Wednesday’s soothing words on inflation from Fed chair Jay Powell seemed a distant memory after Friday’s blockbuster employment report. The market liked hearing that , “…the disinflationary process has started.” More relevant now is his warning that, “The historical record cautions strongly against prematurely loosening policy.” Investors are Confronting Asymmetric Risks, as we noted on Wednesday.

Lost among the inflation questions was Powell’s reminder that the Federal Reserve is Treasury’s “fiscal agent.” This was in response to a question about the debt ceiling and whether the Fed had done its own “analysis of any legal constraints” that might impede or affect its actions during the fiscal brinkmanship that would accompany a stand-off over raising the debt ceiling.

A refusal by Congress to authorize more borrowing is a crisis of its own making, a rare but significant error in the US constitution. Whenever Congress approves spending it’s axiomatic that includes the intent and ability to pay for it, through taxes, borrowing or asset sales. The debt limit should be raised by whatever’s necessary to fund spending that’s been approved. The refusal by Congress to treat the two issues as one may one day lead us all off a fiscal cliff led by miscalculating innumerate Tea Party Republicans.

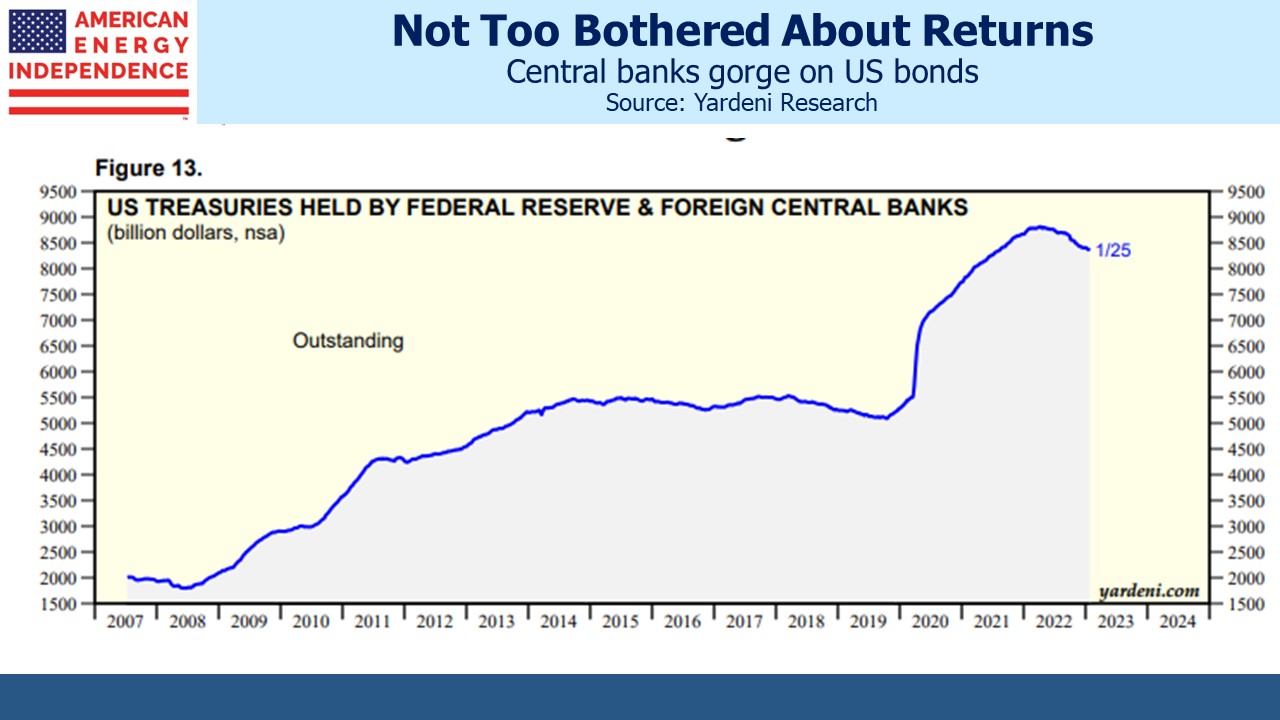

