Company Description

![]()

Stitch Fix

Founded in 2011 as Rack Habit Inc, Stitch Fix is a San Francisco-based online personal styling retailer. As an eCommerce company, Stitch Fix combines data science and human judgment to deliver periodic or on-demand personalized merchandise subscription box (Fix).

Business Model

Stitch Fix generates revenue from the sale of merchandise in the Fix. The company charged a nonrefundable upfront styling fee and only recognized it as revenue if none of the items within the Fix were purchased. Stitch Fix also charge an annual fee for unlimited styling if desired.

IPO History

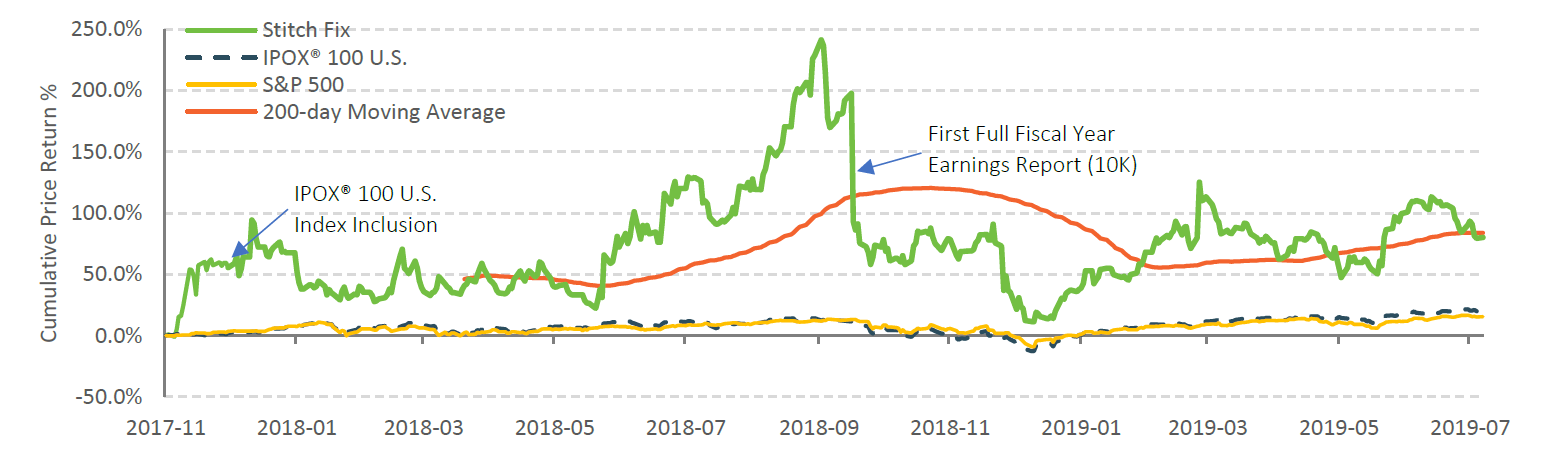

On 11/17/2017, Stitch Fix shares debut on Nasdaq led by Goldman Sachs and J.P. Morgan. The fashion tech company raised $120 million after pricing at $15.00, below its original expected range of $18.00 – $20.00/share and downsized the number of shares from 10 million to 8 million. With a 15% over-allotment option fully exercised, Stitch Fix was valued at $1.45 billion at offer. The stock opened at $16.90/share, a 12.67% pop, and tumbled down to close the first day with a 1% initial return. Stitch Fix was included in the IPOX® 100 U.S. Portfolio on 12/15/2017 and currently weighs approximately 0.29% of the portfolio.

Historical Performance

Growth Outlook

Financials

[table id=12 /]