Last week’s market surge carried the November rally forward, a momentum fueled by a significant repricing of interest rates in the bond market. Since the last Federal Reserve meeting, rates have taken a dramatic dip, sparking optimism in the market.

Bulls can take heart in the ongoing positive sentiment, though it’s worth noting that investor confidence has yet to surpass the peak seen in July. The current optimism is a promising sign, suggesting that there may be room for further growth and market enthusiasm as we navigate the twists and turns ahead.

The Consumer Price Index (CPI) numbers have solidified this shift, with the market now pricing in the end of the Fed’s tightening cycle. No more rate hikes are on the horizon, raising a crucial question: when will the first cut come?

The conclusion of the Fed’s hiking cycle tends to be bullish for the market, but history warns us to tread carefully. The Fed’s tightening efforts are designed to slow down the economy, and historically, by the time they consider lowering rates, the economy is in a rapid descent. On average, following a pause in rate hikes, the S&P 500 tends to be 23.5% lower, with the low hitting 195 trading days later.

A Different Kind of Holiday Cheer

Will this time be different? The Fed has a track record of vigilance on inflation and typically refrains from easing until inflation is below their long-term target range. The inflation experienced in this cycle was substantial, raising questions about the Fed’s commitment to keeping rates higher for an extended period. Patience from the Fed may increase the risk of missing a soft landing and sliding into a recession.

Expectations are shifting, with the anticipation that the Federal Reserve will make a move to cut rates in the first half of the coming year. In March, there is a 25% likelihood of a rate cut, and by May, the probability increases significantly, reaching a notable 60%. This evolving outlook underscores the market’s assessment of potential shifts in monetary policy, signaling a readiness for adjustments in response to the changing economic landscape.

Optimistic Reasons Rates Could Fall

Inflation may prove to be transitory after all. Preceding the Ukraine war, the Fed’s narrative was one of transitory inflation. Looking back to January 2022, we witnessed a surge in consumer savings during the pandemic, coupled with supply chain disruptions aggravated by the ongoing trade war with China. Nearly two years later, the supply chain has overcorrected, and trade dynamics have shifted. The USA now imports more from Mexico than China, and significant investments in India suggest a potential rival to China in labor-intensive production.

Skeptic Reasons Rates Could Fall

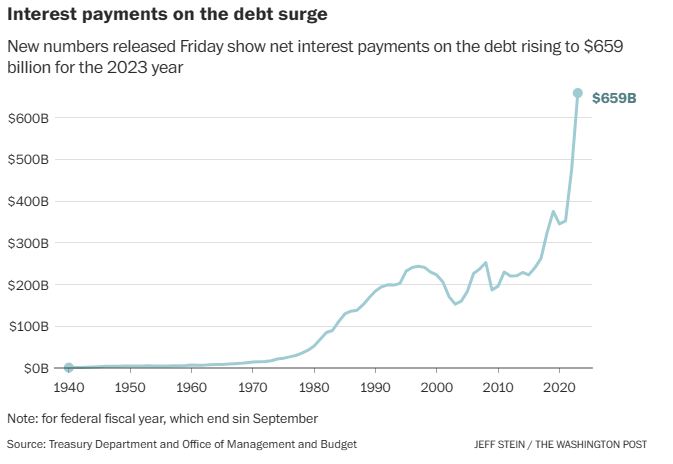

As we approach an election year, there’s pressure to lower interest rates before any potential economic damage. The U.S. government grapples with a growing spending problem; the budget continues to expand, and higher interest rates amplify the cost of maintaining our spending habits. Geopolitical tensions persist globally, and with no signs of easing, there’s a continued push to lower borrowing costs. Should rates fall before inflation cools, we run the risk of another inflation shock in 2025—a topic we’ll delve into in the coming weeks.

Don’t miss a beat in the dynamic world of finance! Stay informed with the latest market insights and updates. Subscribe to the ripple effect weekly newsletter and follow us for real-time analysis and valuable information. Your financial journey just got a whole lot more insightful.