Company Description

Anaplan

Formed in 2008 and launched in 2011, Anaplan is a cloud-based Connected Planning software company addresses performance management and analytic application for large enterprises. Anaplan also offers professional services, including consulting, implementation, and training.

Business Model

Anaplan derives revenue primarily from the cloud-based enterprise software platform subscriptions and renewal. Anaplan also generates revenue from professional services provided.

IPO History

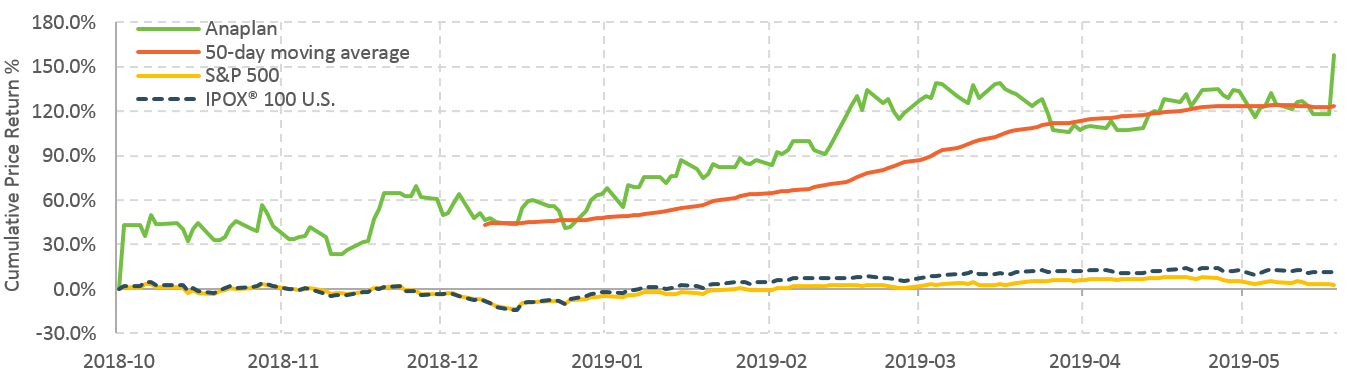

On 10/12/2018, Anaplan made its debut on NYSE led by major banks including Goldman Sachs and Morgan Stanley. The stock was priced at $17.00 per share, top of the elevated range of $15.00 to $17.00/share. With a full subscription of 15.5 million offered shares and the 15% over-allotment option fully exercised, Anaplan was valued at $2.11 billion at offer. Anaplan opened at $24.25/share, a 42.65% surge from its offer price, and closed the first day slightly higher with a 42.94% initial return. Anaplan was included in the IPOX® 100 U.S. Portfolio on 12/14/2018 and currently weighs approximately 0.35% of the portfolio.

Historical Performance

Growth Outlook

Industry Comparison

[table id=3 /]

Other Competitors

| CallidusSoftware (CALD US) | Acquired by SAP for $2.3 billion in 2018 |

| Adaptive Insights | Acquired by Workday for $1.4 billion in 2018 ahead of IPO |

| Host Analytics | Acquired by Vector Capital in 2019 |