Buyers A Quick Profit appeared first on SL-Advisors.