Update: This article was originally written in December 2019. So far, the S&P 500 TR Index has returned -25.09% and the Bloomberg Barclays US Aggregate Bond TR Index has returned -0.62% YTD, as of March 19, 2020.

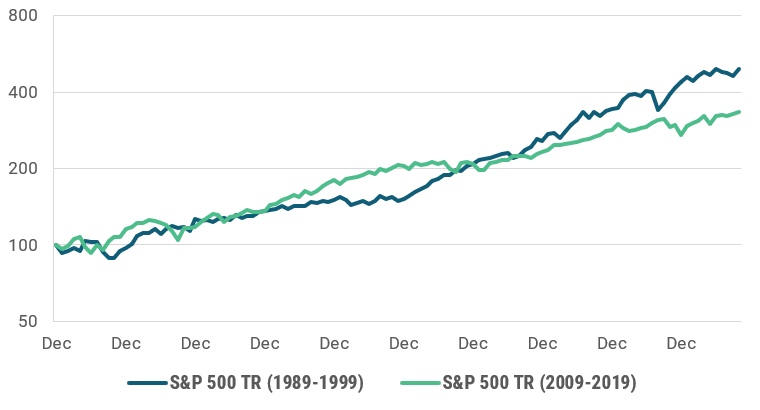

This past decade has been a tremendous run for the S&P 500, remarkably like the path of U.S. equities in the 1990’s. When looking at the other major asset classes, however, the 2010’s have not been nearly as exciting. The equity market has overcome significant risk factors to continue its rally, and a recession is not imminent. However, many financial advisors agree that the 2020’s will not be as lucrative for equities. Historically, except for the 1980’s into the 1990’s, the S&P 500 has not managed to put up two decades of triple-digit returns in a row. Furthermore, equity valuations are currently stretched, the economy can’t seem to get passed low- to moderate-growth, and there are several geopolitical risk factors that could derail equities. When considering this, the stock market could even be set up for another lost decade, where investors face flat or negative returns, like the 2000’s following the strong rally in equities in the 1990’s.

Financial advisors can use the transition into a new decade to explain this possibility to their clients, better position them to handle adverse market conditions, and demonstrate the value a financial advisor can add over the long-term.

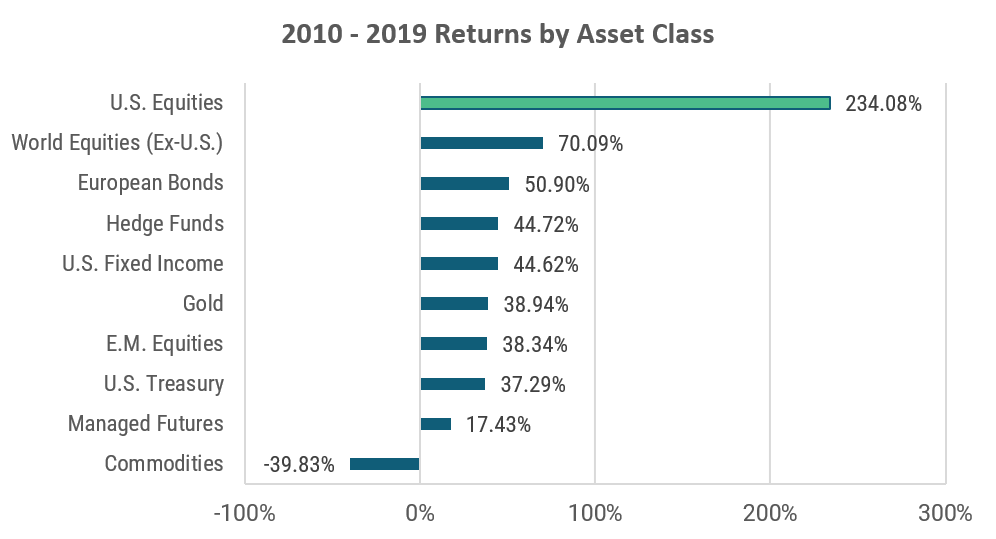

Compared to other asset classes, the returns of the S&P 500 have been remarkable

When looking at the performance of the S&P 500 since 2009, it should be no surprise that assets into passive low-fee and no-fee strategies have ballooned. In fact, no other major asset class has even come close to the returns of the S&P 500. One of the best trades has been to simply buy passive S&P 500 exposure as a “set it and forget it” investment strategy. While this has been a great opportunity for investors to grow the value of their portfolios, a side effect has been a shift in investor mindset to one moving away from the need for active management, including the need to manage a portfolio’s overall risk.