The Fed is much more than Treasury’s fiscal agent. They are the biggest holder of US government debt ($5.4TN), a position they’re unlikely to exit in the foreseeable future. In total, central banks own $8.3TN is US debt, almost 40% of the total. When long term bond yields stubbornly fail to rise to levels that might induce purchases from a return-oriented investor, it’s because the biggest holders have non-commercial objectives. Foreign central bank holdings have been stable in absolute terms but falling as a percentage of debt outstanding because, well, there’s a lot more debt.

Warnings of US fiscal catastrophe have been around for at least as long as my 43-year career. A perpetual trade deficit creates lots of dollars needing a home, and a fiscal deficit creates lots of debt seeking buyers. It is to the benefit of US taxpayers that this benign symmetry has resulted in persistent demand for treasuries. We should hope it continues.

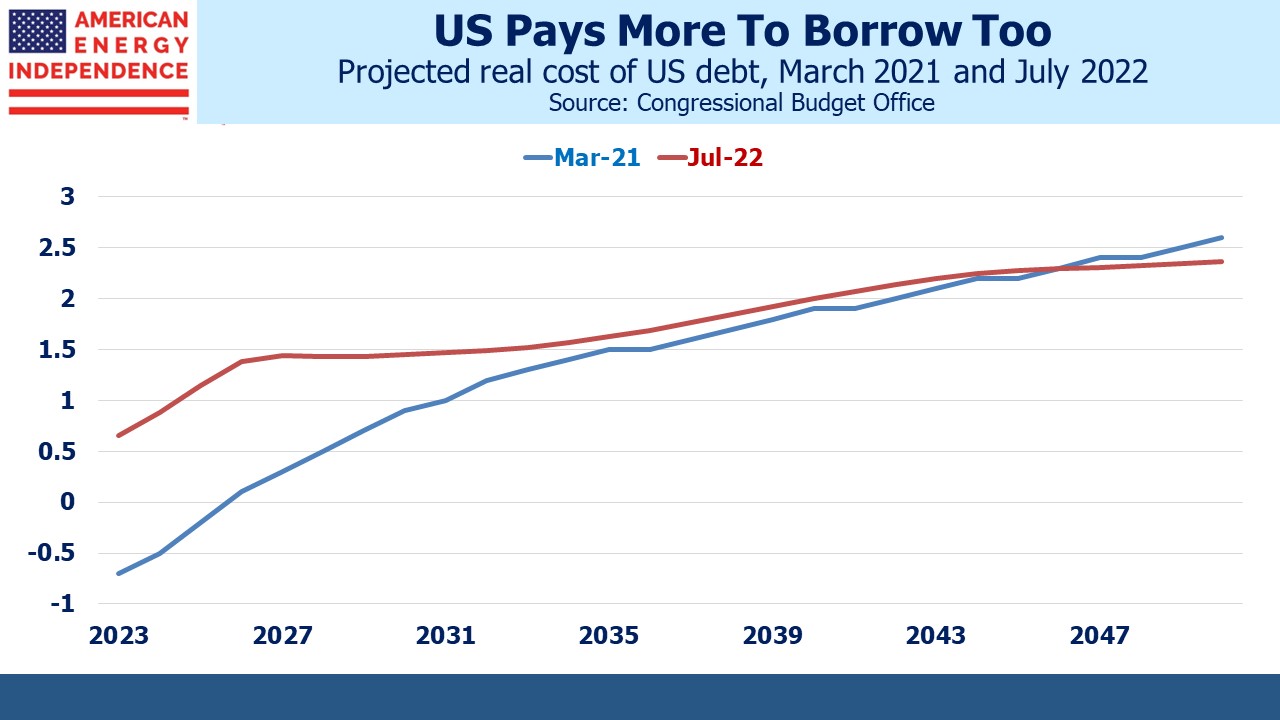

Low or negative real yields are the savior of profligate governments. Elevated inflation has temporarily slashed the real cost of financing our debt. Fed policy has been to ensure such a benefit is fleeting. 2% inflation is not the optimal policy for our fiscal outlook, and positive real rates won’t help. The only time in living memory when there was political consensus to improve our fiscal balance was in the early 1990s when ten year notes yielded as high as 8%. Since then, the tangible costs of profligacy have receded, along with any political gain to be had from tackling it.

