The regional banking crisis rolled on with two key developments on Friday. One was the release of several reports detailing the errors that led up to Silicon Valley Bank’s sudden collapse. Poor regulatory oversight combined with an absence of risk management were to blame. The other was the slow collapse of First Republic, which is turning out to be small enough to fail. Founder and executive chair Jim Herbert doesn’t sound as reckless as the team that ran SVB, but their equity looks to be similarly worthless.

Against this backdrop of regulatory failure and a banking system that has been caught out by higher rates, the Fed is about to deliver more of the same next week, taking short-term rates to 5%. December 2024 Fed Funds futures at 3% are priced for a 2% reduction by the end of next year. Reduced appetite for risk among regional banks worries the Fed less than the market.

Inflation’s return to 2% isn’t assured. Nominal GDP rose at 5% in 1Q23. Since real GDP was +1.1%, the price level is rising at a healthy clip. The 1Q23 Employment Cost Index (ECI) rose 1.2% versus 4Q22, and the prior quarter was revised up from 1.0 to 1.1%. We had thought year-end raises would be more reflective of recent inflation, overwhelming the seasonal adjustment, and this looks to have been true. Compensation is up 4.8% year-on-year.

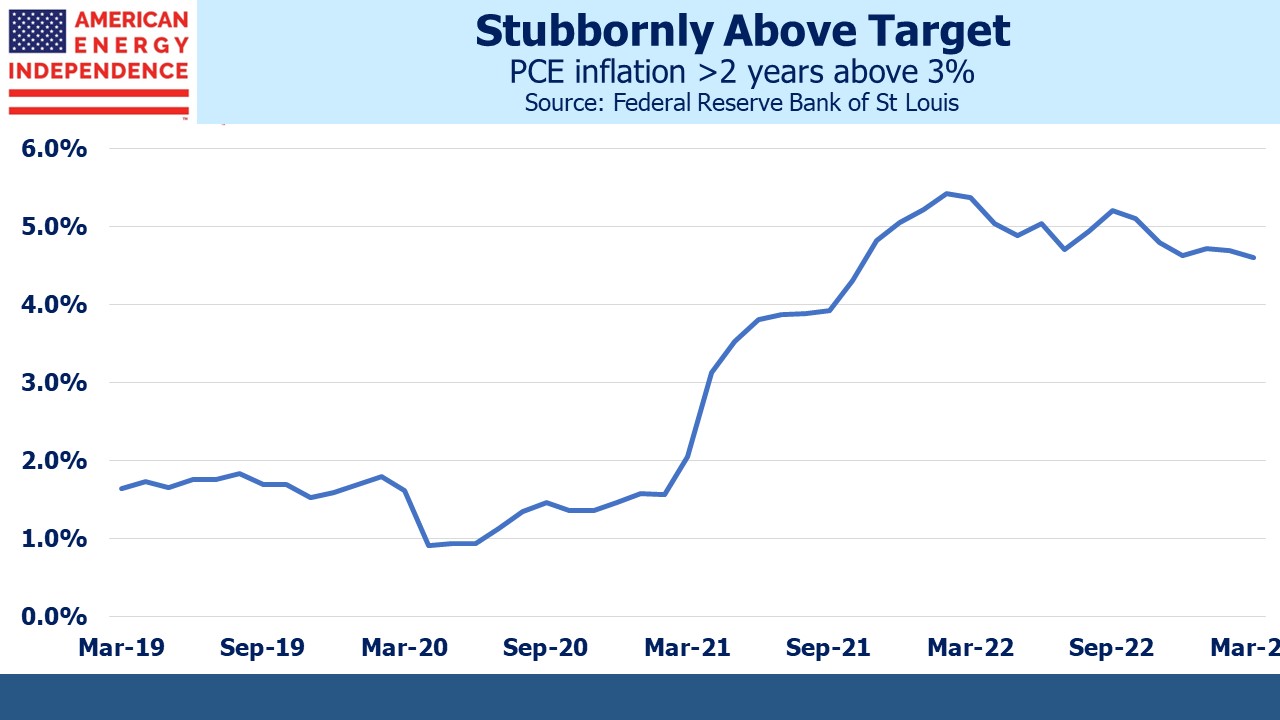

The Fed’s preferred measure of inflation, Personal Consumption Expenditures ex-food and energy (“core PCE”) rose 0.3% month-on-month and is up 4.6% year-on-year. We’ve now experienced two years of inflation above 3% (ie 1% above the Fed’s target). As the ECI figure showed, people are starting to adapt to inflation above 2%.

