You might think that using a crane to place steel boxes so as to block all the entrances to a global energy corporation might attract some attention before completed. Nonetheless, Greenpeace successfully demonstrated a gap in business continuity planning, just hours before BP’s annual general meeting. Even at 3am, BP’s global headquarters should have had some security staff on site. They might be expected to notice the unplanned delivery of five steel boxes so as to block access to the building. Perhaps they were taking a nap. It must have led to a lively exchange between the head of security and senior executives.

People sealing themselves inside a chamber with several days of food and water should perhaps be allowed to languish for somewhat longer. One imagines that, had this imaginative protest occurred in Houston not London, the authorities’ response would have been different.

The steel boxes and the fuel for the cranes were enabled by the type of petroleum products BP produces, but this well-worn criticism of environmental activists (do protesters ever cycle to their protests?) is not our point. The energy industry is under attack by a small but vocal group who deny science to try and impose their own quirky vision of 18th century living standards on the rest of us.

Enbridge (ENB) told us last week they would not attempt a new, “greenfield” crude oil pipeline in Canada given the unpredictable approval process. New York recently denied Williams Companies (WMB) permission to build a natural gas pipeline connecting the Marcellus Shale in Pennsylvania with consumers in New York City. Boston relies on Russian imports of liquefied natural gas in winter, because new pipelines to bring domestic natural gas have been successfully opposed.

80% of the energy that supports modern life comes from fossil fuels and it’s never been cheaper. Living standards and longevity in developing countries are improving due to greater energy use. In spite of this undoubted success, the energy sector has lost the PR battle. Providing the world with what it clearly wants draws the smug opprobrium of those whose fixation on solar and wind power includes opposition to nuclear energy. Bill Gates, who writes thoughtfully on big subjects, has questioned the focus on R&D for renewables instead of more on cleaner use of fossil fuels: “Should you really be funding the intermittent stuff with all the money and putting no money in the stuff that works all the time?”

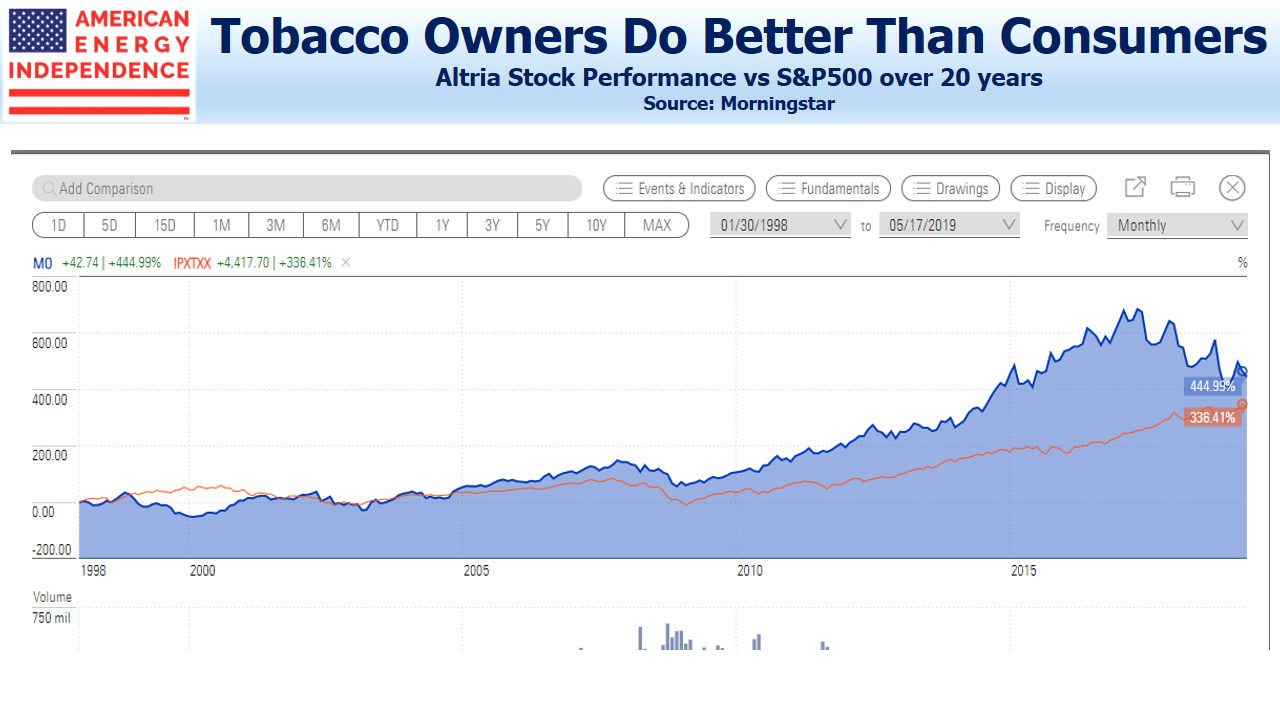

The tobacco industry has no claim to improving well-being, but does share with the energy sector a constant need to apologize for its existence. 25 years ago, big tobacco was being sued by U.S. states and individuals for the terrible health outcomes caused by its products. In 1998 they entered into a Master Settlement Agreement with almost all U.S. states, agreeing to pay billions of dollars over many years.

We are no fans of tobacco companies and the morality of energy companies is wholly different. But it’s worth noting that much-reviled tobacco stocks have provided strong returns since, as shown in the chart. The Wall Street Journal has included Altria (MO) in its “30 best-performing stocks of the past 30 years”. It’s just behind Apple (AAPL). MO also made the top 25 S&P500 stocks of the past 50 years.

Midstream energy infrastructure offers predictable cashflows that are growing, and will always be out of favor with those who like to inhabit steel boxes. It’s a recipe for attractive future returns.

We are invested in ENB and WMB.

The post Fanatics Protest From a Steel Cell appeared first on SL-Advisors.