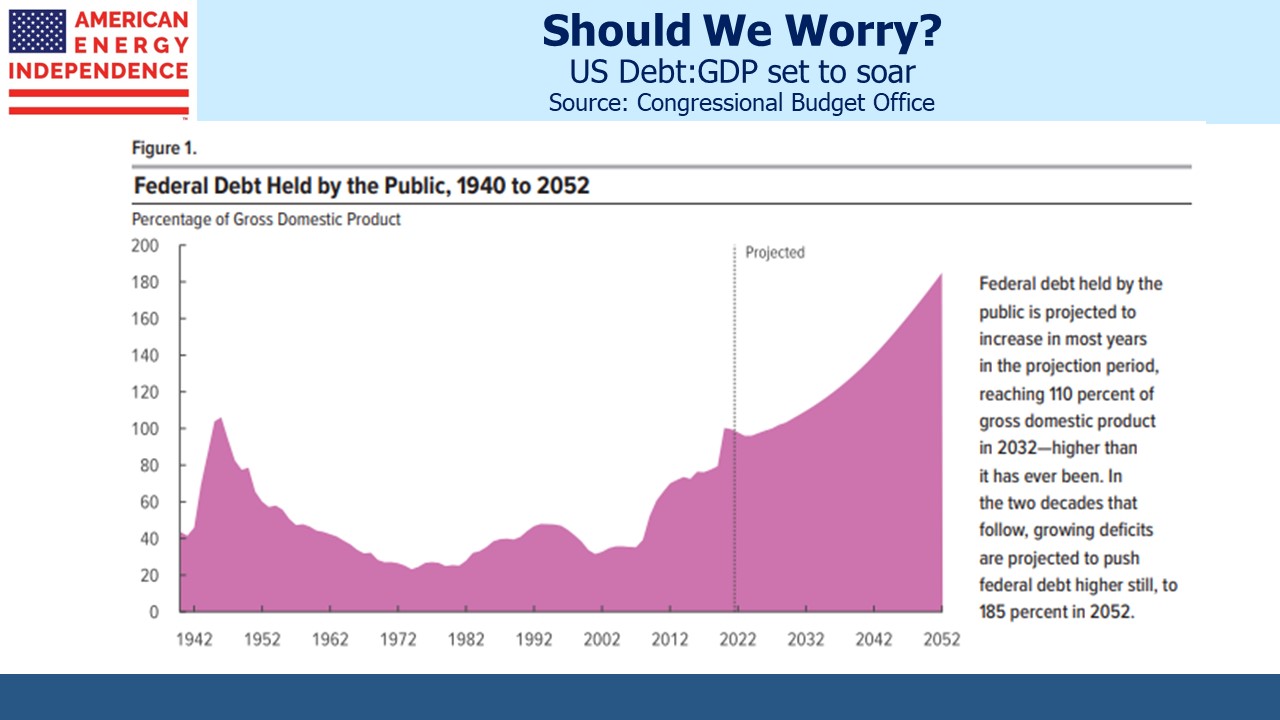

The Congressional Budget Office (CBO) publishes extensive information on our fiscal future complete with charts and figures that leave little room for optimism. A couple of years ago we noted the surprisingly low cost of financing in their projections (see Inflation – Back By Popular Demand).

In subsequent revisions, the real cost of financing has moved up by almost 1% over the next decade. The CBO’s long term inflation outlook is unchanged, but by last July tighter monetary policy had raised the cost of new debt issuance above what the CBO was forecasting in 2021. It’s likely that the next long term budget outlook from the CBO will project even higher real rates.