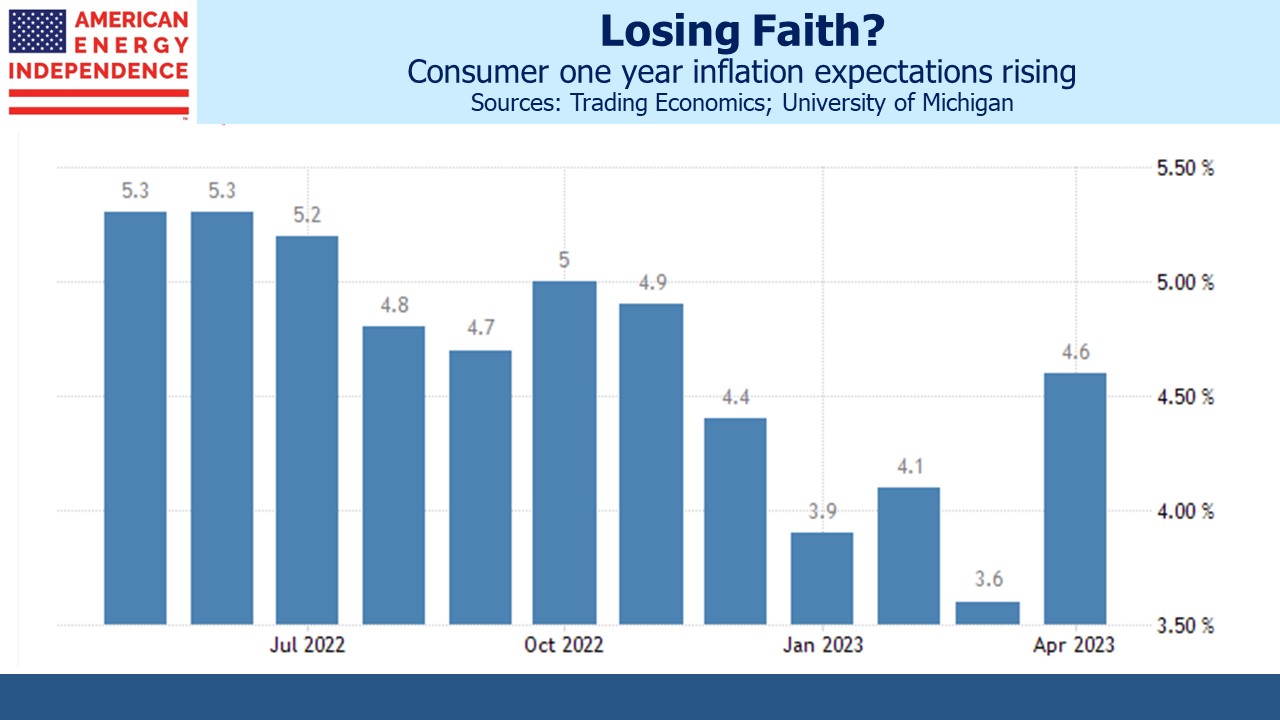

In the University of Michigan survey one year inflation expectations jumped to 4.6% in April, up from 3.6% in March. It’s been rising all year and is the highest since November. It’s hard to justify assuming 2% cost inflation for any big project or for retirement. Long term inflation expectations remain well behaved, but as consumers and businesses manage their affairs for near term inflation of 3% or 4%, it will keep upward pressure on prices.

As 3% becomes the new 2%, the Fed will continue to push back. It’s harder than usual to forecast confidently. The Fed may single mindedly pursue 2% and cause a recession, or the political blowback may force an eventual acceptance of a higher level.

We think midstream energy infrastructure is a good place to be in either scenario.

On April 21 the Federal Energy Regulatory Commission (FERC) reaffirmed prior approval of NextDecade’s proposed LNG export facility at Rio Grande, alongside a deepwater channel within the port of Brownsville, Texas. A Final Investment Decision (FID) should come within a couple of months. Last week their Chairman and CEO Matt Schatzman said, ““We have publicly disclosed that we expect to make it by the end of Q2.”

