Many of the current news headlines tie oil’s recent price decline to lower expectations on world growth outlooks. The price of WTI Crude Oil has dropped 23% from $66.60 on April 23 to a low today of $50.59. This decline has oil returning to levels not seen since mid-February of this year. It’s worth noting that six of the last seven Energy Information Administration (EIA) U.S. Crude Oil Inventories reports have shown less crude oil demand than expected, and rig counts increased last week by three rigs.

| Release Date | Time | Actual | Forecast | Previous |

| Jun 05, 2019 | 10:30 | 6.771M | -0.849M | -0.282M |

| May 30, 2019 | 11:00 | -0.282M | -0.857M | 4.740M |

| May 22, 2019 | 10:30 | 4.740M | -0.599M | 5.431M |

| May 15, 2019 | 10:30 | 5.431M | -0.800M | -3.963M |

| May 08, 2019 | 10:30 | -3.963M | 1.215M | 9.934M |

| May 01, 2019 | 10:30 | 9.900M | 1.485M | 5.479M |

| Apr 24, 2019 | 10:30 | 5.479M | 1.255M | -1.396M |

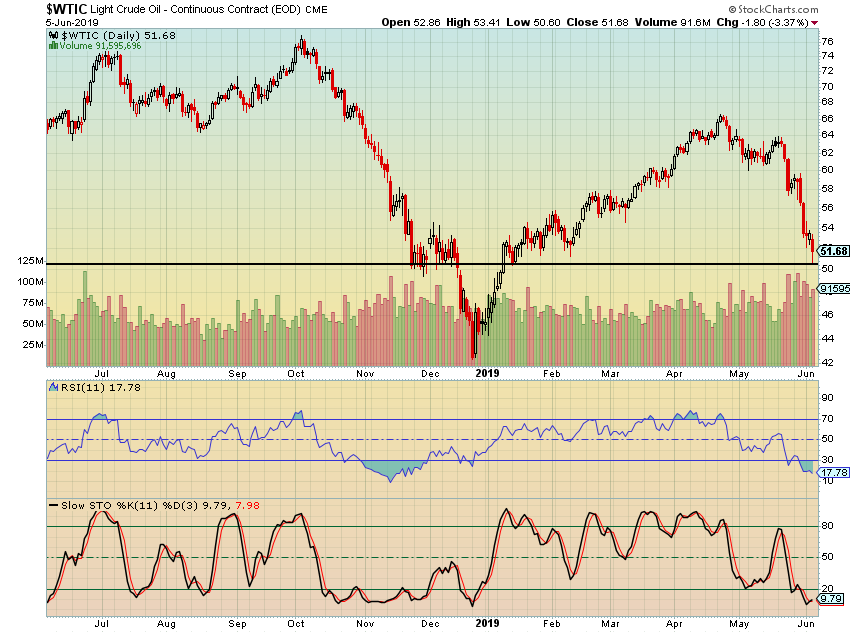

Referencing the oil chart below, price support is seen near today’s low with the RSI and Slow Stochastic oscillators being in oversold territory. While technical indicators alone do not predict oil is going to increase, using them as a guide by combining the oversold indicators, pricing reaching a support line, and considering the magnitude of the drop in just over one month, these items combined suggest that crude oil has a respectable opportunity to bounce from the current level.