The Federal Reserve has considerable influence on fiscal policy because of Quantitative Easing (QE), although Jay Powell would prefer not to concede this. Because QE keeps bond yields lower than they would otherwise be, it dampens the concern about fiscal profligacy that the market would otherwise communicate. The CBO and numerous private forecasts are out there for all to see, but QE constrains the urgency. It’s doubtful that we would have had a balanced budget in the 1990s (albeit for one year) if QE had been employed then.

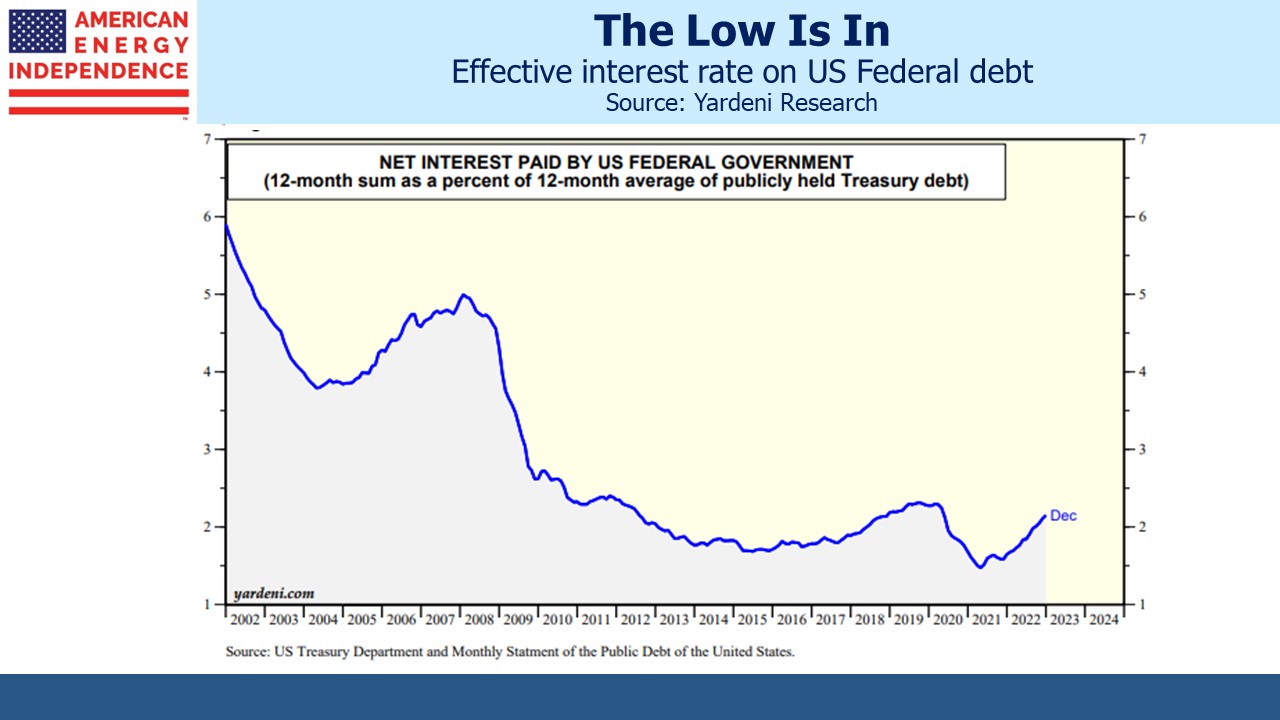

Monetary policy also directly impacts the cost of issuing new debt. The average interest rate paid by the US government has risen quite sharply in the past year. The longer tight policy is required, the worse our fiscal outlook will become. The Fed will continue to pursue their dual mandate, but a graceful exit from QE is probably necessary to generate serious concern about skyrocketing Debt:GDP. Legislating limits on QE would help but is unlikely.

Higher inflation is the only long-term solution to our slowly developing fiscal catastrophe. It’s hard to keep real rates negative when inflation is only 2%. This is why we’re invested in the energy sector.

The post More Than A Fiscal Agent appeared first on SL-Advisors.