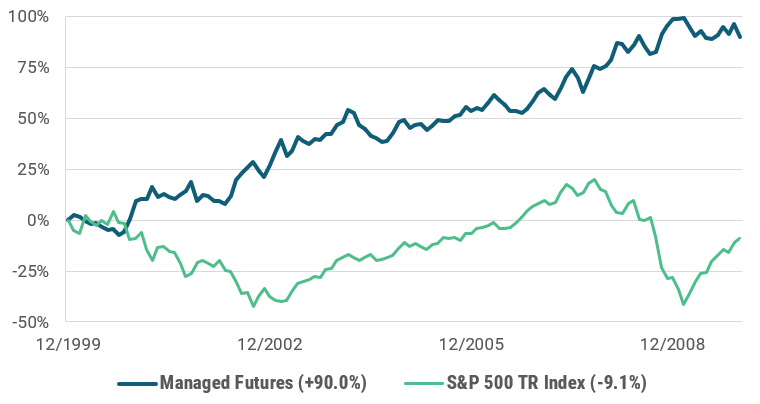

Like the 2000’s, are the 2020’s set up for another lost decade in equities?

After a significant rally in the 1990’s, the S&P 500 TR Index ended the 2000’s down -9.1%. For those without a balanced portfolio, it was a painful decade that likely had a material impact on long-term financial objectives. On the other hand, an asset class like managed futures that can perform well during structural market changes put up significant returns for the decade at +90.0%. While diversification may take away from upside, it plays an important role on mitigating downside risk.

The S&P 500 has spent the past decade on a path like the 1990’s

Just because the S&P 500 is following a similarly strong path as it did in the 1990’s does not necessarily mean we are in for a market downturn. In fact, there are several factors that suggest the S&P 500 may continue to perform well for several years. Corporate America is proving strong and still adjusting to the new, lower tax environment. Monetary policy is favorable, and it’s unlikely that there will be any interest rate hikes through 2020. U.S. consumers have benefited from wage and job growth, and lower financial obligations. Even trade policy seems more likely to be on a path of getting better rather than worse.

Nevertheless, there are several risks that could potentially derail the market at any point, including many of the factors mentioned above getting undone or reversed. In addition to these factors, a bull market long in the tooth, stretched valuations, and only moderate economic growth makes it hard to argue that the 2020’s will be as lucrative for equities.

Clients must understand this risk. Using the transition into a new decade offers a great opportunity to discuss the potential risks and rewards of changing allocations to passive equity strategies.

Diversifying streams of risk and return will be necessary to mitigate the impact of any future equity market collapse. One option that financial advisors could suggest to their clients is a hybrid strategy, which integrates equities and managed futures into one portfolio. These strategies allow clients to maintain equity exposure, while also having a managed futures allocation that can deliver positive returns for the strategy even during structural market changes.

As we look ahead to the next decade, market history may not repeat, but there are economic and market patterns that are too similar to ignore. Even if your clients choose to not change their asset allocations, discussing the risks with them helps them better position for the potential downside. It also demonstrates the need for clients to have a financial advisor, even if it’s to remind them of the risk they’re taking and letting them know somebody is looking after their investments.

Data Source: Bloomberg LP. 2010-2019 returns through 10/31/2019. U.S. Equities, World Equities, European Bonds, Hedge Funds, U.S. Fixed Income, Gold, E.M. Equities, U.S. Treasury, Managed Futures, and Commodities represented by the S&P 500 TR Index, MSCI World Excluding U.S. Index, Bloomberg Barclays EuroAgg TR Index, HFRI Fund Weighted Composite Index, Bloomberg Barclays U.S. Agg. TR Index, LBMA Gold Price PM USD, MSCI Emerging Markets Index, Bloomberg Barclays U.S. Treasury TR Index, SG CTA Index, and Bloomberg Commodity TR Index.