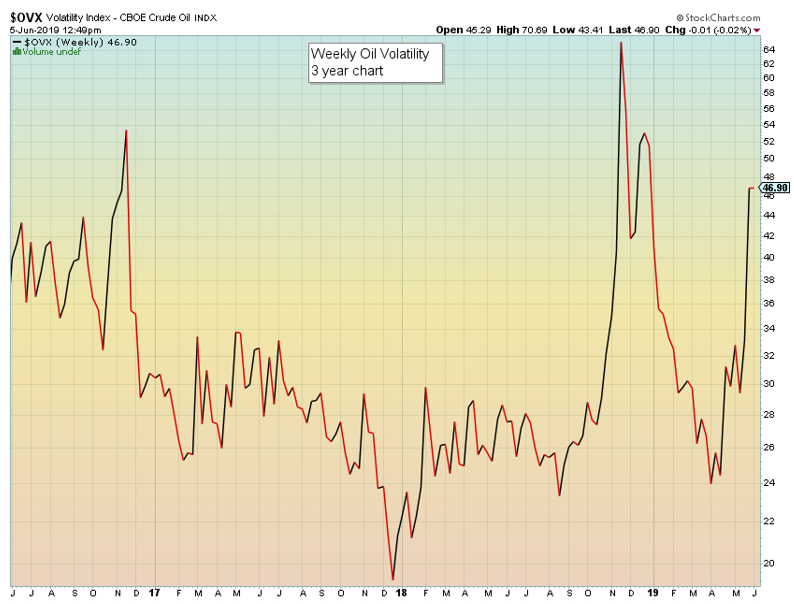

One last note on volatility. Typically, oil volatility increases as the price of oil decreases and vice-versa. Oil volatility measured by $OVX is currently in the mid-40% range, which is considered high, and it’s unusual for oil volatility to stay elevated for long periods of time.

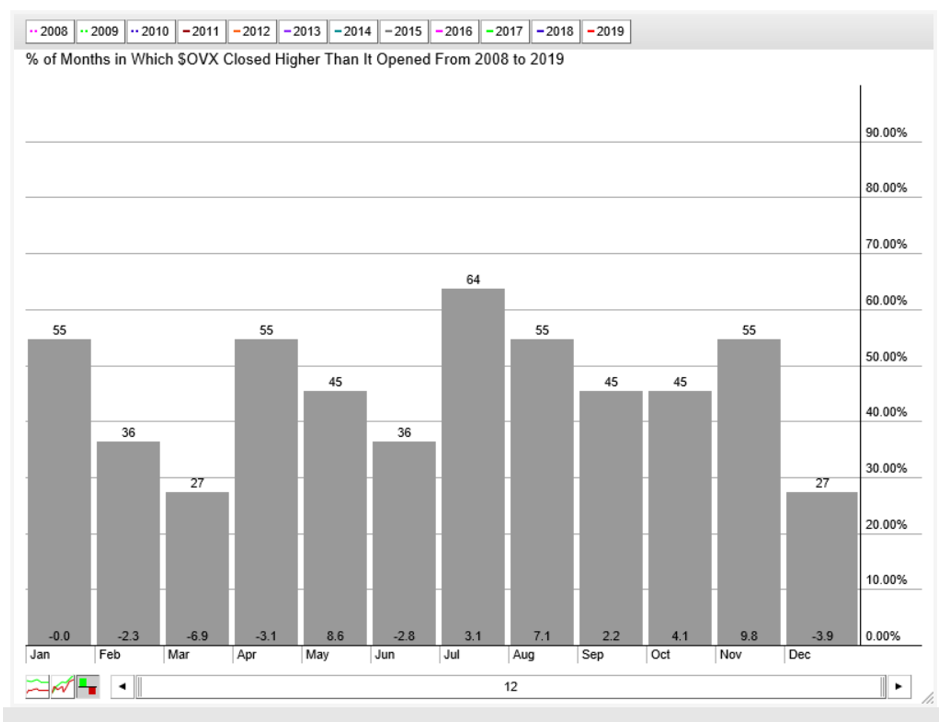

The $OVX oil volatility seasonal chart, over the past 12 years oil volatility in June has only advanced 36% of the time, another area suggesting a possible rebound from this $50 oil price level.

In summary, there are multiple factors indicating that the current price level of oil is in an oversold condition. Even though the fundamentals do not suggest a bounce from this level, technical indicators and seasonal factors disagree.

Disclosure: Authors hold long and short positions in oil.