In November, Engie, a French utility, pulled out of discussions with NextDecade Corp (NEXT) to import up to $7BN of Liquified Natural Gas (LNG). It was a big blow to NEXT, which is seeking partners to underwrite its construction of an LNG export facility in Brownsville, TX. Engie concluded that the natural gas sourced by NEXT would be tainted by its involvement in fracking, methane leaks and flaring. It wasn’t consistent with their energy transition goals.

Last week, NEXT launched a new business, NEXT Carbon Solutions (NCS). Their intention is to use Carbon Capture and Sequestration (CCS) to keep 90% of the CO2 generated by their proposed LNG plant as it chills methane in preparation for transfer onto an LNG tanker.

It’s a natural response to the market. Engie’s decision was a wake-up call. Natural gas has a clear edge over coal when it’s burned to generate electricity. But the flaring and methane leaks that are part of natural gas production worldwide are a consideration for some buyers.

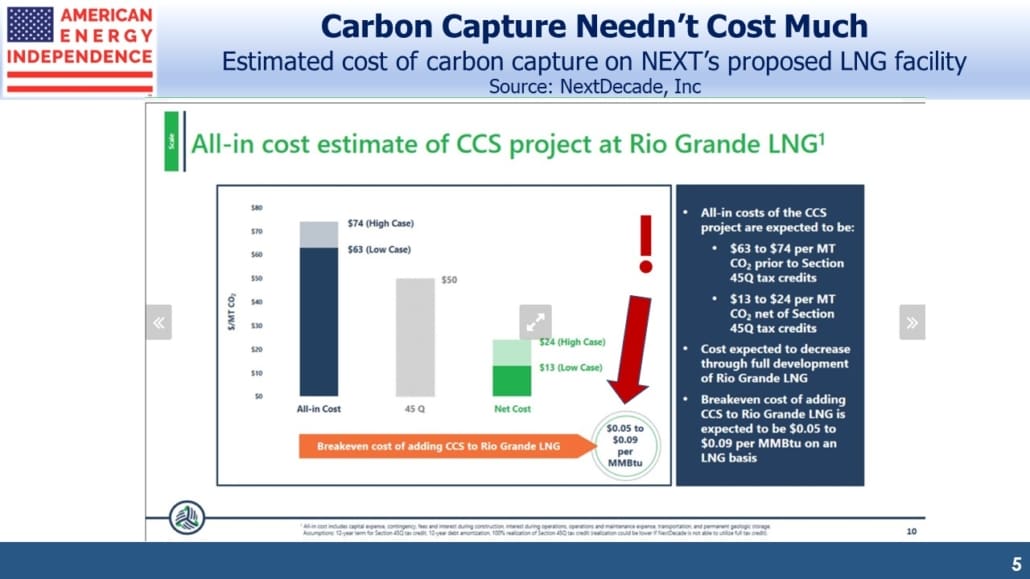

Liquifaction of natural gas uses a lot of energy. NEXT plans to use natural gas to power this process, and then capture and store the resulting CO2 emissions in former gas wells. The geology of south Texas is well suited to this. By installing the CCS equipment when the LNG liquifaction facility is built, there are substantial savings compared with adding CCS to an existing facility. NEXT intends to make the clean credentials of its product a competitive advantage.

Interestingly, the added cost is modest, maybe 2% of the price of natural gas based on its U.S. benchmark once tax credits are added. It’s less than 1% of its ultimate delivery cost to European buyers

NEXT is going further, by planning to use Responsibly Sourced Gas (RSG). This will be natural gas whose production has been independently certified as not associated with routine flaring and reliant only on electricity from renewables.

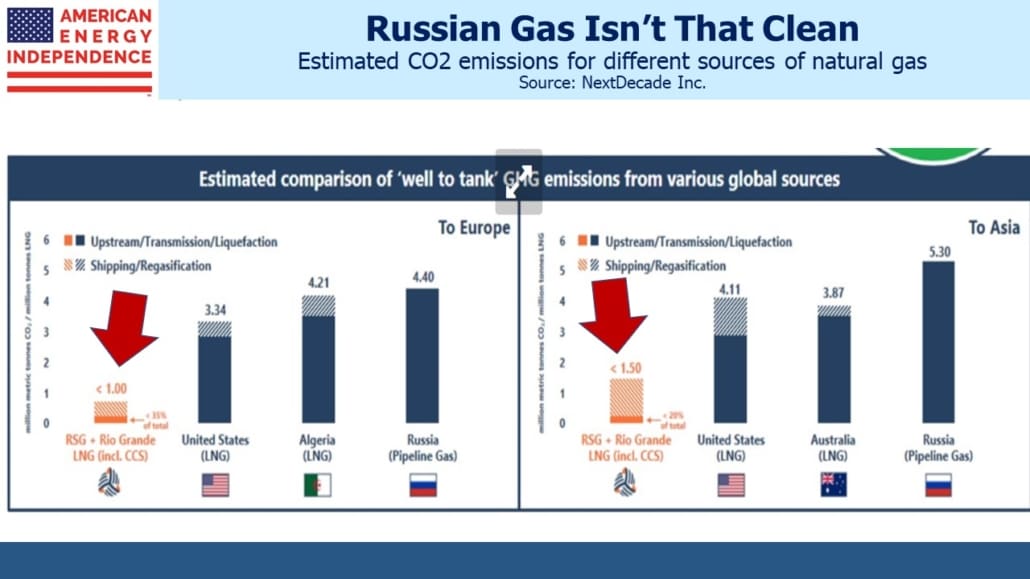

Their goal is to deliver natural gas to customers in Europe and Asia that has generated almost no Global Greenhouse Gases (GHG) on its way to the LNG tanker. Will it make a difference? NEXT is convinced it will.

It’s a logical development. The world has a huge opportunity to substantially reduce emissions by phasing out coal in favor of natural gas. Reducing the emissions involved in producing natural gas makes it even more compelling. NEXT is betting that gas produced with lower GHGs will attract environmentally motivated buyers, presumably an increasing portion of the market.

Over the next couple of years, U.S. GHG emissions will be moving in the wrong direction (see Emissions To Rise Under Democrats). This is partly an unavoidable result of comparisons with last year’s Covid slump in economic activity. But we’ll also be increasing coal consumption relative to natural gas, reversing a very positive trend that has lowered emissions for the past decade. Higher natural gas prices are the reason, since prior coal-to-gas switching by U.S. power plants has been driven by favorable economics.

This will be an uncomfortable result for a Democrat administration that campaigned on reducing emissions. Promoting coal to natural gas switching should become a more visible part of their strategy, both here and overseas.

NEXT includes an interesting slide comparing CO2 emissions that result from the RSG they plan to ship with competing sources. Nord Stream 2, the natural gas pipeline from Russia to Germany, is already controversial. Trump asked why the U.S. maintains troops in Germany to protect against Russia when Germany plans to increase its energy dependence on this potential adversary. There’s no good response to this question, and the Biden administration is similarly opposed to the pipeline’s completion.

Although geopolitics is a strong enough reason for Germany to buy its natural gas elsewhere (such as from the U.S.), the chart above from NEXT’s presentation suggests that different sources of gas come with a different climate impact. Maybe Climate Czar John Kerry can use such data in his discussions with other countries about lowering emissions.

NEXT is a tiny company with big plans. Their latest move may be a last, desperate attempt to sign up enough customers to finance the construction of their LNG facility. Or it may be an important step in the energy transition. If other established companies, such as Cheniere, make similar plans it’ll confirm that NEXT is on to something.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

The post Making LNG Cleaner appeared first on SL-Advisors.