Building three “trains,” as LNG export facilities are called, is an $11-12BN project. The returns to equity investors will rely on successful execution and also on the mix of debt and equity the company adopts for financing. We still like the stock.

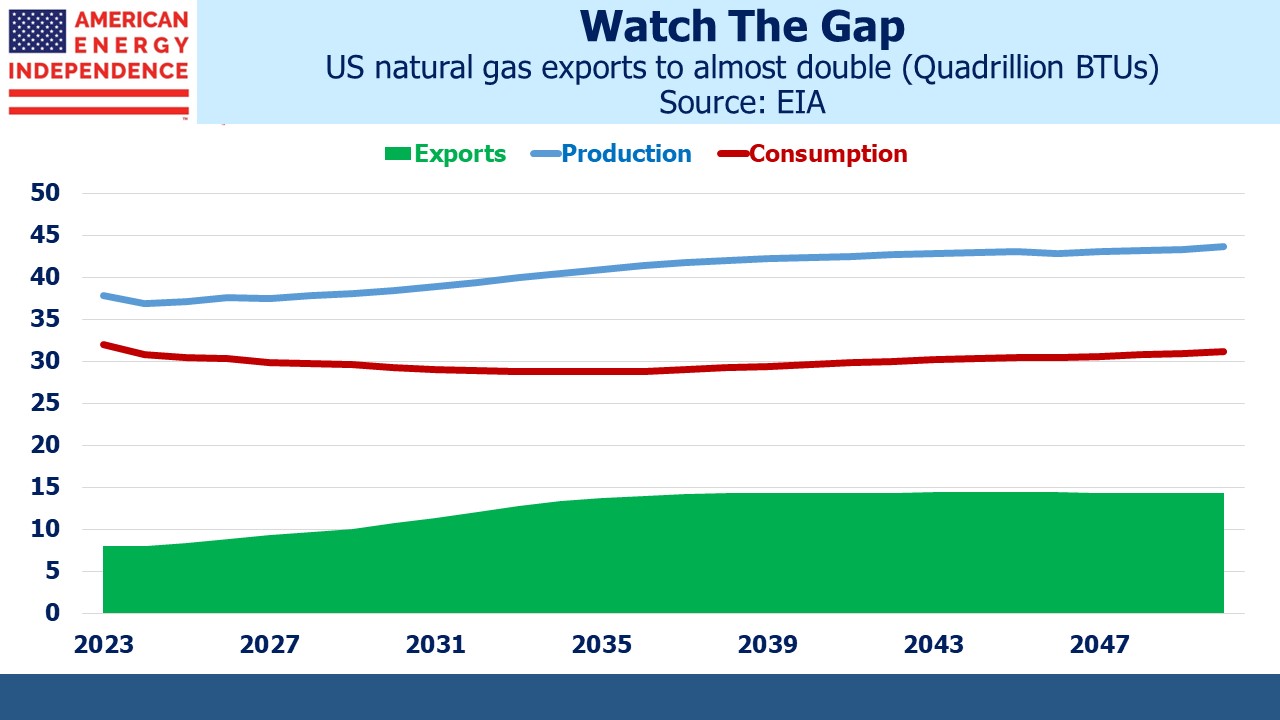

The Energy Information Administration (EIA) expects natural gas consumption to moderate in the years ahead as renewables gain market share in power generation. The need for permitting reform is illustrated by the Mountain Valley Pipeline’s continued failure to complete, held up by legal challenges to permits issued long ago.

Increased output from solar and wind also depends on a predictable approval process for infrastructure to move electricity. Solar and wind need wide open spaces and are generally not close to population centers. The EIA assumes new transmission lines will match increased output. Nobody wants their view sullied with electric pylons, especially if the electricity is merely passing by on its way elsewhere. Environmentalists are not a cohesive bunch, and every project will face objections.

However, even accepting the EIA’s rosy assumptions on vast grid improvements, increasing exports will drive improving economics for the owners of natural gas infrastructure. Russia’s invasion of Ukraine has created long term European demand for natural gas, competing with Asia and other emerging economies.

This outlook doesn’t depend on a defter execution of monetary policy than in the past few years. It does align with the desire of developing nations to consume more energy. If in time 3-4% inflation becomes the new normal, tariff escalators on pipeline tariffs linked to PPI and CPI will enable energy infrastructure to grow cashflows commensurately, if not better.

The post Not Yet Cool Enough appeared first on SL-Advisors.