Company Description

MongoDB

Founded in 2012, Invitation Homes is a single-family homes rental company. The company owns and operates homes for lease in the United States. Invitation Homes has a portfolio of 80,361 homes (as of March 31, 2019) with high concentration in Western United States and Florida. Invitation Homes is controlled by Blackstone Group.

Business Model

Invitation Homes generates on average 95% of revenue through rental income from leases and the rest from other property income including: (i) resident reimbursements for utilities, HOA fines, and other chargebacks; (ii) rent and non-refundable deposits associated with pets; and (iii) various other fees including application and lease termination fees.

IPO History

On 02/01/2017, Invitation Homes made its REIT IPO debut on NYSE led by Deutsche Bank and J.P. Morgan. The share was priced at $20.00 per share, close to the higher end of the expected range of $18 to $21 per share. With a full subscription of 77,000,000 shares offered and an additional 15% over-allotment option fully exercised, Invitation Homes was valued at over $6.27 billion at offer. The stock opened at $20.10/share and closed the first day unchanged. It was the second largest U.S. REIT IPO in history, just behind Paramount Group’s IPO in 2014. Invitation Homes was included in the IPOX® 100 U.S. Portfolio on 06/21/2019 and currently weighs approximately 0.70% of the portfolio.

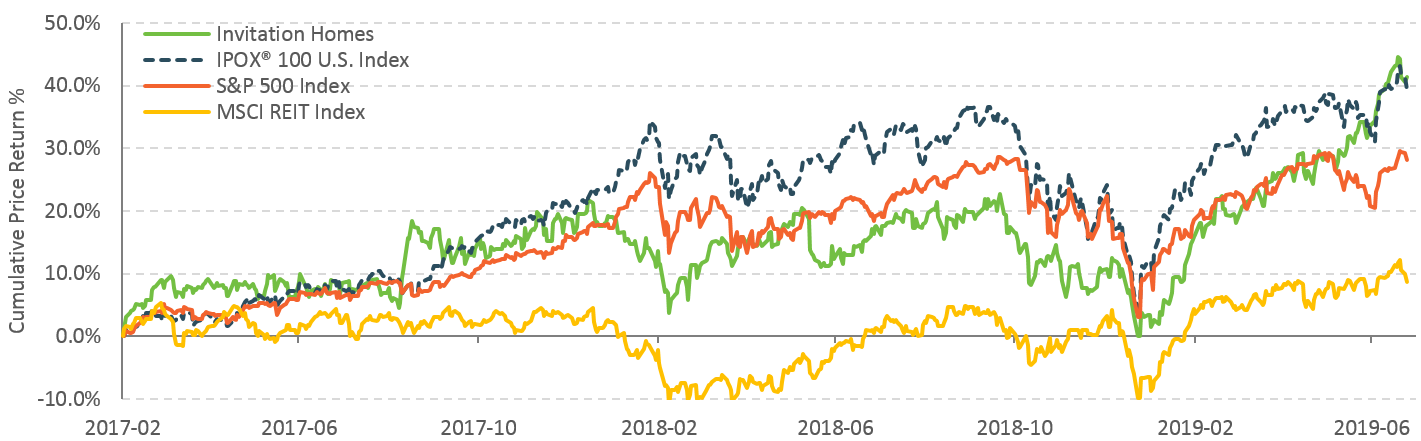

Historical Performance

Growth Outlook

Industry Comparison

[table id=8 /]