Company Description

Established in 2009, Trade Desk is an advertising technology company. Trade Desk provides a self-serve technology platform for ad buyers, which the programmatic advertising platform provides an omnichannel that allows advertising agencies to bid and compete in real-time advertising inventory auctions, display and manage advertising campaigns. Trade Desk is a buy-side only platform (DSP).

Business Model

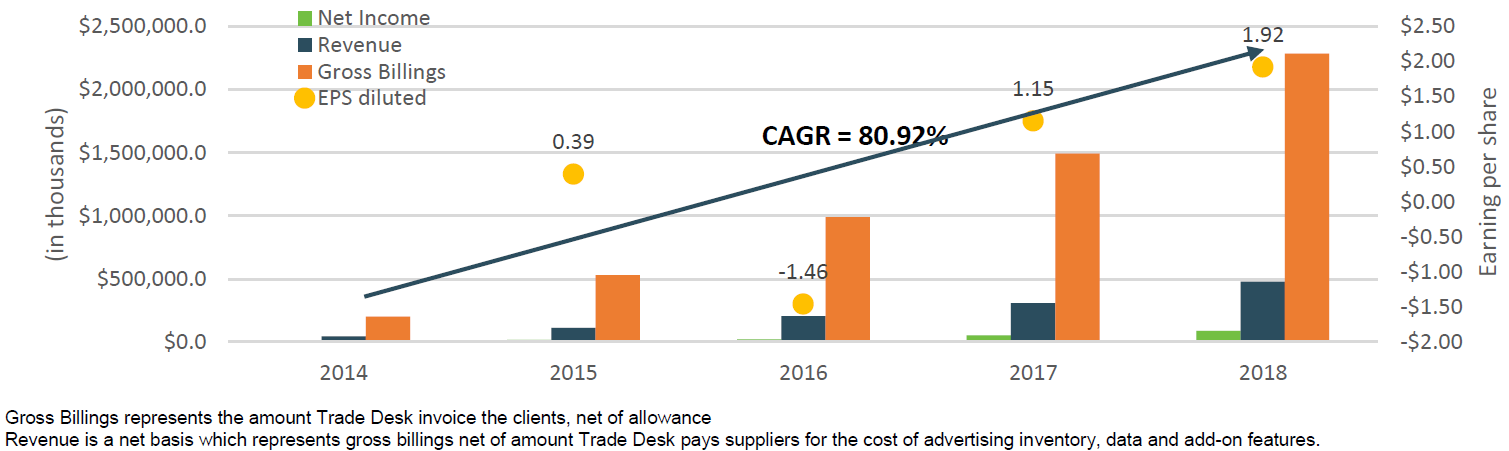

The Trade Desk generates revenue by charging clients a platform fee based on a percentage of a client’s total spend on advertising inventory purchase, data, and other add-on features. Trade Desk focuses on ongoing master service agreement as opposed to episodic insertion orders.

IPO HIstory

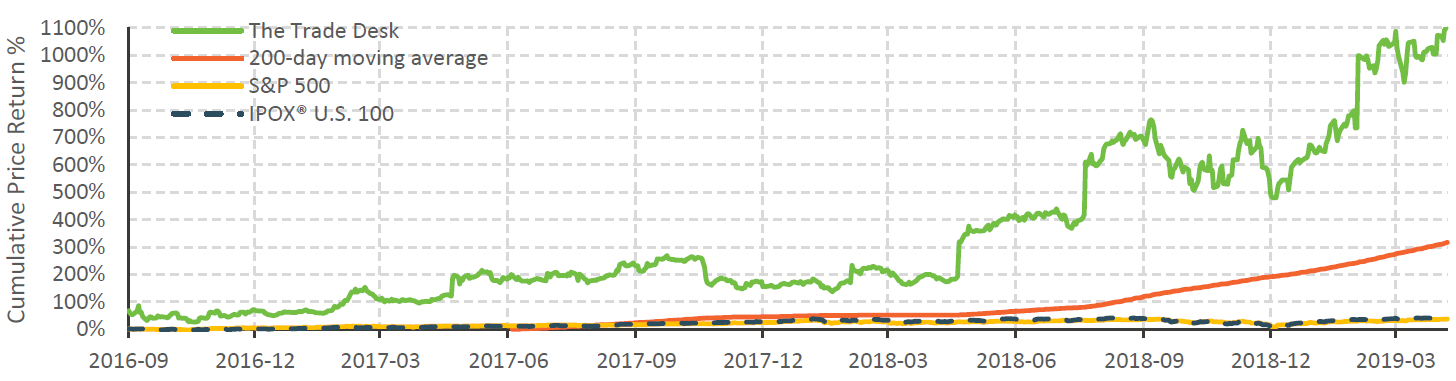

On 09/20/2016, The Trade Desk made its highly anticipated IPO debut on NASDAQ Global Market led by Citigroup, Jefferies, and RBC Capital Markets. The stock was priced at $18.00 per share, the high-end of its elevated offering price range of $16.00 – $18.00/share. With 4,666,667 shares offered and the 15% over-allotment option fully exercised, the company was valued approximately $700 million at offer yet closed the first day with a valuation over $1.1 billion. TTD opened at $28.75/share, a 59.72% pop from its offer price, and climbed to close the first day of trading at $30.10/share with a 67.22% initial return. Trade Desk was first included in the IPOX® U.S. 100 Portfolio on 12/16/2016 and currently weighs approximately 0.66% of the portfolio.

Historical Performance

Growth Outlook

| Company | Stock Symbol | IPO/Spin-off Date | Initial Return | Offer to Date | 2019 YTD | Beta to S&P | EPS 2018 | Revenue (in millions) | P/S ratio |

| The Trade Desk | TTD US | 09/20/2016 | 67.22% | 1130.44% | 90.67% | 1.84 | $1.92 | 477.29 | 117.6x |

| Rocket Fuel | FUEL US | 09/09/2013 | 93.45% | Acquired by Sizmek in 2017 for $145 million, a -3.35% premium | |||||

| AOL | AOL US | 12/10/2009 | Spin-off | Acquired by Verizon in 2015 for $4.4 billion, a 17.40% premium | |||||